MCA Revises Indian Accounting Standards Rules : Key Changes for 2024 [Read Notification]

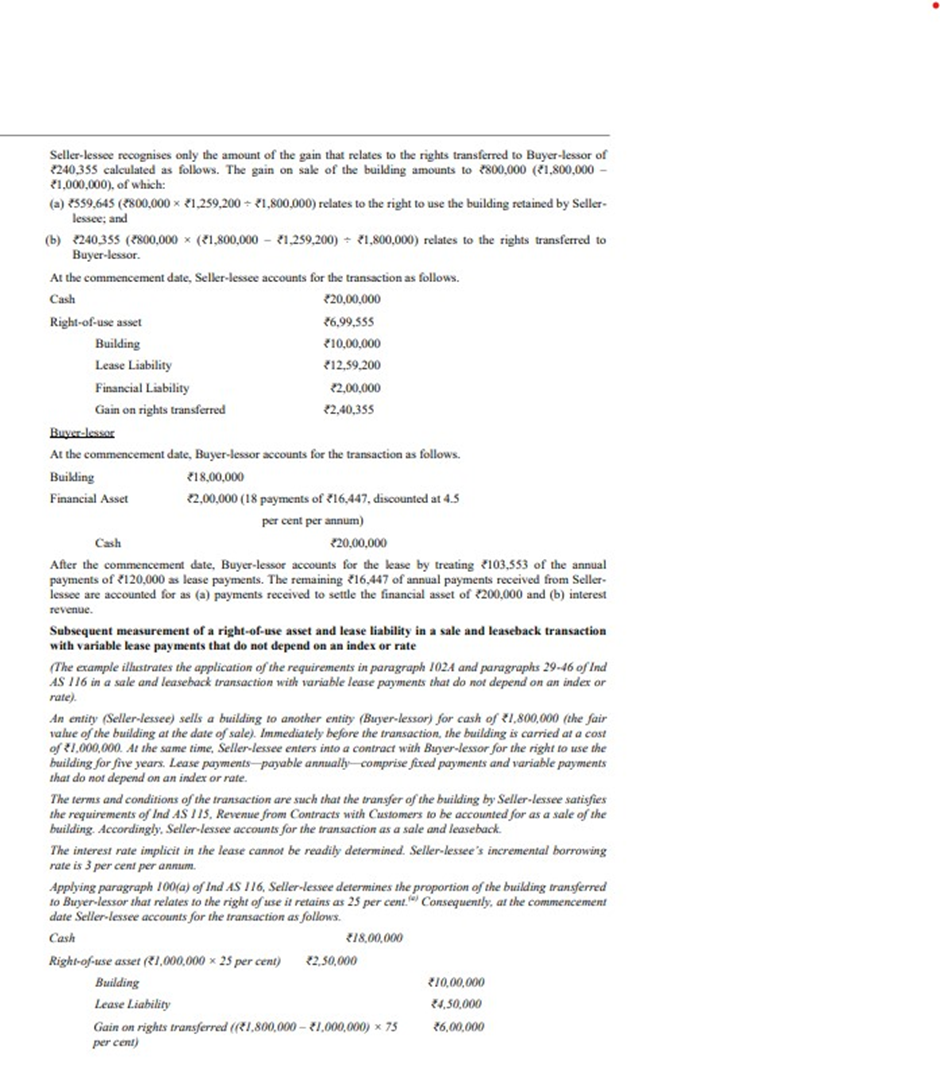

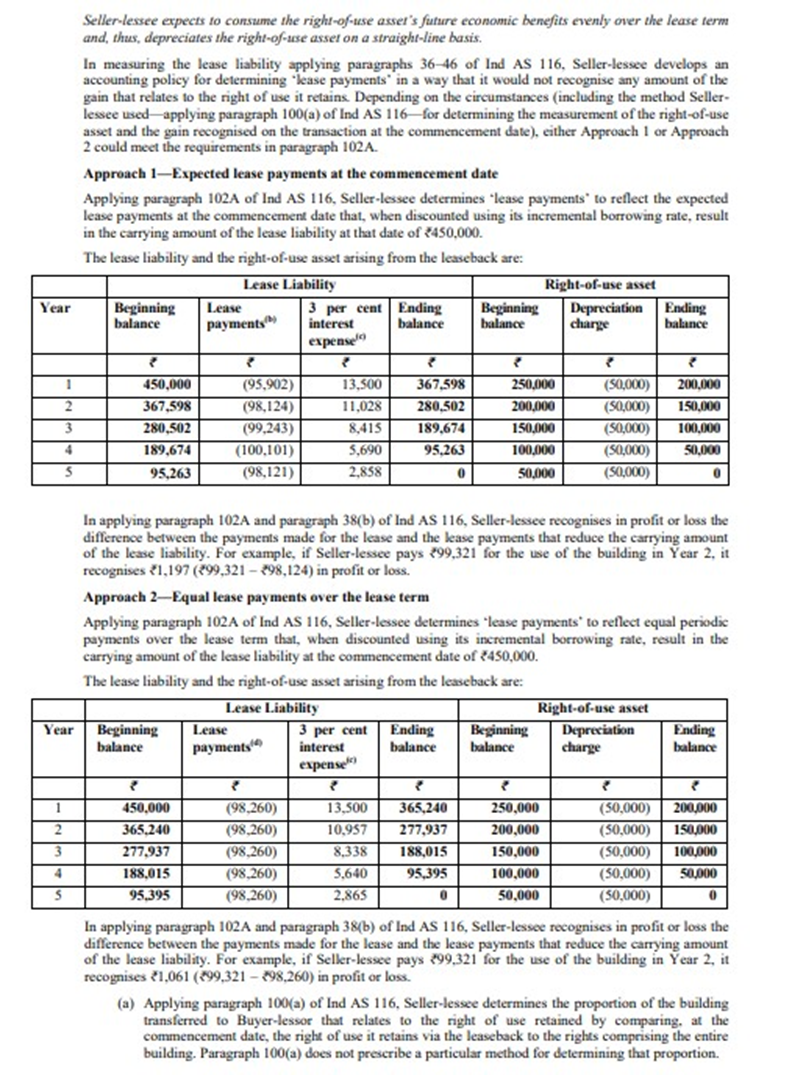

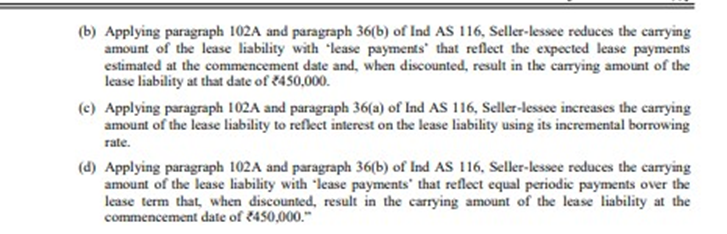

The primary update involves the treatment of leaseback transactions. A new paragraph, 102A, has been added to Ind AS 116, mandating that after the commencement date, seller-lessees must apply specific paragraphs (29–35 and 36–46) to right-of-use assets and lease liabilities arising from sale and leaseback transactions.

MCA – Revises Indian Accounting – Indian Accounting – Ministry of Corporate Affairs – Taxscan

MCA – Revises Indian Accounting – Indian Accounting – Ministry of Corporate Affairs – Taxscan

The Ministry of Corporate Affairs ( MCA ) has revised the Indian Accounting Standards with the notification of the Companies (Indian Accounting Standards) Second Amendment Rules, 2024, effective from the date of publication in the official gazette.

This amendment, made under the powers conferred by section 133 and section 469 of the Companies Act, 2013, updates the Companies (Indian Accounting Standards) Rules, 2015. The key changes are significant for entities applying Indian Accounting Standard (Ind AS) 116, which deals with leases.

The primary update involves the treatment of leaseback transactions. A new paragraph, 102A, has been added to Ind AS 116, mandating that after the commencement date, seller-lessees must apply specific paragraphs (29–35 and 36–46) to right-of-use assets and lease liabilities arising from sale and leaseback transactions.

Ready to Grow? Choose a Course That Fits Your Goals!

The revised rules stipulate that in determining 'lease payments' or 'revised lease payments', the seller-lessee should avoid recognizing any gain or loss related to the right-of-use retained. However, this does not preclude the recognition of gains or losses from the partial or full termination of a lease as required by paragraph 46(a).

Additionally, Appendix C of Ind AS 116 has been updated to reflect these changes. Paragraph C1D introduces amendments for lease liabilities in sale and leaseback transactions, which must be applied retrospectively for transactions occurring after the initial application date, set as April 1, 2024.

The amendment also revises paragraph C2 to define the date of initial application as the beginning of the annual reporting period in which the standard is first applied. New paragraph C20E requires retrospective application of lease liability amendments in accordance with Ind AS 8.

Ready to Grow? Choose a Course That Fits Your Goals!

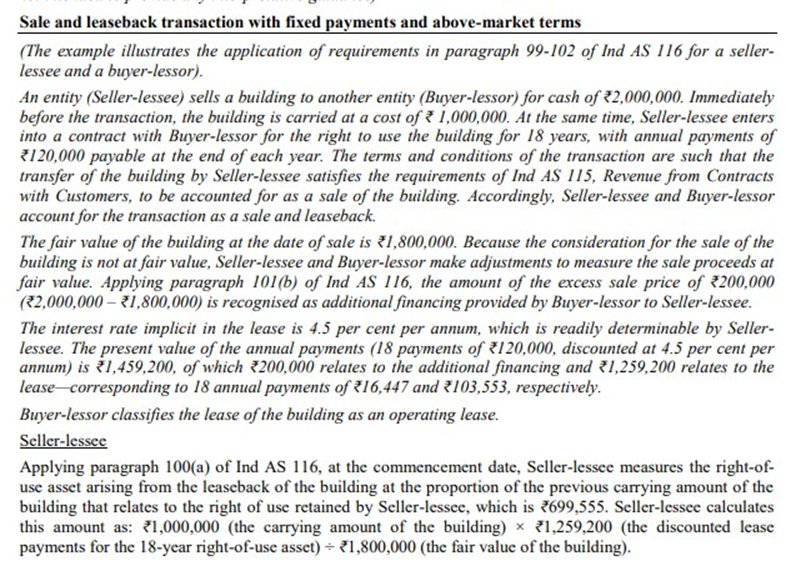

A new Appendix D has been added to provide illustrative examples of the revised rules, particularly focusing on a sale and leaseback transaction involving fixed payments and above-market terms.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates