Ministry of Corporate Affairs enhances Threshold Limits for Asset and Turnover Values by 150% [Read Notification]

According to the updated threshold, there is a 150% rise from the original value specified in section 5 of the Competition Act, 2002.

Ministry of Corporate Affairs – Threshold Limits – Asset and Turnover Values – TAXSCAN

Ministry of Corporate Affairs – Threshold Limits – Asset and Turnover Values – TAXSCAN

The Ministry of Corporate Affairs ( MCA ), vide notification no. S.O. 1130(E) dated 7th March 2024 has announced the revision of the threshold values pertaining to assets and turnover for combination filings by 150%.

According to the updated threshold, there is a 150% rise from the original value specified in section 5 of the Competition Act, 2002. The revised threshold values will be effective from the date of publication of this notification in the Official Gazette.

In accordance with the authority vested by sub-section (3) of Section 20 of the Competition Act, the Central Government, in consultation with the Competition Commission of India, has decided to augment the value of assets and turnover by 150% for the purposes of section 5 of the Competition Act. This enhancement is determined based on the wholesale price index and exchange rate of the rupee.

Previously, the threshold limits outlined in Section 5 of the Act underwent revision in the year 2011 via notification S. O. No. 480 (E) dated March 4th, 2011. Following that, these threshold limits were reassessed and updated in 2016 through notification S. O. No. 675 (E) dated March 4th, 2016.

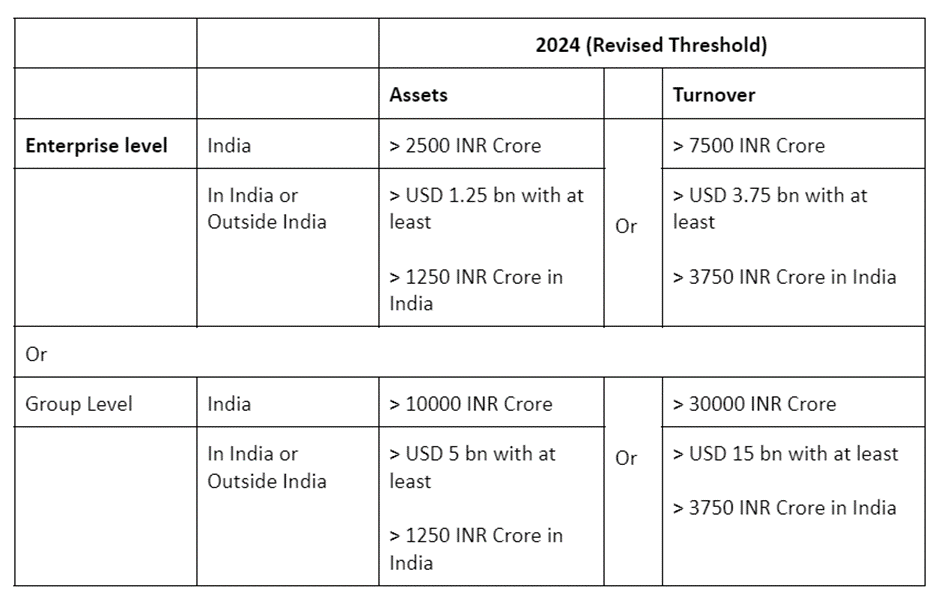

The value of assets and turnover after revision is as under:

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates