MSME Form 1 Filing Alert: MCA reminds Companies to File Before Deadline, Check Here for Details

The Finance Act, 2023 has introduced a 45 day payment rule under Section 43B(h) , which is in favour of the MSMEs. The objective of introducing the rule was to ensure that the MSMEs get timely payments form the big companies.

The Ministry of Corporate Affairs (MCA) has issued a timely reminder to all eligible companies regarding the filing of MSME Form I for the half-yearly period October 2024 to March 2025.

The MSME Form 1 is a half-yearly return that companies must file with the Registrar of Companies (ROC) if they have outstanding dues to MSME suppliers exceeding 45 days from the date of acceptance or deemed acceptance of goods or services.

Get The Clause by Clause Checklist for Form 3CD - CLICK HERE

45 - Day Payment Rule

The Finance Act, 2023 has introduced a 45 day payment rule under Section 43B(h) , which is in favour of the MSMEs. The objective of introducing the rule was to ensure that the MSMEs get timely payments form the big companies. However, it only applies to the supplier Is Registered Under The MSMED Act, 2006. Notably, the registration of the buyer under the MSMED Act, 2006 is not mandatory.

If the buyer fails to pay an MSME on time, they will be charged compound interest that is three times higher than the bank rate and the interest will start on the agreed payment date or the day after the 15-day period. The most important point to note is that businesses are not allowed to write off this interest as an expense, per the Income Tax Act, 1961.

Details to provided in MSME Form 1

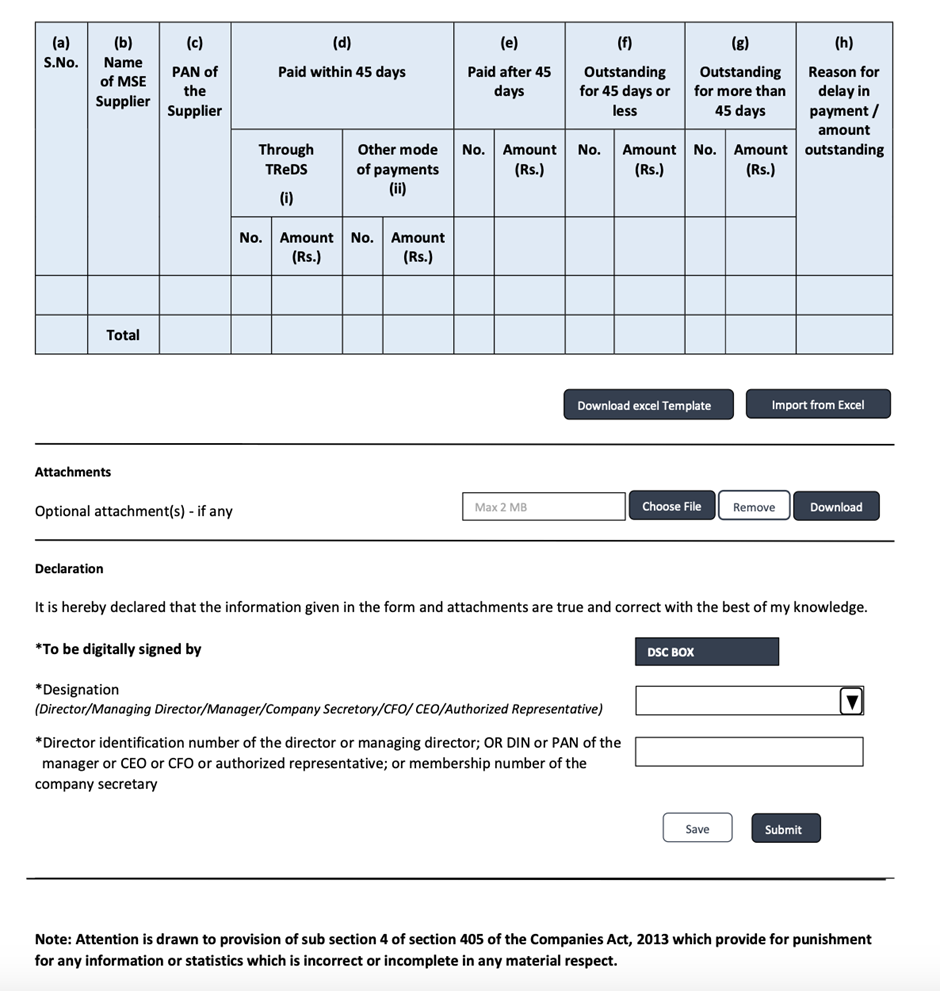

The details to be provide in the form are as follows:

- Corporate Identity Number (CIN)/ Foreign Company Registration Number (FCRN)

- Name of the Company

- Address of the registered office of the company

- Email ID of the company

- Permanent Account Number (PAN) of the company

- Returns - Type of Return

- Period - Start Date (DD/MM/YYYY) & End Date (DD/MM/YYYY)

Complete Blueprint for Preparing Project Reports, CLICK HERE

Along With these, the details shown in the image below also should be furnished :

Last Date to file MSME Form 1

The last date to file the MSME form 1 for October 2024 to March 2025 is April 30, 2025. Any default in filing the form within the time frame will attract a penalty of ₹20,000 and each officer in default will also be liable separately for a penalty of ₹20,000. Also, where there is habitual non-filing, additional penalties of ₹1,000 per day (up to ₹3 lakh) will be imposed.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates