MSME Portal Update: Udyam Portal simplifies Registration Verification for MSMEs

MSME Udyam Portal has been updated with a Simplified Verification of Registration without OTP Requirement

MSME Portal – MSME Udyam Portal – Udyam Portal – Small business registration – MSME verification process – taxscan

MSME Portal – MSME Udyam Portal – Udyam Portal – Small business registration – MSME verification process – taxscan

In a significant update, the MSME Udyam Portal has rolled out an enhanced verification facility, eliminating the requirement for OTP entry.

This strategic move aims to simplify the process of verifying Udyam Registration details, aligning with the latest amendments in the Section 43B(h) Income Tax Act, 1961.

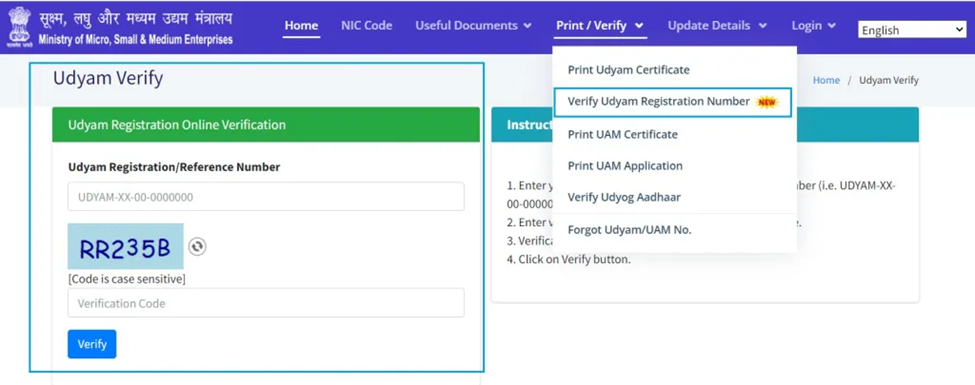

Users can now effortlessly verify specific Udyam Registration details without the hassle of entering OTPs. This streamlined process caters to the need for a more efficient and user-friendly experience on the MSME Udyam Portal.

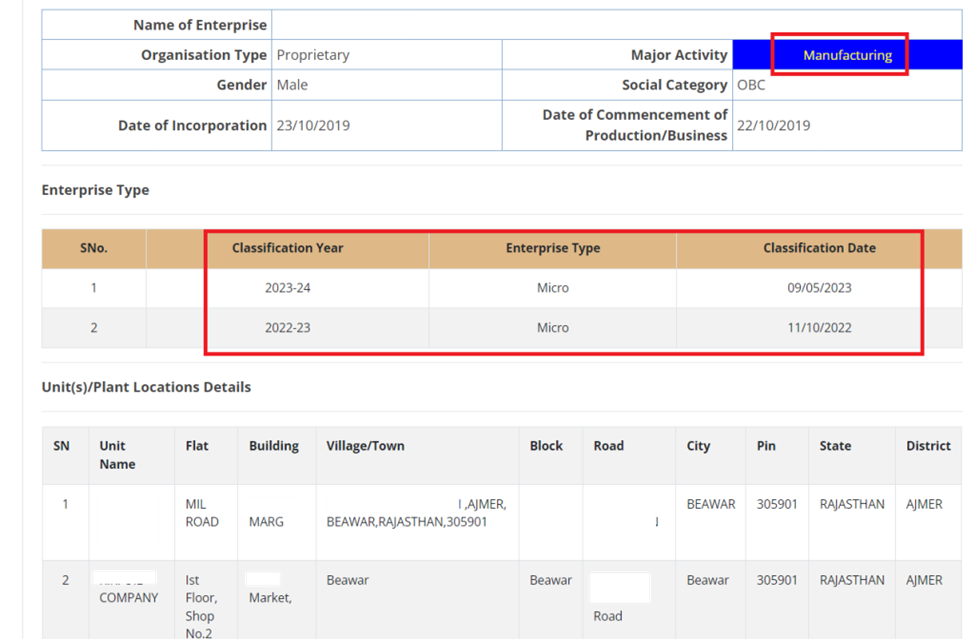

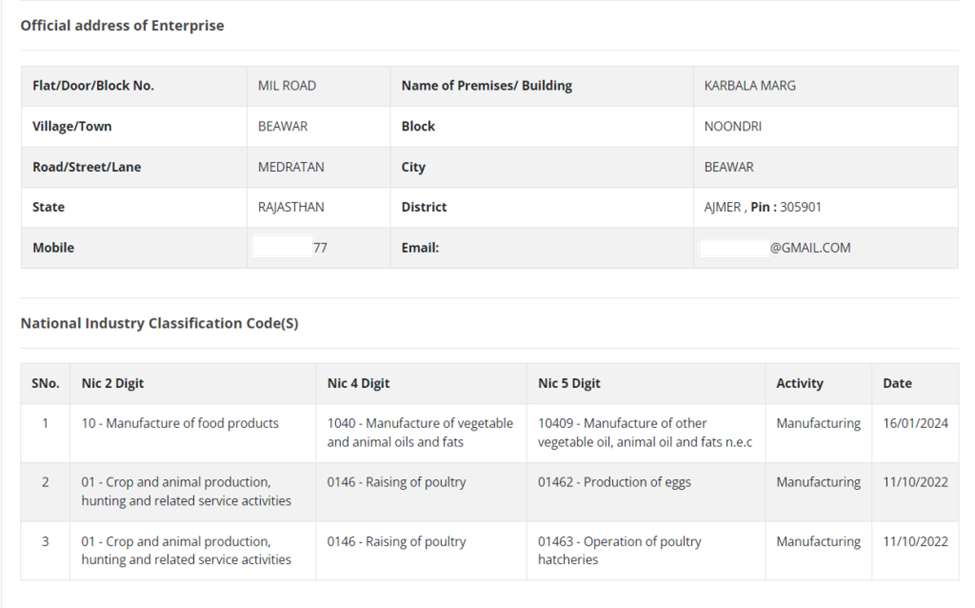

The newly introduced feature allows users to verify critical information such as activity type ( Manufacturing/Trading ), yearly classification ( Micro/Small/Medium ), and other pertinent details associated with the Udyam Registration. This comprehensive approach ensures accuracy and transparency in the verification process.

The implementation of this feature is particularly relevant in light of the recent amendment, Section 43B(h) of the Income Tax Act. By adapting to the evolving regulatory landscape, the MSME Udyam Portal aims to provide businesses with tools that align seamlessly with compliance requirements.

User-Friendly Interface:

The user interface has been designed to be intuitive, making the verification process accessible even for users with minimal technical expertise. This user-friendly approach contributes to a positive overall experience for individuals and businesses interacting with the MSME Udyam Portal.

Impact on Businesses:

This update is poised to have a positive impact on businesses, allowing them to efficiently verify their Udyam Registration details without unnecessary hurdles. The ability to access and confirm critical information swiftly enhances the overall ease of doing business for Micro, Small, and Medium Enterprises ( MSMEs ).

Know More: Decoding Section 43B(h) Amendment: Implications and Remedies under Income Tax Act 1961

In conclusion, the enhanced verification facility on the MSME Udyam Portal reflects a proactive response to regulatory changes, specifically Section 43B(h) of the Income Tax Act. This user-friendly and efficient feature underscores the portal's commitment to providing a seamless experience for businesses, contributing to the growth and compliance of the MSME sector. As businesses navigate evolving regulatory landscapes, tools like these play a pivotal role in fostering a conducive environment for their success.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates