MSMEs - Growth Engine of India

MSMEs – GROWTH ENGINE OF INDIA – taxscan

MSMEs – GROWTH ENGINE OF INDIA – taxscan

INTRODUCTION

The micro, Small, and Medium Enterprises (MSME) sector, is an industry that has become a game changer for the Indian economy. More than 42% of the employment opportunities as of today are generated by the MSME sector. This has opened up doors for the industrialization of rural & backward areas, and promoted regional development, assuring more fair distribution of national income and wealth. MSMEs have become a backbone for the mega industries as ancillary units, and this sector contributes enormously to the socio-economic development of the country.

The Khadi and Coir have become a legacy carrier for the MSME Sector. A raw material native to India with worldwide demand. Ministry of Micro, Small & Medium Enterprises (M/o MSME) envisions a vibrant MSME sector by promoting growth and development of the MSME Sector, including Khadi, Village, and Coir Industries, in cooperation with concerned Ministries/Departments, State Governments, and other Stakeholders, through providing support to existing enterprises and encouraging the creation of new enterprises.

In 2006, The Micro; Small and Medium Enterprises Development (MSMED) Act, 2006 was established to address policy issues affecting MSMEs as well as the coverage and investment ceiling of the sector.

Wait, What’s an MSME?

A business entity is eligible to be qualified as a Micro; Small and Medium Enterprise (MSME) if it fulfils certain parameters prescribed by the Micro; Small and Medium Enterprises Development (MSMED) Act, 2006.

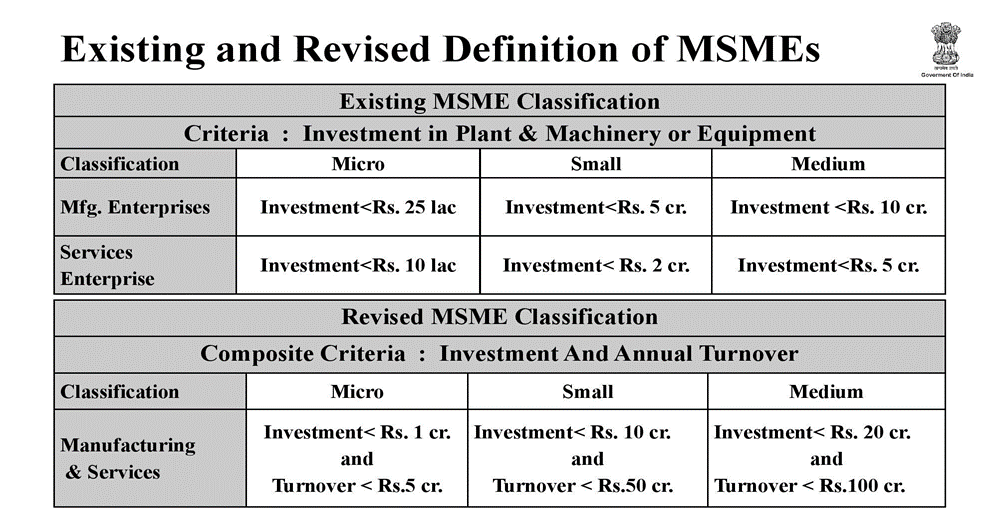

Here’s a crisp table from the Ministry of MSMEs to help you understand what’s exactly going on:

Note: MSMEs in the service sector (IT and stuff) will also be classified along the same lines as their manufacturing counterparts. So no bias for the people in the service industry either.

MSME and India

India is currently one of the fastest growing economies of the world. MSME sector is likely to continue to play a significant role in the growth of the Indian economy. In the last ten years, MSME sector has shown impressive growth in terms of parameters like number of units, production, employment, and exports. Given the right set of support systems and enabling framework, this sector can contribute much more, enabling it to actualize its immense potential. MSMEs have been contributing significantly to the expansion of entrepreneurial base through business innovations. MSMEs are widening their domain across sectors of the economy, producing diverse range of products and services to meet demands of domestic as well as global markets.

The Greener Side

When the Government of India was deciding to set parameters for sector as Micro, Small, and Medium Enterprises (MSMEs) they tried to make an attempt to set up an incentive linked structure to bring in new age of growth. And the incentives are amazing viz.:

- Collateral Free loans from banks

- Ease of getting Licenses, approvals and registrations:

- Reservation policies to manufacturing / production sector

- Special consideration on international trade fairs

- Waiver of Stamp Duty and Registration Fees

- Exemption under Direct Tax Laws

- Bar Code registration subsidy

- Subsidy on NSIC Performance and Credit ratings

- Eligibility for IPS subsidy

- Protection against delay in payment

- Reduction in rate of Interest from banks

- Waiver in Security Deposit in Government

- Concession in electricity bills

- Reimbursement of ISO Certification Excise Exemption Scheme

- Preference in procuring from Government

- 1% exemption on interest rate on OD

- 50% subsidy for patent registration

- and boatload of other freebies.

Also, to support this regime, the two most prestigious stock exchanges of this country – the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) have introduced a specially dedicated trading platform for the MSMEs. What more a business could ask for ?

But as you step-up, from Micro to Small and Small to Medium, the government will gradually step-down from the support system and put you on a path of self-reliance — “Atmanirbhar” as the Prime Minister would love to quote it.

The Debt Trap

Owing to factors like Demonetization, GST, red tape, and a bunch of other issues have crippled them. MSMEs have been struggling almost for a decade now. In fact, they are heavily leveraging on banks and new loans to stay afloat.

The pandemic of Covid-19 has trampled their aspirations and ripped them off completely. The only way to keep them afloat is some boatload of money. However, banks have been reluctant to lend to these people since they’re likely going to default on their obligation.

Unfortunately, despite the borrowing, there hasn’t been a significant improvement. A majority chunk of the MSMEs have become NPAs for Banks and Financial Institutions and as of 2018, the aggregated figure stands at Rs 80,000 Crores. So, a government intervention was inevitable to plug the funding holes.

MSME, RAMP and the World Bank

Majority of the MSMEs rely more on ‘informal sources’ of capital – a factor that is often negatively linked to growth and firm performance. For MSMEs, financial services can be a real catalyst to accelerate employment opportunities, income, and increase stability and investments. MSME can be a real game changer for employment and GDP at global level, but, when they have limited access to finance, the economy suffers a series of negative repercussions.

The World Bank has a wide range of available instruments to help meet the challenge of MSME finance viz.;

- Data and Analysis: The World Bank also works at the country level to assess policy and regulatory barriers to MSME finance, and to survey financial-service providers.

- Financing and Risk-sharing: The World Bank has an active lending portfolio of US$3.2 billion supporting MSME Finance. Support for risk-sharing facilities, including partial credit guarantees, also helps unlock the financial resources of banks and other financial institutions.

- Technical Assistance and Capacity-Building: The Bank provides advisory support, training and other services to help governments and regulators support MSME finance, and to help financial institutions expand access to finance.

Anyway, MSME has recently been in news as the Union Cabinet has approved a World Bank assisted Central Sector Scheme “Raising and Accelerating MSME Performance (RAMP)”.

It was formulated and proposed by the Government of India, for strengthening MSMEs in line with the recommendations made by U K Sinha Committee, KV Kamath Committee and Economic Advisory Council to the Prime Minister (PMEAC).

The “Raising and Accelerating MSME Performance” (RAMP) would act as:

- Policy provider – To improve competitiveness and business sustainability among MSMEs.

- Knowledge Provider – By benchmarking, sharing and demonstrating best practices, success stories by leveraging international experiences.

- Technology Provider - Providing access to high-end technology resulting in the digital and technological transformation of MSMEs through state of art technology Artificial Intelligence, Data Analytics, Internet of Things (IoT), Machine Learning etc.

So, where does this road lead us to ? MSMEs are the backbone of this economy as they have helped generate employment for millions and help businesses achieve the growth. Despite of the role it serves for the economy, the MSMEs are yet to achieve the growth they deserve. And to strengthen them further, and to see them become Atmanirbhar, a move like this was much necessary.

Disclaimer:

The entire contents have been prepared based on relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, we assume no responsibility. Therefore, users of this information are expected to refer to the relevant existing provisions of applicable Laws. Consequently, we take no responsibility for the consequences of the use of such information. In no event we shall be liable for any direct, indirect, special, or incidental damage resulting from, arising out of or in connection with the use of the information. This is only a knowledge-sharing initiative. The author does not intend to solicit any business or profession.

CS Mehul Solanki is a practicing Company Secretary and law graduate having more than Six years of working experience in company law compliances, setting-up companies, compliances of listed companies, and not-for-profit companies. He is currently a Consultant at Jaya Sharma & Associates and has authored various articles on corporate and securities law-related topics which have been published on various websites, blogs, and professional magazines including Compliance Calendar, Taxguru, Legal Service India, and the journal of ICSI, etc.

Ms. Smita Patil is a commerce graduate and aspiring corporate secretary who is currently undergoing her long-term training as a Junior Associate with Jaya Sharma & Associates. She believes in the Japanese philosophy of ‘Kaizen’, that means “change for the better or continuous improvement”. She is a keen enthusiast of Corporate and Securities law.