No Relaxation during Interim Period: GSTN Started Levying Late Fee for late Filing of GST Return

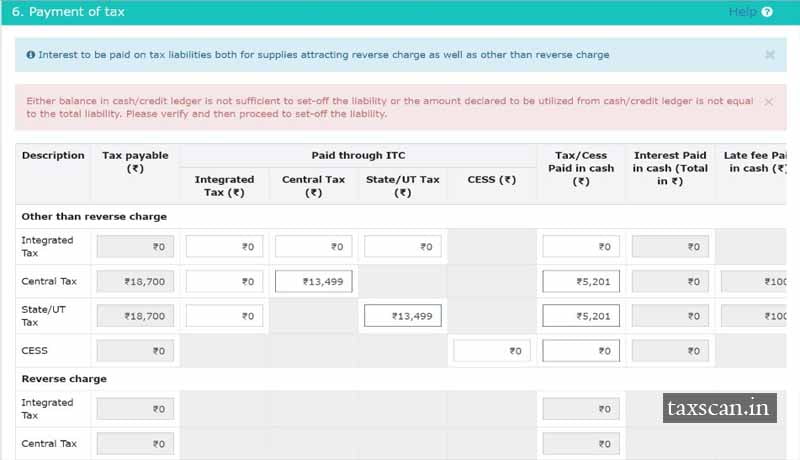

Despite the press release of the Finance Ministry that the Government will not charge any late fee or penalty for late filing of GST returns during the interim period, tax payers reported that the Goods and Services Tax Network (GSTN) has started to levy penalty for late filing of GSTR 3B.

Under the present GST laws, penalty of Rs. 100 per day is leviable under the CGST/SGST Acts. This may go upto 5,000/=. GSTR 3B will not be uploaded without paying the penalty.

Earlier, the Revenue Secretary Hasmukh Adhia and the CBEC Chief Vanaja N Sarna had stated that the department would take lenient view in case of implementation of GST laws.

Further, the Central Government, in June, released a press release clarifying that it will relax the return filing procedure for first two months of GST implementation .

It is important to note that Ministry of Finance on 18th June 2017 via press release announced Relaxation in return filing procedure for first two months of GST implementation .

In the above press release, the Government had specifically stated that “No late fees and penalty would be levied for the interim period. This is intended to provide a sense of comfort to the taxpayers and give them an elbow room to attune themselves with the requirements of the changed system. This not only underlines the government’s commitment towards ensuring that all the stakeholders are on board but also provides an opportunity to the taxpayers to be ready for this historic reform.”

However this Relaxation for levying of late fees or penalty is now contradicted by GSTN levying late fees.