Odisha Govt. Issues GST Advisory on Generation of Document Reference Number for Communication with Taxpayers

The Finance Department of the Commissionerate of CT & GST, Odisha, has published a notification regarding the option of Document Reference Number (RFN) generation for communication with taxpayers and verification of RFN through Goods and Services Tax (GST) Portal.

In order to increase transparency and accountability in the administration of indirect taxes, the Supreme Court has ruled in the case of Pradeep Goyal v. Union of India and Others that it must set up a system of electronic generation of a DIN (Document Identification Number) for all communications sent by State Tax Officers to taxpayers along with other concerned parties.

The taxpayer receives notices, orders, and other documents that have been produced by the GST portal. Nearly all of these records have a DIN (Document Identification Number)/RFN (Reference Number), which is a system-generated unique identification. These documents are already discernible in the portal, namely on the taxpayer's dashboard, by virtue of being generated by the System.

Additionally, a facility for document Reference Number (RFN) generation by State tax officers and taxpayer verification has been provided in alignment with the Supreme Court's guidelines. With the help of this feature, the tax officer can create an RFN for any communication that needs to be delivered to the taxpayer but wasn't created by the system. The taxpayer is able to employ this RFN to verify the legitimacy of the communication prior to and upon signing in.

GST BACK OFFICE:

- In Back Office, navigate to ‘Services’ > RFN Generation

- Display of RFN Page

- Fill in appropriate details:

- Name of the Taxpayer

- Trade name

- Module Type

- Subject of Communication

- Name of the Office issuing Documents

- GSTIN/UIN/Temp ID of Taxpayer

- Date of RFN generation

- Type of Communication

- Brief description of communication

- Name of the officer Issuing Documents

- Legal Name

- File Number

- Date of Issuing Document

- Reason for Delayed RFN generation (if any)

- Designation of the officer generating document

4. Click on the ‘Generate RFN’ button.

GST COMMON PORTAL

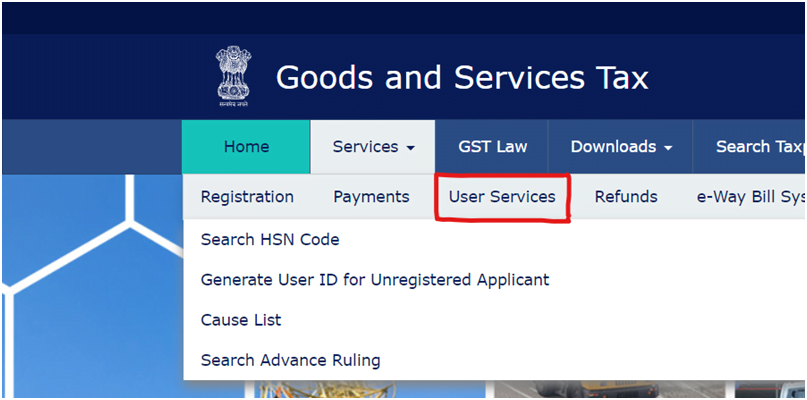

- GST portal - www.gst.gov.in

- Go to ‘Services’ > ‘User Services’

- Click on ‘Verify RFN’

It was requested that from here, all the offline contacts between tax officers and taxpayers (particularly where those communications do not occur through the GST Common Portal) can be handled using the RFN.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates