Begin typing your search above and press return to search.

Oman to Exclude VAT from 2020 Budget

Exclude VAT – OMAN VAT – Taxscan

Exclude VAT – OMAN VAT – Taxscan

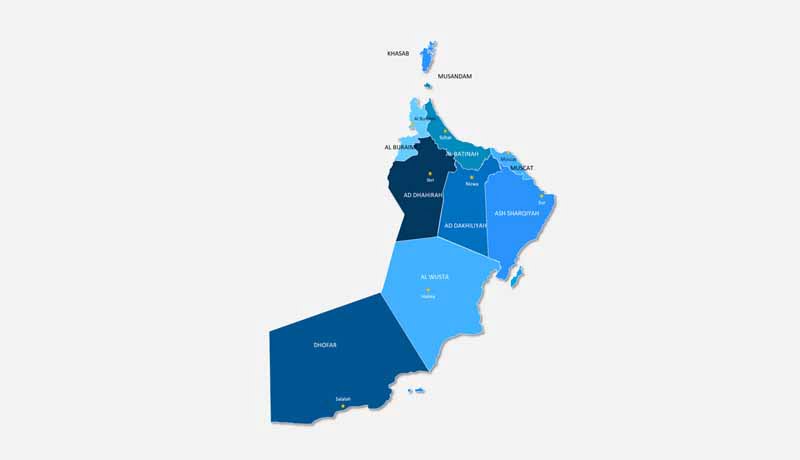

The Oman’s Ministry of Finance has affirmed the exclude of Value Added Tax (VAT) as revenue from the 2020 budget. It was also stated that the VAT regime will not be introduced until 2021.

Oman was fifth to join the “sin tax” regime with other GCC countries and was also looking to implement VAT at a standard rate of 5%. 100% sin tax was imposed on tobacco, pork, alcohol and energy drinks and later the tax on alcohol was reduced to 50%. A tax rate of is applicable on carbonated drinks.

Next Story