Begin typing your search above and press return to search.

Full Text of the Budget Speech 2016 by Finance Minister Arun Jaitley

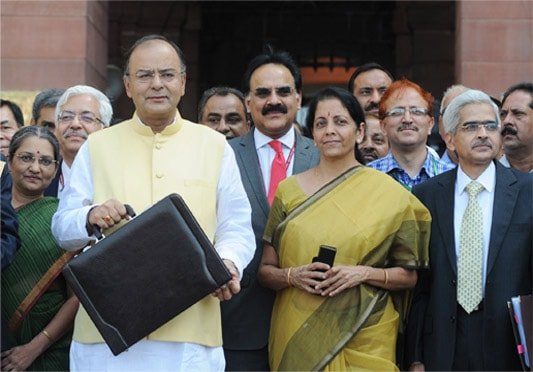

Union Finance Minister Arun Jaitley on monday delivered his third Budget speech in Parliament. The full text can be read here. [googleapps domain="drive" dir="file/d/0B3j3oXdY53gVWFlHLVJ2ZVpKeUE/preview" query="" width="640" height="480" /]

Next Story