Pan Masala and Tobacco: Central Govt notifies Special Procedures for Manufacturers to Furnish Form SRM [Read Notification]

Pan Masala and Tobacco – Form SRM – Pan Masala-Tobacco – Central Govt notifies Special Procedures for Manufacturers -Manufacturers to Furnish Form SRM – taxscan

Pan Masala and Tobacco – Form SRM – Pan Masala-Tobacco – Central Govt notifies Special Procedures for Manufacturers -Manufacturers to Furnish Form SRM – taxscan

The Central Government vide notification no. 30/2023–Central tax S.O. 3424(E) issued on 1st August 2023 has notified the special procedures for the manufacturers of Pan Masala and tobacco.

According to the notification,on the recommendations of the GST Council, notified the special procedure to be followed by a registered person engaged in manufacturing of the goods, the description of which is specified in the corresponding entry in column (3) of the Schedule appended to this notification, and falling under the tariff item, sub- heading, heading or Chapter, as the case may be, as specified in the corresponding entry in column (2) of the said Schedule.

The special procedures mentioned are:

- Details of Packing Machines

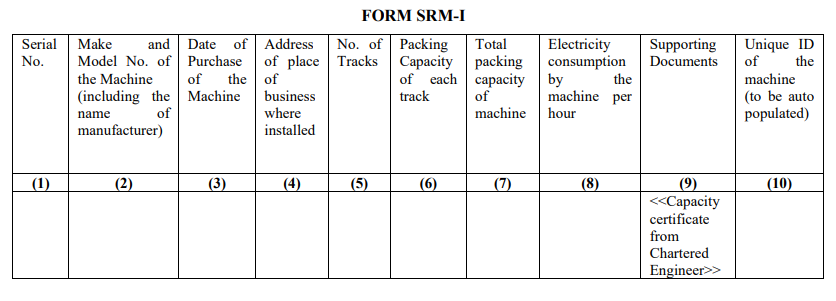

All the existing registered persons engaged in manufacturing of the goods mentioned in Schedule to this notification shall furnish the details of packing machines being used for filling and packing of pouches or containers in FORM SRM-I, within 30 days of issuance of this notification, electronically on the common portal,—

- Any person intending to manufacture goods as mentioned in Schedule to this notification, and who has been granted registration after the issuance of this notification, shall furnish the details of packing machines being used for filling and packing of pouches or containers in FORM SRM-I on the common portal, within fifteen days of grant of such registration.

- The details of any additional filling and packing machine being installed in the registered place of business shall be furnished, electronically on the common portal, by the said registered person within 24 hours of such installation in FORM SRM-IIA.

- Upon furnishing such details in FORM SRM-I or FORM SRM-IIA, a unique ID shall be generated for each machine, whose details have been furnished by the registered person, on the common portal.

- In case, the said registered person has submitted or declared the production capacity of his manufacturing unit or his machines, to any other government department or any other agency or organization, the same shall be furnished by the said registered person in FORM SRM-IA on the common portal, within fifteen days of filing said declaration or submission:

Provided that where the said registered person has submitted or declared the production capacity of his manufacturing unit or his machines, to any other government department or any other agency or organization, before the issuance of this notification, the same shall be furnished by the said registered person in FORM SRM-IA on the common portal, within thirty days of issuance of this notification.

- The details of any existing filling and packing machine removed from the registered place of business shall be furnished, electronically on the common portal, by the said registered person within 24 hours of such removal in FORM SRM-IIB.

II. Additional records to be maintained by the registered persons manufacturing the goods mentioned in the Schedule

- Every registered person engaged in manufacturing of goods mentioned in Schedule shall keep a daily record of inputs being procured and utilized in quantity and value terms along with the details of waste generated as well as the daily record of reading of electricity meters and generator set meters in a format as specified in FORM SRM-IIIA in each place of business.

- Further, the said registered person shall also keep a daily shift-wise record of machine-wise production, product-wise and brand-wise details of clearance in quantity and value terms in a format as specified in FORM SRM-IIIB in each place of business.

III. Special Monthly Statement

- The said registered person shall submit a special statement for each month in FORM SRM-IV on the common portal, on or before the tenth day of the month succeeding such month.

SCHEDULE

| S.No. | Chapter / Heading / Sub-heading / Tariff item | Description of Goods |

| (1) | (2) | (3) |

| 1 | 2106 90 20 | Pan-masala |

| 2 | 2401 | Unmanufactured tobacco (without lime tube) – bearing a brand name |

| 3 | 2401 | Unmanufactured tobacco (with lime tube) – bearing a brand name |

| 4 | 2401 30 00 | Tobacco refuse, bearing a brand name |

| 5 | 2403 11 10 | 'Hookah' or 'gudaku' tobacco bearing a brand name |

| 6 | 2403 11 10 | Tobacco used for smoking 'hookah' or 'chilam' commonly known as 'hookah' tobacco or 'gudaku' not bearing a brand name |

| 7 | 2403 11 90 | Other water pipe smoking tobacco not bearing a brand name |

| 8 | 2403 19 10 | Smoking mixtures for pipes and cigarettes |

| 9 | 2403 19 90 | Other smoking tobacco bearing a brand name |

| 10 | 2403 19 90 | Other smoking tobacco not bearing a brand name |

| 11 | 2403 91 00 | “Homogenised” or “reconstituted” tobacco, bearing a brand name |

| 12 | 2403 99 10 | Chewing tobacco (without lime tube) |

| 13 | 2403 99 10 | Chewing tobacco (with lime tube) |

| 14 | 2403 99 10 | Filter khaini |

| 15 | 2403 99 20 | Preparations containing chewing tobacco |

| 16 | 2403 99 30 | Jarda scented tobacco |

| 17 | 2403 99 40 | Snuff |

| 18 | 2403 99 50 | Preparations containing snuff |

| 19 | 2403 99 60 | Tobacco extracts and essence bearing a brand name |

| 20 | 2403 99 60 | Tobacco extracts and essence not bearing a brand Name |

| 21 | 2403 99 70 | Cut tobacco |

| 22 | 2403 99 90 | Pan masala containing tobacco ‘Gutkha’ |

| 23 | 2403 99 90 | All goods, other than pan masala containing tobacco 'gutkha', bearing a brand name |

| 24 | 2403 99 90 | All goods, other than pan masala containing tobacco 'gutkha', not bearing a brand name |

| 25 | 3301 24 00, 3301 25 10, 3301 25 20, 3301 25 30, 3301 25 40, 3301 25 90 | Following essential oils other than those of citrus fruit namely: - (a) Of peppermint (Mentha piperita); (b) Of other mints : Spearmint oil (ex-mentha spicata), Water mint-oil (exmentha aquatic), Horsemint oil (ex-mentha sylvestries), Bergament oil (exmentha citrate), Mentha arvensis |

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates