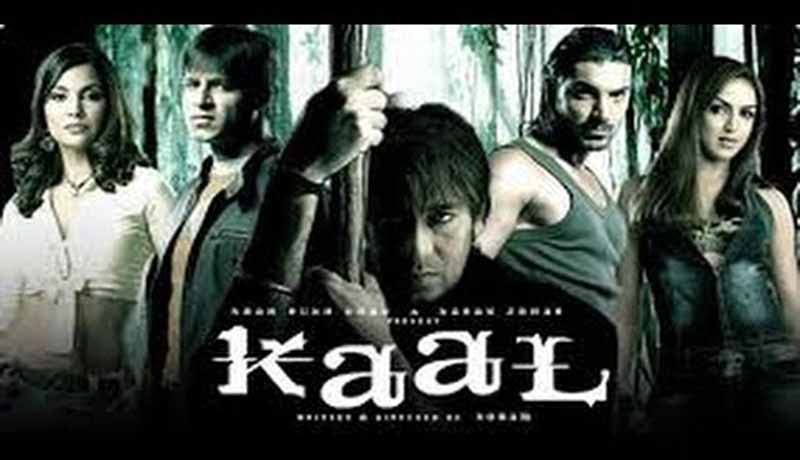

Payment to SRK’s RCEPL by Dharma Productions for the production of ‘Kaal’ Film is allowable as Expenditure: Bombay HC

While giving Tax relief to the Bollwood Director Karan Johar’s Dharma Productions Pvt Ltd, the Bombay High Court held that the payments made by them to Red Chillies Entertainment Pvt Ltd, in connection with the production of ‘Kaal’ Film is allowable as expenditure under section 37(1) of the Income Tax Act.

Assessee, a Film production Company, entered into an agreement with Red Chillies Entertainment Pvt Ltd, for sharing revenue at the rate of 50% with respect to "Kaal" film. As per the agreement, RCEPL had to provide certain services. Assessee poined out that RCEPL was very much involved in the Film as they have provided various equipments for the production. Further, Mr.Shahrukh Khan, a director of RCEPL, has not only advised/helped in the production of the film but also performed in the title song of the film itself in the form of creative input. They further pointed out that this agreement is valid for a period of eleven years from the date of execution, under which, they have to share profit with RCEPL for a period of eleven years from the date of execution of agreement. In view of the contractual liability and use of the services provided by RCEPL, the assessee has paid 50% of the net realization of the film `Kaal' to the said company during the year and they claimed expenditure of Rs.1,51,80,116/incurred as payment to RCEPL.

Both the Assessing Officer and the first appellate authority denied the claim on ground that the assessee had not produced any tangible material to substantiate the claim. They were of the view that the said expenses are liable to be treated as business income of the assessee under section 28(iv) of the IT Act. However, the Appellate Tribunal, on second appeal preferred by the assessee, held that the assessee has established that the payment has been made as per agreement between the parties and against services provided by RCEPL and is allowable under Section 37(1) of the Act.

Dismissing the departmental appeal, the division bench upheld the findings of the tribunal that existence of agreement between the parties has not been disputed by the authorities but the payment in question has been disallowed on account that no service was rendered by RCEPL and consequently it was held that the expenditure was not for the purpose of business. “It was observed that the assessee company is owned by Mr.Karan Johar and RCEPL is owned by Mr.Shahrukh Khan. Both are known personalities of Indian film industry. The authorities have not disputed the fact of providing services by Mr.Shahrukh Khan in the production and marketing of the film `Kaal'. The film was released under joint banner of Karan Johar and Shahrukh Khan which itself is an material aspect of marketing and publicity of the film. Undisputedly, Mr.Shahrukh Khan has performed in the title song of the film and for which no separate payment has been made by the assessee. Further, it is evident from the terms and conditions of the agreement that RCEPL shall provide necessary contribution in the field of concept, characterization, dialogue, music, theme etc. in the production of the film. Thus, functions are creative in nature and require personal and professional expertise and, therefore, the confirmation of the party regarding rendering of the services itself is a material evidence. If the parties to the agreement admitted the role and function of creative work in the film, then, in the absence of any contrary material, the confirmation cannot be doubted.”

Read the full text of the Judgment below.