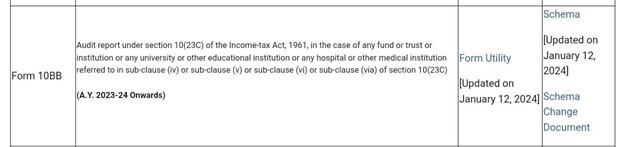

Portal Update: Income Tax Dept updates Form 10BB Audit Report e-filing Utility and JSON Schema

The Income Tax Department has updated the portal with new e-filing Utility and Schema for Form 10BB Audit Report filing.

In a move to streamline the audit reporting process, the Income Tax Department has re-notified Form 10BB with the issuance of Notification No. 7/2023 dated 21st February 2023.

This article provides a detailed resolution to common queries regarding the applicability, filing process, and other crucial aspects of Form 10BB for Assessment Year 2023-24 and subsequent years.

1. Applicability of Form 10BB:

The re-notified Form 10BB is applicable from Assessment Year 2023-24 onwards, as per Notification No.

7/2023 dated 21st February 2023.

2. Availability of Previous Form 10BB:

The existing Form 10BB, applicable until Assessment Year 2022-23, is still available on the e-Filing portal.

Users can access it for filings up to the mentioned assessment year.

3. Conditions for Filing Form 10BB:

Form 10BB is required to be filed from A.Y. 2023-24 onwards if any of the following conditions are met:

- Total income exceeds five crores during the previous year.

- The auditee has received foreign contributions.

- The auditee has applied for any part of its income outside India.

For other cases, the re-notified Form 10BB is applicable. Refer to Rule 16CC and Rule 17B of Income Tax

Rules, 1962 for more details.

4. Filing Process for Form 10BB (A.Y. 2023-24 Onwards):

The filing process involves steps for both taxpayers and Chartered Accountants (CAs). It includes

assignment, acceptance, and verification. Ensure timely filing to avoid delayed filing consequences.

5. Definition of "Auditee":

The term "auditee" refers to any fund, institution, trust, university, educational institution, hospital, or

medical institution mentioned in specific clauses of section 10 or sections 11 and 12 of the Income Tax

Act.

6. Understanding "Foreign Contribution":

The term "foreign contribution" in the context of re-notified Form 10BB refers to the definition provided

in the Foreign Contribution (Regulation) Act, 2010.

7. Due Date for Filing Form 10BB:

Form 10BB must be filed before the specified date mentioned in section 44AB, i.e., one month before

the due date for filing the return under section 139(1).

8. Completion of Form 10BB Filing:

Filing is considered complete when the taxpayer accepts the form uploaded by the CA and verifies it

with an active Digital Signature Certificate (DSC) or Electronic Verification Code (EVC).

9. Verification Modes for Form 10BB:

Different verification modes are available for CAs and taxpayers, including DSC and EVC options based

on the entity type.

10. Applicability of Form 10B and 10BB from A.Y. 2023-24:

The amendment rules dictate the applicability of Form 10B and 10BB from A.Y. 2023-24 onwards,

irrespective of the form filed in previous assessment years.

11. Providing Records for Schedules with "Add Details" and "Upload CSV" Options:

Specific guidelines are provided for handling schedules with tables, allowing either table or CSV

options for records up to 50, and only CSV for records exceeding 50.

12. Revision Option for Form 10BB:

Yes, the revision option is available for the filed Form 10BB.

13. Instructions and Guidance for Filling the Form:

CAs can download an instruction file during the form-filling process under their ARCA login.

14. Attachments Required for Form 10BB:

Mandatory attachments include Income and Expenditure Account/Profit and Loss Account and Balance

Sheet. An optional "Miscellaneous Attachments" section is available.

15. Viewing Filed Form Details:

Filed form details can be viewed under the e-File tab on the Income Tax portal for both CA and

taxpayer logins.

16. Downloading Offline Utility:

The offline utility of Form 10BB can be downloaded from the Income Tax Department's website. Ensure

the use of the latest version available on the e-Filing portal.

17. Filing through ERIs (Third-Party Softwares):

Form 10BB can be filed through ERIs using the "Offline" filing mode.

18. Applicability Below Basic Exemption Limit:

Refer to relevant provisions for the applicability of Form 10BB, considering the basic exemption limit.

19. Selecting Organization Type in Form 10BB:

Form 10BB provides options like fund, trust, institution, university, educational institution, hospital, or

medical institution for selection based on the nature of the auditee.

20. Handling Submission Errors:

Ensure complete profiles for both taxpayers and CAs, delete old drafts, and reattempt filing.

21. Mandatory Details for Specified Persons in Section 13(3):

Details of specified persons in Sl. No. 28 is mandatory, as per Circular No. 17/2023, even if certain

conditions in section 13 are not applicable.

22. Generating UDIN for Form 10BB:

For A.Y. 2023-24 onwards, UDIN needs to be generated by selecting the appropriate Form name on the

UDIN portal.

This comprehensive guide aims to address various questions related to the re-notified Form 10BB, providing clarity on its applicability, filing process, conditions, and other essential aspects. Taxpayers and CAs are encouraged to adhere to the guidelines and stay informed about any updates from the Income Tax Department.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates