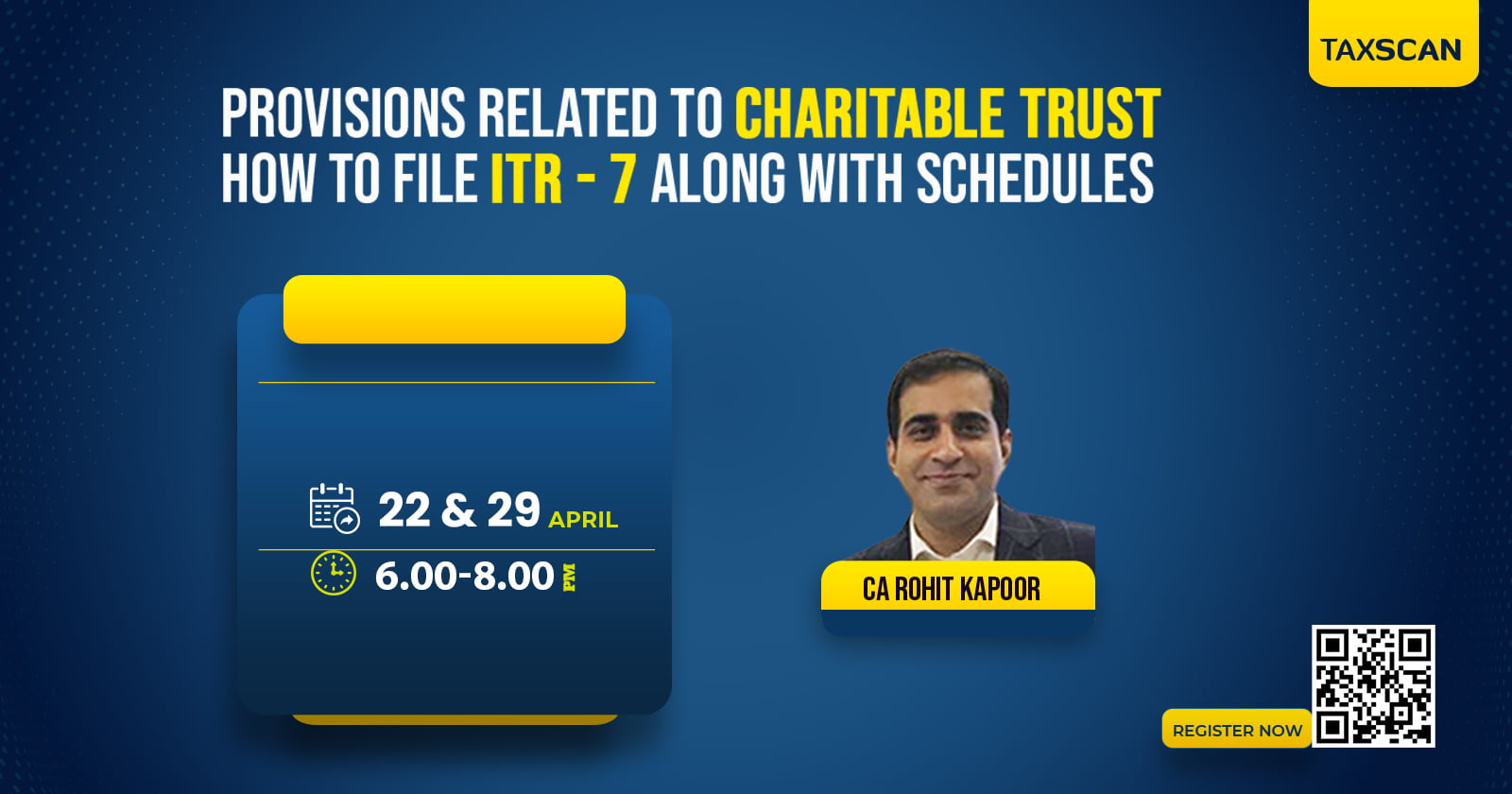

Provisions Related to Charitable and Religious Trust & How to File ITR7 along with Shedules

PROVISIONS – CHARITABLE TRUST – RELIGIOUS TRUST – ITR7 – taxscan

PROVISIONS – CHARITABLE TRUST – RELIGIOUS TRUST – ITR7 – taxscan

Faculty - CA Rohit Kapoor

📆22 & 29 April

⏰6.00PM to 8.00PM

Course Fees1999/-(Including GST)

1299/-(Including GST)

Click Here To Pay

Key Features

✅English Medium

✅E Notes available

✅E Certificate

✅The Recordings will be provided

What will be covered in the course?

◾ How to form SOCIETY or TRUST?

◾ How to get registration & re-registration of institution under new regime of Income Tax Act? How to apply for registration under section 80G of the Income Tax Act?

◾ Types of AOP/BOI & its taxability.

◾ Oral trust & Private trust.

◾ Provisions related to section 11, 12 and 10(23C)(iiiab), (iiiac), (iiiad), (iiiae), (iv), (v), (vi) and (via).

◾ Taxability of Corpus Donation under both the regimes.

◾ How to file ITR-7 in case of charitable & religious institutions.

◾ What amounts are eligible as application under both the regime.

◾ Taxability of Capital Gain under Charitable & religious trust.

◾ Charitable institution carrying on business u/s 11(4) and taxability of incidental business of Charitable Institution.

◾ Applicability of sec 56 in the case of unregistered charitable and religious trust.

◾ Detailed discussion of section 115(TD) i.e. special provisions relating to tax on accreted income of certain trust and institutions.

For Queries - 8891 128 677, 89434 16272, info@taxscan.in