Punjab Govt notifies One-Time Settlement Scheme for Recovery of Outstanding Dues for Assessment made till 31st March 2023 up to 1 Crore [Read Order]

Punjab Govt – One-Time Settlement Scheme – Recovery of Outstanding Dues – Assessment -TAXSCAN

Punjab Govt – One-Time Settlement Scheme – Recovery of Outstanding Dues – Assessment -TAXSCAN

The Punjab Government, through notification no. G.S.R.85/P.A.8/2005/S.29 A/C.A.74/1956/S.9/P.A.8/2002/S.25/P.A.5/2017/S.174/2023 issued on November 9, 2023, has introduced a one-time settlement scheme for the recovery of outstanding dues related to assessments made until March 31, 2023, up to 1 crore.

As per the notification, the scheme will be in effect from November 15, 2023. Additionally, the deadline to avail of this scheme is set until March 15, 2024.

Individuals whose assessments have been conducted under the applicable Acts until March 2023 are qualified to apply for and benefit from the settlement offered by this Scheme, adhering to the specified terms and conditions. To initiate the process, the applicant must submit an application in FORM OTS-1 to the designated State Tax Officer or Excise and Taxation Officer. The application should be supplemented by evidence demonstrating the full payment of the self-assessed determined amount under the relevant Acts.

Vide FORM OTS-2, on receipt of the application, the concerned officer will issue the acknowledgment. Further, if there is any deficiency in the application, the concerned Officer shall serve a deficiency memo in FORM OTS-3 on the applicant with the directions to remove the deficiencies within fifteen working days from the date of Service Of deficiency memo. Where the applicant fails to submit a reply to the said deficiency memo within fifteen working days, his application shall be deemed to be rejected.

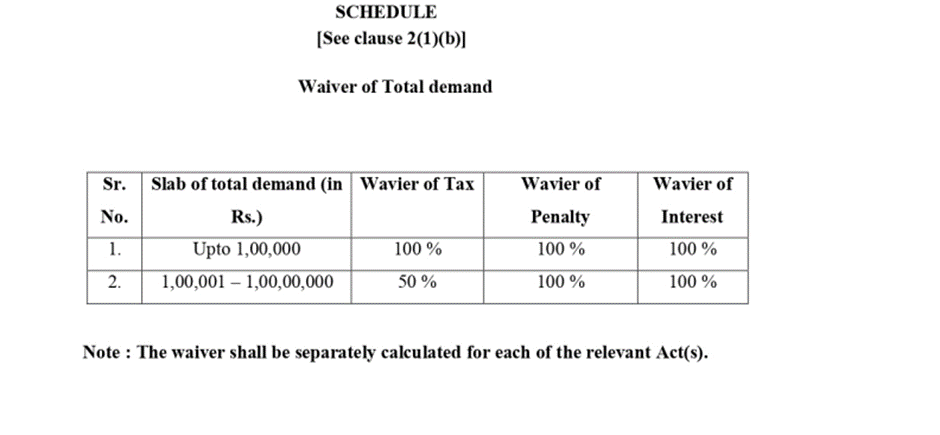

The terms and conditions for accessing this scheme by applicants are explicitly outlined in the notification. Attached to the notification are schedules containing the forms to be utilized by both applicants and the relevant officers. The subsequent section outlines the schedule for the total demand waiver:

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates