Rs. 97,597 Cr Gross GST Revenue collected in March 2020

The gross GST revenue collected in the month of March, 2020 is Rs. 97,597crore of which CGST is Rs. 19,183 crore, SGST is Rs. 25,601 crore, IGST is Rs. 44,508 crore (including Rs. 18,056 crores collected on imports) and Cess is Rs. 8,306 crore (including Rs. 841 crores collected on imports). The total number of GSTR-3B Returns filed for the month of February up to 31st March, 2020 is 76.5 lakh.

The government has settled Rs. 19,718 crore to CGST and Rs. 14,915 crore to SGST from IGST as regular settlement. In addition, the Centre has also apportioned unsettled balance IGST of Rs. 6000 crores on an ad-hoc basis in the ratio of 50:50 between centre and States/UTs.The total revenue earned by the Central Government and the State Governments after regular settlement in the month of March,2020 is Rs. 41,901 crore for CGST and Rs. 43,516 crore for the SGST.

The GST revenues during the month of March, 2020 from domestic transactions have shown a negative growth of 4% over the revenue during the month of March, 2019. Taking into account the GST collected from import of goods, the total revenue during March, 2020has also decreased by 8% in comparison to the revenue during March, 2019. During this month, the GST on import of goods has shown a negative growth of (-) 23% as compared to March, 2019.

For the full financial year, 2019-20, the GST for the domestic transaction has shown a growth rate of 8% over the revenues during last year. During the year, GST from import on goods fell down by 8% as compared to last year. Overall, gross GST revenues grew at 4% over the last year’s GST revenue.

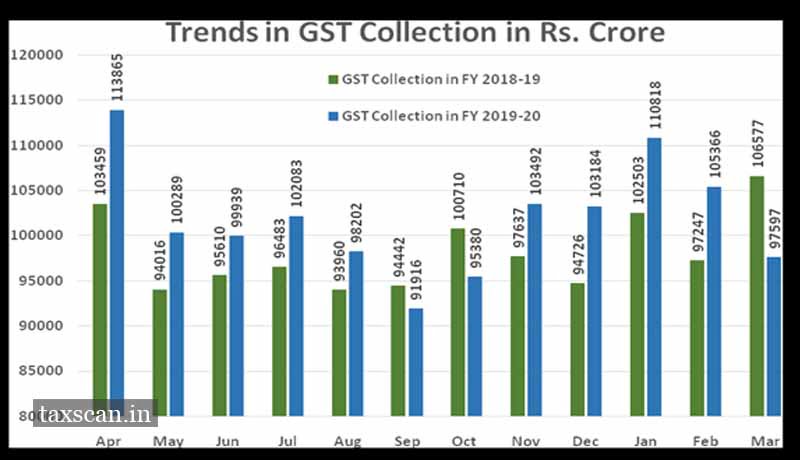

The chart shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of March, 2020 as compared to March, 2019 and for the full year.

State-wise GST Collections during March 2020| State | Mar-19 | Mar-20 | Growth | 2018-19 | 2019-20 | Growth |

| Jammu and Kashmir | 388 | 276 | -29% | 3,792 | 4,010 | 6% |

| Himachal Pradesh | 660 | 596 | -10% | 7,593 | 7,960 | 5% |

| Punjab | 1,166 | 1,181 | 1% | 13,979 | 15,235 | 9% |

| Chandigarh | 162 | 153 | -5% | 1,779 | 1,988 | 12% |

| Uttarakhand | 1,451 | 1,195 | -18% | 15,150 | 14,722 | -3% |

| Haryana | 4,561 | 4,874 | 7% | 55,233 | 59,560 | 8% |

| Delhi | 3,722 | 3,273 | -12% | 39,845 | 44,161 | 11% |

| Rajasthan | 3,132 | 2,820 | -10% | 30,722 | 32,821 | 7% |

| Uttar Pradesh | 5,548 | 5,294 | -5% | 61,337 | 65,281 | 6% |

| Bihar | 1,177 | 1,056 | -10% | 10,755 | 12,640 | 18% |

| Sikkim | 160 | 189 | 19% | 1,917 | 2,248 | 17% |

| Arunachal Pradesh | 85 | 67 | -22% | 398 | 581 | 46% |

| Nagaland | 46 | 39 | -16% | 227 | 317 | 40% |

| Manipur | 46 | 36 | -22% | 309 | 435 | 41% |

| Mizoram | 50 | 33 | -33% | 213 | 296 | 39% |

| Tripura | 64 | 67 | 5% | 556 | 680 | 22% |

| Meghalaya | 127 | 133 | 5% | 1,368 | 1,522 | 11% |

| Assam | 956 | 932 | -3% | 8,989 | 10,423 | 16% |

| West Bengal | 3,841 | 3,582 | -7% | 39,780 | 43,386 | 9% |

| Jharkhand | 2,149 | 2,049 | -5% | 23,916 | 22,847 | -4% |

| Odisha | 2,626 | 2,633 | 0% | 26,952 | 29,677 | 10% |

| Chhattisgarh | 2,143 | 2,093 | -2% | 22,932 | 24,160 | 5% |

| Madhya Pradesh | 2,624 | 2,407 | -8% | 25,683 | 28,354 | 10% |

| Gujarat | 6,521 | 6,820 | 5% | 73,440 | 78,923 | 7% |

| Daman and Diu | 103 | 95 | -8% | 1,105 | 1,155 | 5% |

| Dadra and Nagar Haveli | 174 | 169 | -3% | 1,718 | 1,810 | 5% |

| Maharashtra | 15,596 | 15,002 | -4% | 1,70,289 | 1,85,917 | 9% |

| Karnataka | 6,983 | 7,144 | 2% | 78,763 | 83,408 | 6% |

| Goa | 389 | 316 | -19% | 4,103 | 4,280 | 4% |

| Lakshadweep | 1 | 1 | 54% | 20 | 20 | 2% |

| Kerala | 1,635 | 1,475 | -10% | 16,343 | 19,234 | 18% |

| Tamil Nadu | 6,941 | 6,178 | -11% | 70,562 | 74,430 | 5% |

| Puducherry | 184 | 149 | -19% | 1,924 | 1,871 | -3% |

| Andaman &Nicobar Islands | 28 | 39 | 40% | 297 | 361 | 21% |

| Telangana | 3,897 | 3,563 | -9% | 36,408 | 39,820 | 9% |

| Andhra Pradesh | 2,589 | 2,548 | -2% | 25,331 | 27,108 | 7% |

| Other Territory | 167 | 133 | -21% | 2,484 | 1,753 | -29% |

| Center Jurisdiction | 74 | 81 | 10% | 580 | 1,003 | 73% |

| Total | 82,165 | 78,700 | -4% | 8,76,794 | 9,44,414 | 8% |