Salaried Citizen Alert! EPF Credits, Deposits and Transactions into Accounts Linked with Paytm Payments Bank to Stop from Tomorrow

EPF Organization instructs Field Officers to not entertain Paytm Payments Bank related credits and deposits

Paytm Payments Bank – EPF Credits – Salaried Citizen Alert – Deposits and Transactions – TAXSCAN

Paytm Payments Bank – EPF Credits – Salaried Citizen Alert – Deposits and Transactions – TAXSCAN

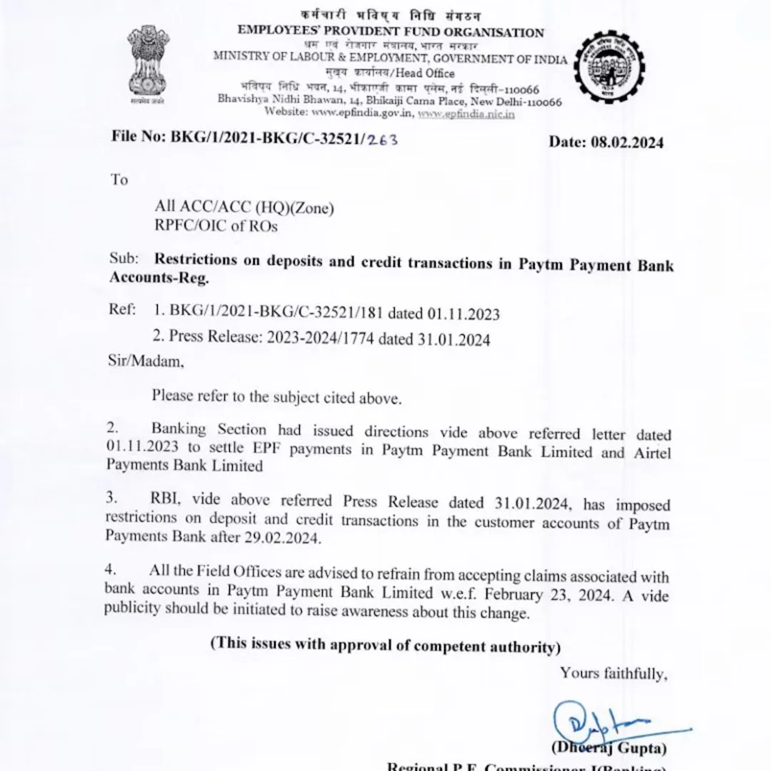

In a circular dated February 8, 2024, the Employees’ Provident Fund Organisation ( EPFO ) instructed its Field Offices not to entertain claims related to Paytm Payments Bank Limited ( PPBL ) accounts, effective from February 23, 2024. This move comes in response to the recent restrictions imposed by the Reserve Bank of India ( RBI ), affecting deposits and credit transactions in EPF accounts held at Paytm Payments Bank.

EPFO Circular on Restriction of Deposits and Credits Transactions in Paytm Bank

Previously, the EPFO had directed its banking section to facilitate EPF payments through Paytm Payments Bank and Airtel Payments Bank accounts. However, following the RBI's intervention on January 31, which included limitations on Paytm Payments Bank activities, such as deposits, credit transactions, and top-ups, these options are now restricted after February 29.

Read More: Paytm Ban Supervisory, Not Detrimental to FinTech Ecosystem, says RBI

Paytm Payments Bank, operating as a payments bank since May 23, 2017, obtained its license under Section 22 (1) of the Banking Regulation Act, 1949. The recent regulatory action by the RBI against Paytm Payments Bank is attributed to its failure to comply with regulations despite repeated warnings.

Read Also: Clear your Doubts: RBI issues FAQs w.r.t Restrictions imposed on Paytm Payment Banks Ltd.

The decision to curb new deposits into Paytm Payments Bank was made after allowing sufficient time for the company to rectify its non-compliance issues, as stated by RBI Deputy Governor Swaminathan J during a press conference after the MPC meeting.

Read Also: RBI Ban on Paytm: What Paytm Users Need to Know about Their Accounts

RBI Governor Shaktikanta Das emphasized that regulated entities are provided ample time to meet regulatory requirements. The central bank engages in discussions with companies regarding compliance issues and encourages corrective measures. When such efforts prove ineffective, the RBI resorts to imposing supervisory or business restrictions. Das reassured that the RBI is a responsible regulator and would not take action if all regulatory norms were followed.

Responding to queries, Das mentioned plans to issue an FAQ next week to address concerns and provide clarity. With Paytm's extensive network of over 30 million merchants, including roughly 20 percent utilizing Paytm Payments Bank Ltd ( PPBL ) for financial settlements, the RBI's directive restricting new deposits has raised concerns about potential disruptions to digital payments.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates