Sales Tax Bar Association Moves Delhi HC on Technical Flaws on GST Portal

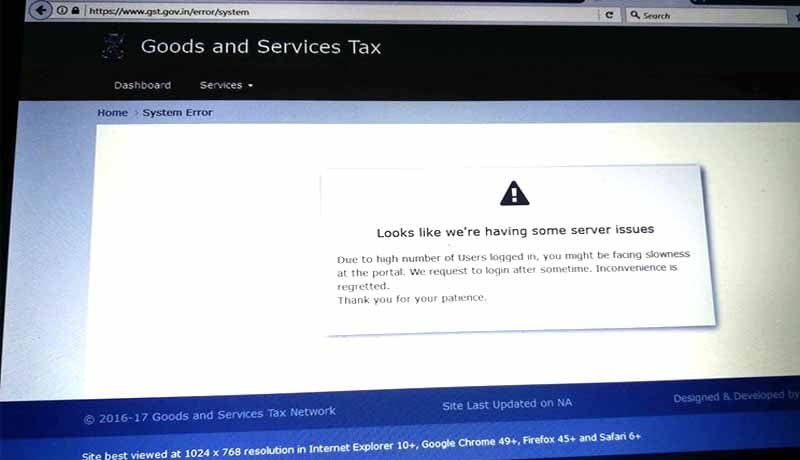

Sales Tax Bar Association has filed a petition before the Delhi High Court highlighting several technical glitches on the portal (software) of the Goods and Services Tax Network (GSTN) Portal.

The Sales Tax Bar Association is an association of more than 1700 members constituting lawyers, Chartered Accountants and tax professionals.

The Petitioners alleged that various Inaction on the part of the respondents including in action to provide form GST Tran-2, Non availability of option to make revision in Form GST Tran-1, Inaction to provide for any machinery / mechanism / option / window / link to file Advance Ruling Application etc.

The division bench comprising of Justice Sanjiv Khanna and Justice Prathibha M. Singh has issued notices to respondents.

Senior Advocate Prem Lata Bansal, Advocates Puneet Agrawal, Abhishek Boob, Purvi Sinha appeared for the petitioners.

The Petitioners prayed to constitute expert committee, with representatives from various stake holders, for overseeing as to whether the common portal is functioning in an appropriate manner in accordance with law, and without any technical glitches and to make suggestions / recommendations to GSTN regarding the concerns / problems being faced by various stakeholders.

The petition stated that, “the provisions regarding filing of returns/ making compliances under the CGST Act / DGST Act on the Common Portal be kept in abeyance, till its functioning is duly approved by this Hon’ble Court after receiving proper testing report and recommendations from the expert committee regarding the appropriate functioning of the common portal”.

“To hold that GSTN is operating the common portal in complete defiance of the express provisions of the CGST and DGST Act / Rules and that therefore, no tax can be validly collected since the machinery to collect and operate the provisions of law does not infact exist. GSTN is operating in complete defiance and in violation of Article 14, 19, 21, 265 and 300A of the Constitution of India”, the petition also stated.

The Court posted the matter for further hearing on 11th December, 2017.