Settlement of Outstanding Income Tax Demands: Know How to Check Status in Portal and Address Queries

These demands, up to particular monetary limits across various assessment years until 2015-16, are covered, with a maximum cap of ₹1,00,000 per taxpayer, excluding TDS/TCS demand entries

The Finance Minister, in her budget speech 2024, has announced the remission and extinguishment of specific outstanding direct tax demands. The Central Board of Direct Taxes ( CBDT ) has also issued an order related to the same on February 13, 2024.

These demands, up to particular monetary limits across various assessment years until 2015-16, are covered, with a maximum cap of ₹1,00,000 per taxpayer, excluding TDS/TCS demand entries.

The remission and extinguishment include the principal tax demand and associated interest, penalties, fees, cess, or surcharges under relevant provisions of the Income-tax Act, 1961, or corresponding provisions of the Wealth-tax Act, 1957, or Gift-tax Act, 1958. However, demands against tax deductors or collectors under TDS or TCS provisions are not included.

Additionally, interest calculations due to payment delays under section 220(2) of the Income-tax Act, 1961, or corresponding provisions of the Wealth-tax Act, 1957, and Gift-tax Act, 1958, will not be required following this remission.

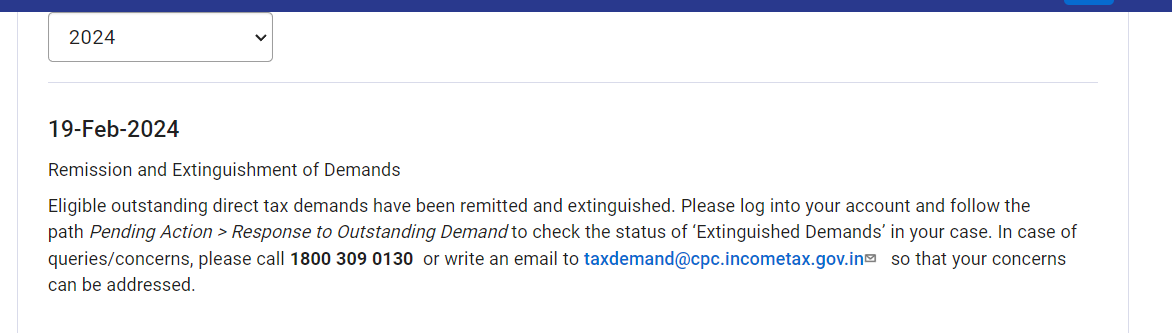

The Income tax department has made an update that “Eligible outstanding direct tax demands have been remitted and extinguished.”

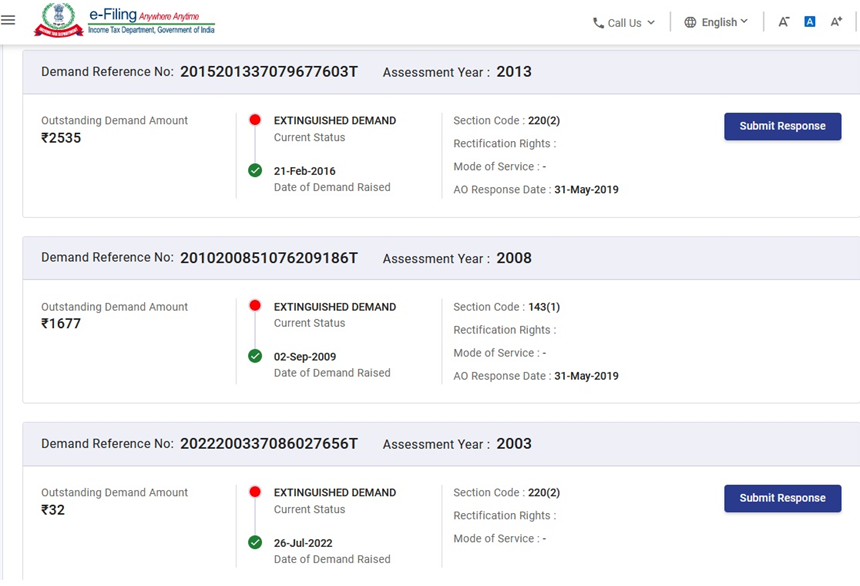

How to Check Status in Portal and Address Queries

- Go to Income Tax Portal

- Login on to your into your account

- Navigate to ‘Pending Action’ > Response to Outstanding Demand

- Check the status of your Outstanding Demand

The status will be shown as in the image given below:

In case of queries/concerns, please call 18003090130 or write an email to taxdemand@cpc.incometax.gov.in so that your concerns can be addressed.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates