South Africa broadeds Scope of VAT by Digitalisation, Applicable on Foreign Businesses, Non-Compliance will attract Penalties

South Africa – VAT – Digitisation – Taxscan

South Africa – VAT – Digitisation – Taxscan

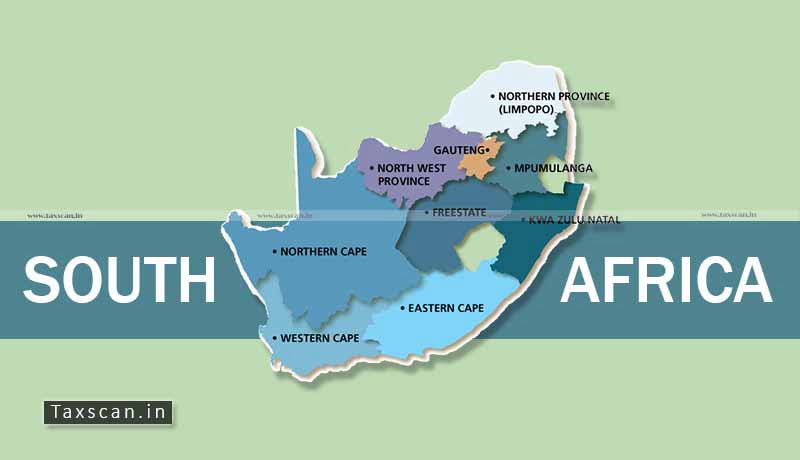

The country of South Africa claimed that it will broaden the scope of Value Added Tax (VAT) by April 1, 2020, by digitizing the transactions made by the foreign digital company and if the company does not register for the same and the non-compliance of the norms under Value Added Tax (VAT) Act, then the strict actions will be taken against the foreign companies and as a consequence penalties would be imposed.

Under this scheme, South Africa strives to broaden the definition of the word ‘digital services’. Further, the nation has specified the services wherein the Value Added Tax (VAT) will be applicable on e-services such as online newspapers, blogs, journals, apps, web services, webcasts, social media, e-books, images, online media; all the internet-based auctions; and education which will not include those educational services which are regulated by the educational authority.

Further, the Value Added Tax (VAT) will be applicable to all the businesses wherein digital services are availed such as online consulting; online advertising online gaming; online training; and every kind of other software subscriptions.

Wherefore, the digital services charged under the Value Added Tax (VAT) Act of South Africa can be determined on the basis of resident and non-resident of South Africa. These laws will be applicable only in the case of foreign digital business and not to the residents of South Africa.

Further, the foreign digital business must be registered under VAT of South African income if exceeds ZAR 1 Million per annum. Also in the case of B2B services, the non-resident foreign digital business providing e-services are ought to register under the VAT Act. This practice is not based on zero-rating and use of reverse charge like any other nation of the world.