Begin typing your search above and press return to search.

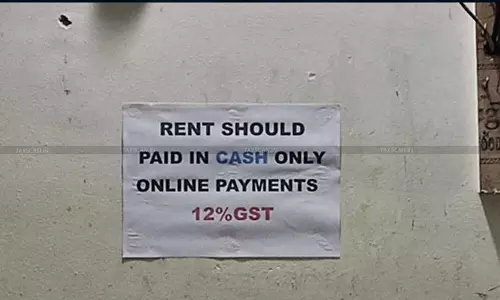

‘Pay Rent in Cash or Pay Online With 12% GST’: Bengaluru PG’s Notice Stirs Debate on Reddit

A notice from a paying guest accommodation in Bengaluru has caused a stir online after it appeared to tell tenants to pay rent in cash only. The...

![GST: Leasing of Property for use as Residence along with basic amenities, covered under Accommodation Services, rules AAR [Read Order] GST: Leasing of Property for use as Residence along with basic amenities, covered under Accommodation Services, rules AAR [Read Order]](https://www.taxscan.in/wp-content/uploads/2021/04/Leasing-of-property-residence-basic-amenities-accommodation-services-AAR-taxscan.jpeg)

![No TDS on Rent If Accommodation Services were taken on Casual Basis: ITAT [Read Order] No TDS on Rent If Accommodation Services were taken on Casual Basis: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2020/10/ITAT-TDS-accommodation-services-rent-Taxscan-1.jpg)

![Supply of Accommodation Services to SEZ units is for Authorized Operations, Covered Under ‘Zero-Rated Supplies’: AAR [Read Order] Supply of Accommodation Services to SEZ units is for Authorized Operations, Covered Under ‘Zero-Rated Supplies’: AAR [Read Order]](https://www.taxscan.in/wp-content/uploads/2016/11/Special-Economic-Zone.jpg)