Begin typing your search above and press return to search.

![Relief for Reliance Industries: CESTAT allows Proportionate CENVAT Credit on Insurance Services Spanning Pre-And Post-Taxable Period [Read Order] Relief for Reliance Industries: CESTAT allows Proportionate CENVAT Credit on Insurance Services Spanning Pre-And Post-Taxable Period [Read Order]](https://images.taxscan.in/h-upload/2025/12/23/500x300_2114140-relief-for-reliance-industries-cestat-allows-proportionate-cenvat-credit-taxscan.webp)

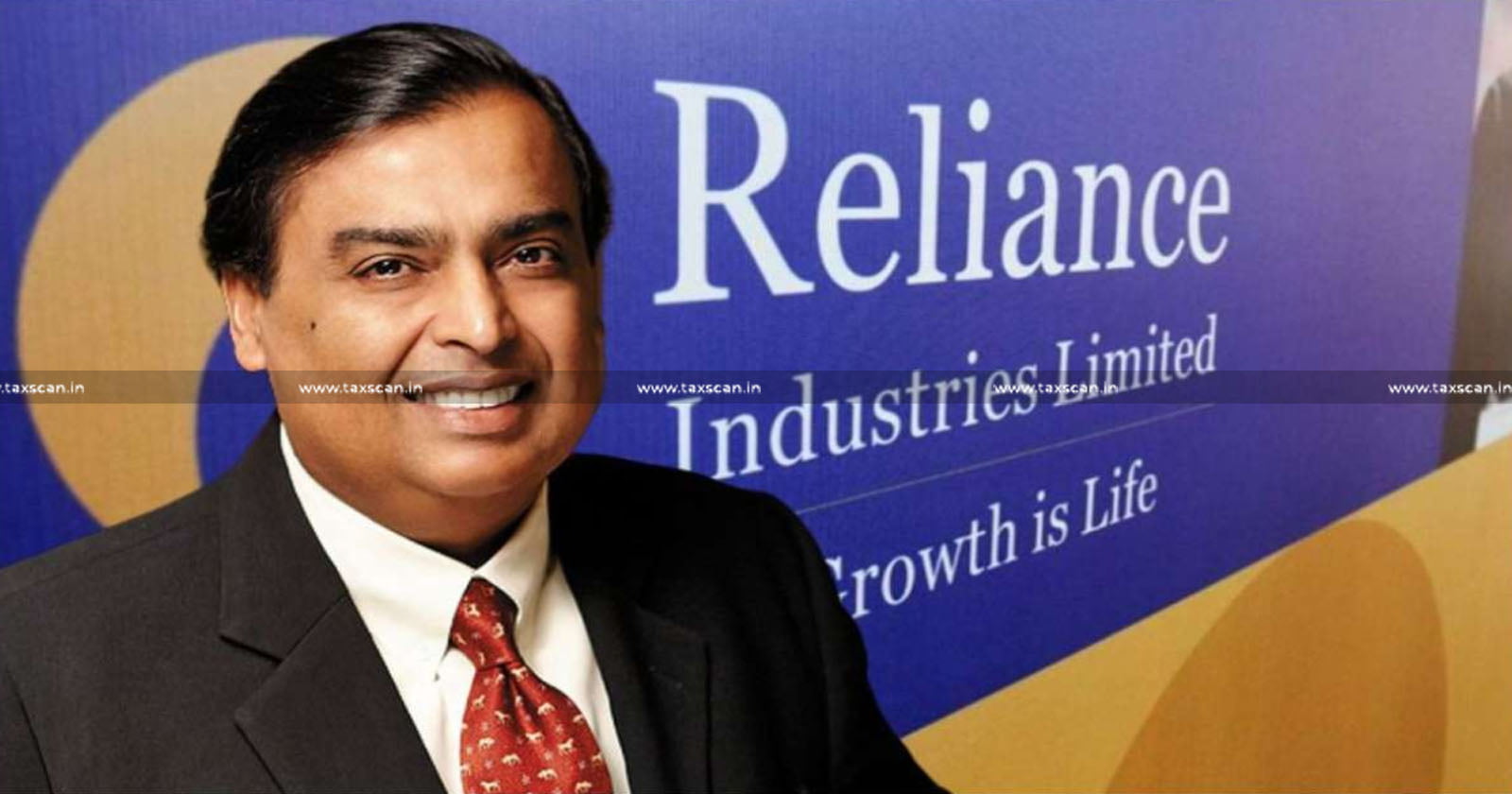

Relief for Reliance Industries: CESTAT allows Proportionate CENVAT Credit on Insurance Services Spanning Pre-And Post-Taxable Period [Read Order]

The Ahmedabad Bench of the Customs, Excise, and Service Tax Appellate Tribunal ( CESTAT ) held that proportionate CENVATcredit on insurance services...

![CESTAT Favors Berger Paints: Ethyl Benzene Recognized as Xylene Isomer in Customs Classification Dispute [Read Order] CESTAT Favors Berger Paints: Ethyl Benzene Recognized as Xylene Isomer in Customs Classification Dispute [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/04/Berger-Paints.jpg)

![No GST ITC on Services Procured by Port for Operation and Maintenance of Diving Support Vehicle: AAAR [Read Order] No GST ITC on Services Procured by Port for Operation and Maintenance of Diving Support Vehicle: AAAR [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/01/diving-support-vehicle-gst.jpg)

![Services in Forms of Receipt of Patent Registered Outside India not liable to Service Tax: CESTAT [Read Order] Services in Forms of Receipt of Patent Registered Outside India not liable to Service Tax: CESTAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/11/Services-in-Forms-Receipt-of-Patent-Registered-Outside-India-Patent-Registered-Outside-India-Receipt-of-Patent-cestat-taxscan.jpg)

![Relief to Reliance Industries: CESTAT allows Cenvat Credit on Premium Paid for Group Insurance under VSS [Read Order] Relief to Reliance Industries: CESTAT allows Cenvat Credit on Premium Paid for Group Insurance under VSS [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/12/Reliance-Industries-Cenvat-Credit-CESTAT-Premium-Paid-Group-Insurance-Insurance-VSS-Voluntary-Separation-Scheme-taxscan.jpg)

![Refund not sanctioned within the stipulated time period of 3 Months from Date of Refund Application: CESTAT grants Relief to Reliance Industries [Read Order] Refund not sanctioned within the stipulated time period of 3 Months from Date of Refund Application: CESTAT grants Relief to Reliance Industries [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/11/Refund-Refund-Application-CESTAT-Reliance-Industries-taxscan.jpg)

![Relief to Reliance Industries: CESTAT approves eligibility for Refund of amount reversed in CENVAT Credit account under rule 6(3A) of CCR between April 2010 and March 2011 [Read Order] Relief to Reliance Industries: CESTAT approves eligibility for Refund of amount reversed in CENVAT Credit account under rule 6(3A) of CCR between April 2010 and March 2011 [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/10/Reliance-Industries-CESTAT-refund-CENVAT-credit-account-CCR-taxscan.jpg)

![Delay in Filing Refund Claim is merely a Procedural Lapse substantial benefit of Exemption Notification can’t be denied: CESTAT grants relief to Reliance [Read Order] Delay in Filing Refund Claim is merely a Procedural Lapse substantial benefit of Exemption Notification can’t be denied: CESTAT grants relief to Reliance [Read Order]](https://www.taxscan.in/wp-content/uploads/2021/12/Delay-Filing-Refund-claim-procedural-lapse-exemptional-notification-CESTAT-Reliance-Industries-Taxscan.jpg)

![Relief to Reliance Industries: Excise Duty needs to be paid on Product in the form it is cleared at Value from Factory, rules CESTAT [Read Order] Relief to Reliance Industries: Excise Duty needs to be paid on Product in the form it is cleared at Value from Factory, rules CESTAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2021/10/Reliance-Industries-Excise-Duty-CESTAT-Taxscan.jpg)

![Relief to Reliance Industries: CESTAT allows Refund of Amount on LPG cleared under PDS Exemption [Read Order] Relief to Reliance Industries: CESTAT allows Refund of Amount on LPG cleared under PDS Exemption [Read Order]](https://www.taxscan.in/wp-content/uploads/2021/10/Reliance-Industries-CESTAT-LPG-PDS-exemption-Taxscan.jpg)

![Relief to Reliance Industries: ITAT quashes Revision Order of Pr. CIT(A) as AO conducted Proper Enquiry [Read Order] Relief to Reliance Industries: ITAT quashes Revision Order of Pr. CIT(A) as AO conducted Proper Enquiry [Read Order]](https://www.taxscan.in/wp-content/uploads/2021/09/Reliance-Industries-ITAT-Proper-Officer-Taxscan.jpg)