Begin typing your search above and press return to search.

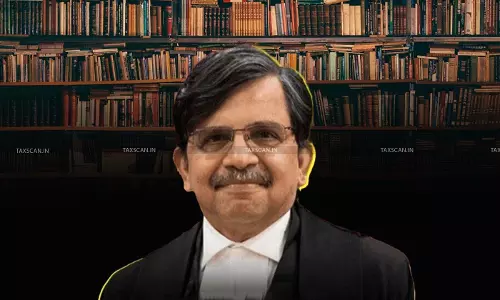

Former Odisha CJ Dr. S. Muralidhar Named Chair of UN Panel Probing Human Rights Violations in Palestine-Israel Conflict

The United Nations Human Rights Council has appointed former Chief Justice of the Odisha High Court and Senior Advocate Dr S. Muralidhar as the...

![Profits from Sale of Jaggery is Taxable, Not considered as Agricultural Income: Madras HC [Read Order] Profits from Sale of Jaggery is Taxable, Not considered as Agricultural Income: Madras HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/12/Madras-High-Court-Agricultural-Income-Sale-of-Jaggery-Is-Taxable-Taxscan.jpg)

![Hiring of Motor Vehicle or Cranes not Sale of Goods when Control is Retained by Contractor, VAT not Leviable: SC [Read Judgement] Hiring of Motor Vehicle or Cranes not Sale of Goods when Control is Retained by Contractor, VAT not Leviable: SC [Read Judgement]](https://www.taxscan.in/wp-content/uploads/2024/01/Motor-Vehicle-Hiring-of-Motor-Vehicle-hiring-of-cranes-Contractor-VAT-supreme-court-taxscan.jpg)

![Section 16B of HP General Sales Tax Act not Ultra Vires to SARFAESI Act or the Constitution: Supreme Court [Read Judgement] Section 16B of HP General Sales Tax Act not Ultra Vires to SARFAESI Act or the Constitution: Supreme Court [Read Judgement]](https://www.taxscan.in/wp-content/uploads/2023/05/Section-16B-HP-General-Sales-Tax-Act-sales-tax-Ultra-Vires-Supreme-Court-Section-16B-of-HP-General-Sales-Tax-Act-Ultra-Vires-to-SARFAESI-Act-Supreme-Court-of-India-taxscan.jpg)

![Failure to consider the C and F Declaration Forms submitted by assessee invalidates the Assessment Order under Central Sales Tax Act: Madras HC [Read Order] Failure to consider the C and F Declaration Forms submitted by assessee invalidates the Assessment Order under Central Sales Tax Act: Madras HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/03/C-and-F-Declaration-Forms-Assessment-Order-Assessment-Central-Sales-Tax-Act-Sales-Tax-Act-Sales-Tax-Tax-Madras-High-Court-Taxscan.jpg)

![No Provision under Sales Tax Act to Fastening the Liability of the Company on its Director: Gujarat High Court lifts Attachment of Bank Account [Read Order] No Provision under Sales Tax Act to Fastening the Liability of the Company on its Director: Gujarat High Court lifts Attachment of Bank Account [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/03/Sales-Tax-Act-Fastening-Liability-Gujarat-High-Court-lifts-Attachment-Bank-Account-Taxscan.jpg)

![No Service Tax on Charging License Fee for Quick Heal Antivirus software: CESTAT [Read Order] No Service Tax on Charging License Fee for Quick Heal Antivirus software: CESTAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2020/01/Quick-Heal-Antivirus-software-No-Service-Tax-License-Fee-CESTAT-Taxscan.jpg)

![Rectification u/s 55 of TN General Sales Tax Act is possible in case of a Revised Assessment: Madras HC [Read Judgment] Rectification u/s 55 of TN General Sales Tax Act is possible in case of a Revised Assessment: Madras HC [Read Judgment]](https://www.taxscan.in/wp-content/uploads/2016/06/Madras-High-Court-Tax-Scan-1.jpg)