Begin typing your search above and press return to search.

![Tax Exemption is Allowable to Officer belong to Scheduled Tribe: Gauhati HC Upholds Refund of Income Tax Deducted u/s 10(26) from Salary [Read Order] Tax Exemption is Allowable to Officer belong to Scheduled Tribe: Gauhati HC Upholds Refund of Income Tax Deducted u/s 10(26) from Salary [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/Income-Tax-Refund-Tax-Exemption-Salary-taxscan.jpg)

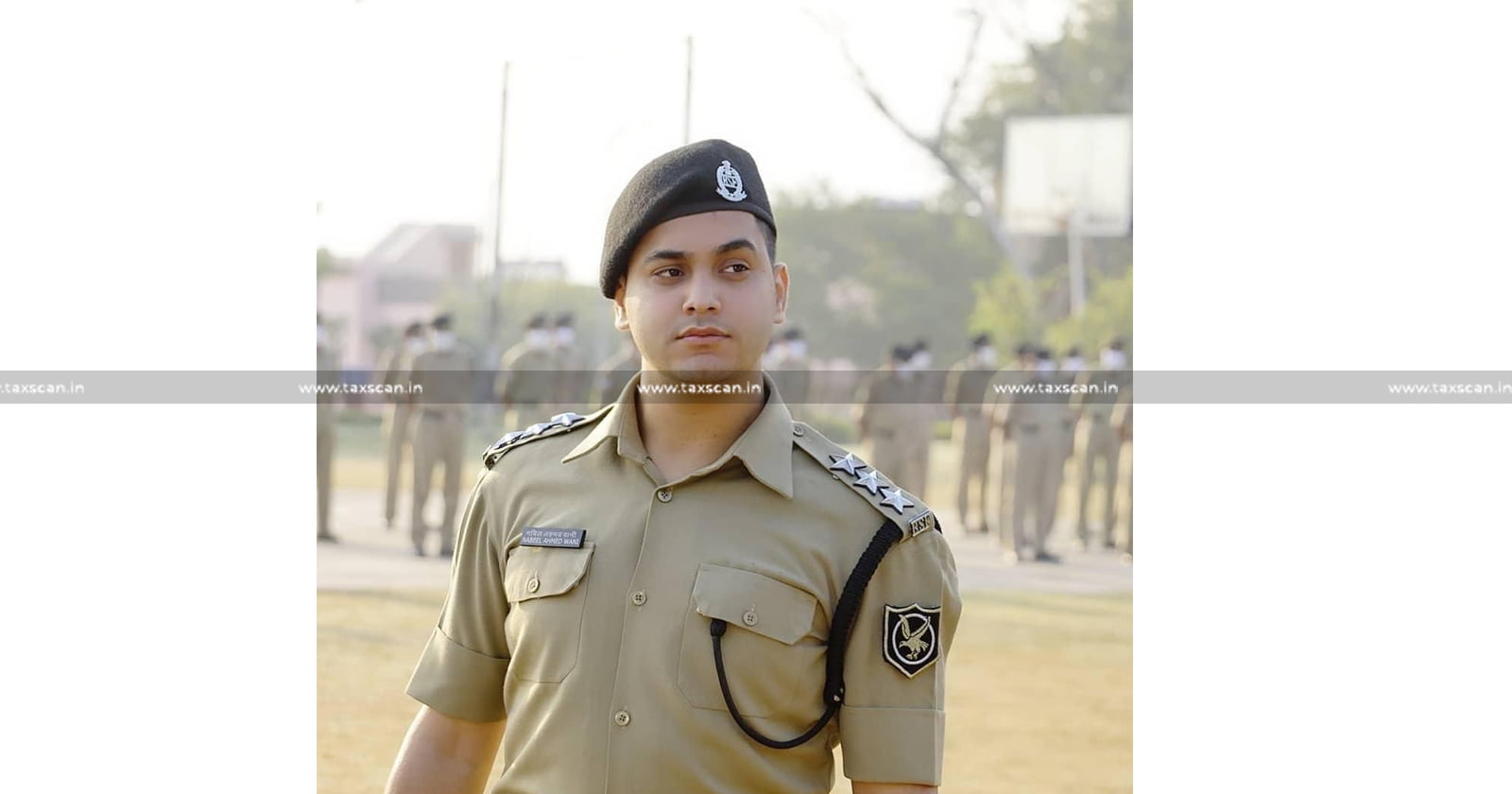

Tax Exemption is Allowable to Officer belong to Scheduled Tribe: Gauhati HC Upholds Refund of Income Tax Deducted u/s 10(26) from Salary [Read Order]

The Gauhati High Court allowed a request that the central government reimburse the income tax withheld from the wages of a BSF Assistant Commandant...

![ITAT Sets Aside CIT(A) Order on Scheduled Tribe Doctor’s S.10(26) Exemption Claim Over Eligibility Misinterpretation [Read Order] ITAT Sets Aside CIT(A) Order on Scheduled Tribe Doctor’s S.10(26) Exemption Claim Over Eligibility Misinterpretation [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/03/ITAT-ITAT-Sets-CITA-Order-Tribe-Doctor-Exemption-Claim-Eligibility-Misinterpretation-Exemption-Claim-Over-Eligibility-Misinterpretation-taxscan.jpg)

![No Liability for Assessee in Default to Deduct TDS on Payee having No Liability to Pay Tax on Income: ITAT [Read Order] No Liability for Assessee in Default to Deduct TDS on Payee having No Liability to Pay Tax on Income: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/07/No-Liability-Assessee-Default-Deduct-TDS-Payee-No-Liability-Pay-Tax-Income-ITAT-TAXSCAN.jpg)

![Gauhati HC Orders to Expedite TDS Refund Process to Scheduled Tribe Officer [Read Order] Gauhati HC Orders to Expedite TDS Refund Process to Scheduled Tribe Officer [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/02/Gauhati-HC-TDS-Refund-TAXSCAN.jpg)