Begin typing your search above and press return to search.

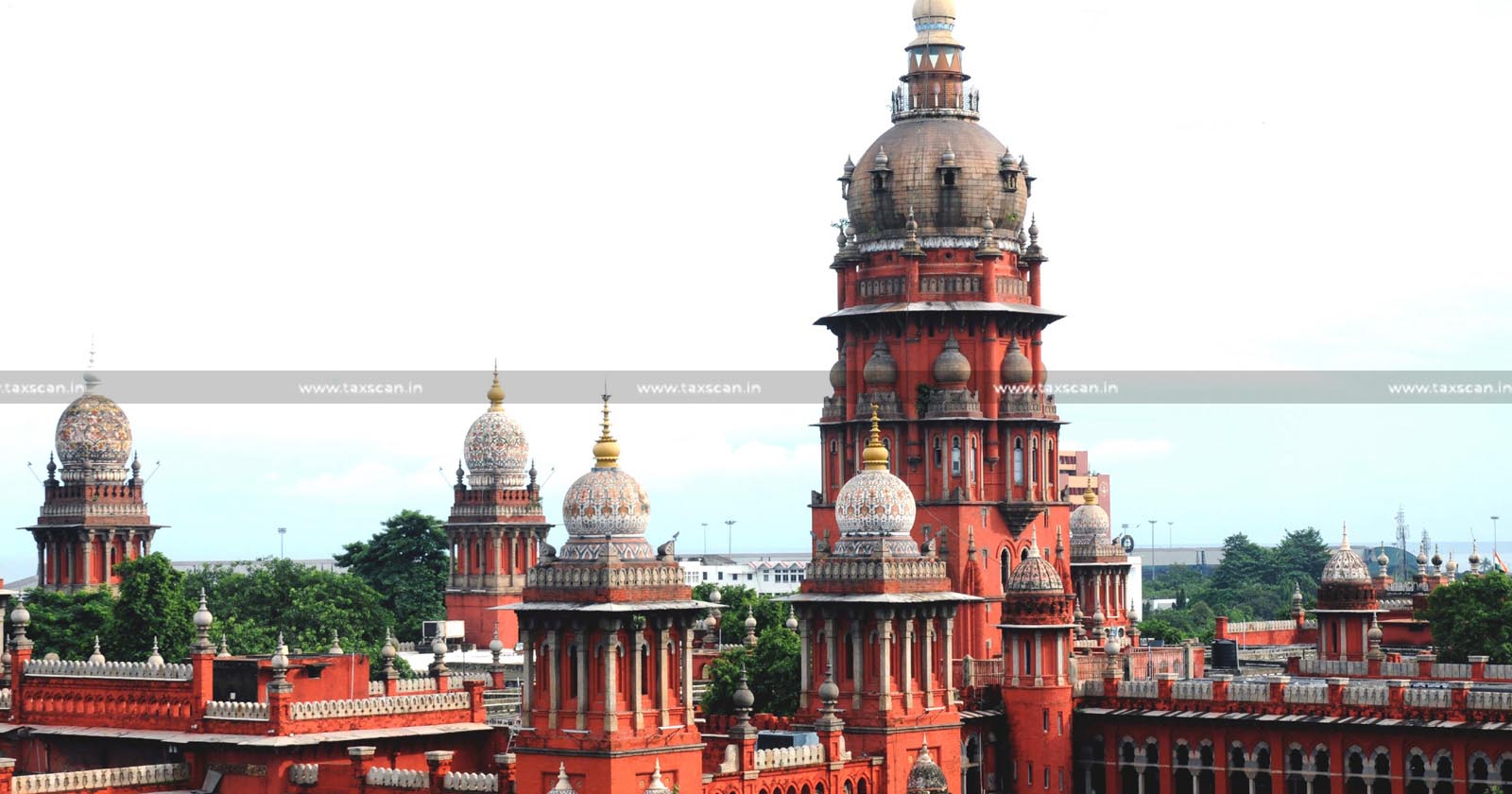

Entities Claiming Charitable Status under GPU cannot Exceed 20% of Gross Receipts from Commercial Activities: Madras HC [Read Order]

In a recent ruling, the Madras High Court ruled that entities claiming charitable status under the "general public utility" ( GPU ) category as...

![ITAT upholds Rejection of Tax Exemption, Citing Non-Compliance with Charitable Purpose Criteria [Read Order] ITAT upholds Rejection of Tax Exemption, Citing Non-Compliance with Charitable Purpose Criteria [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/12/ITAT-ITAT-Chennai-Tax-Exemption-Citing-Non-Compliance-with-Charitable-Purpose-Non-Compliance-taxscan.jpg)

![No Violation of Proviso to Provision of Section 2(15) of Income Tax Act: ITAT Set Aside Revision Order on Exemption u/s 11[Read Order] No Violation of Proviso to Provision of Section 2(15) of Income Tax Act: ITAT Set Aside Revision Order on Exemption u/s 11[Read Order]](https://www.taxscan.in/wp-content/uploads/2023/11/No-Violation-of-Proviso-to-Provision-Income-Tax-Act-ITAT-Aside-Revision-Order-on-Exemption-TAXSCAN.jpg)

![Distribution of food to poor people spending on cremation of diseased during Covid-19 by trust: ITAT allows registration u/s 2(15) of Income Tax Act [Read Order] Distribution of food to poor people spending on cremation of diseased during Covid-19 by trust: ITAT allows registration u/s 2(15) of Income Tax Act [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/09/Distribution-of-food-poor-people-cremation-of-diseased-Covid-19-ITAT-Income-Tax-Act-registration-taxscan.jpg)

![ITAT Grants Registration to Punjab Plastic Waste Management Society u/s 12A of Income Tax Act [Read Order] ITAT Grants Registration to Punjab Plastic Waste Management Society u/s 12A of Income Tax Act [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/08/ITAT-ITAT-Grants-Registration-Punjab-Plastic-Waste-Management-Society-Income-Tax-Act-taxscan.jpg)

![Depreciation Allowable only on Fixed Assets not used for Commercial Purpose: ITAT [Read Order] Depreciation Allowable only on Fixed Assets not used for Commercial Purpose: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/07/Depreciation-Allowable-Fixed-Assets-Commercial-Purpose-ITAT-TAXSCAN.jpg)

![Contributions received for Charitable Purpose cant be treated as Income u/s 2(24) (iia) of Income Tax Act: ITAT allows Appeal [Read Order] Contributions received for Charitable Purpose cant be treated as Income u/s 2(24) (iia) of Income Tax Act: ITAT allows Appeal [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/07/Contributions-received-for-Charitable-Purpose-treated-as-Income-Income-Tax-Act-ITAT-allows-Appeal-TAXSCAN.jpg)

![Activity of Providing Courses for Women is Charitable in Nature: ITAT allows IT Refund to Women Training Institute [Read Order] Activity of Providing Courses for Women is Charitable in Nature: ITAT allows IT Refund to Women Training Institute [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/05/Activity-of-Providing-Courses-Providing-Courses-for-Women-Courses-for-Women-Charitable-ITAT-IT-Refund-Refund-Women-Training-Institute-Taxscan.jpg)

![Income Tax Exemption to Trust u/s 11 cannot be Denied in respect of Income from Letting Out of School Auditorium for Public: ITAT [Read Order] Income Tax Exemption to Trust u/s 11 cannot be Denied in respect of Income from Letting Out of School Auditorium for Public: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/02/Income-Tax-Exemption-Denied-Income-School-Auditorium-Public-ITAT-TAXSCAN.jpg)

![MSME registered for Skill Development not eligible for Income Tax Exemption under Section 12AA of Income Tax Act: ITAT [Read Order] MSME registered for Skill Development not eligible for Income Tax Exemption under Section 12AA of Income Tax Act: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/12/MSME-Income-Tax-Exemption-under-Income-Tax-Act-ITAT-TAXSCAN.jpg)

![GTD Expenses are allowable as Income Tax Deduction: ITAT upholds deletion of Disallowance [Read Order] GTD Expenses are allowable as Income Tax Deduction: ITAT upholds deletion of Disallowance [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/10/GTD-Expenses-Income-Tax-Deduction-ITAT-taxscan.jpg)

![Advancement of GPU cannot be interpreted as Charitable Purposes If Done as Business, No Income Tax Exemption: Supreme Court [Read Judgment] Advancement of GPU cannot be interpreted as Charitable Purposes If Done as Business, No Income Tax Exemption: Supreme Court [Read Judgment]](https://www.taxscan.in/wp-content/uploads/2022/10/GPU-Income-Tax-Exemption-Supreme-Court-taxscan.jpg)