Begin typing your search above and press return to search.

Case Digest on Section 269ST of Income Tax Act

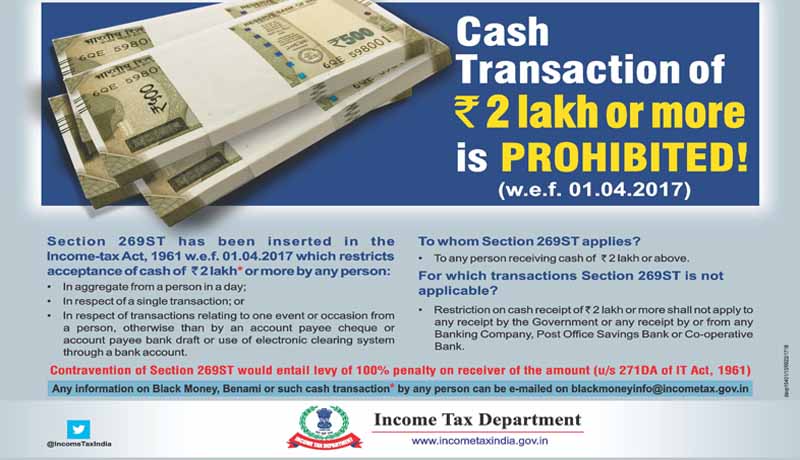

Section 269ST was introduced in the Income Tax Act, 1961 by the budget 2017. Under this section, no person can receive payment above ₹2 Lakhs in a...

![Distributorship Contracts Alone would not Attract Penalty for Cash Transaction Exceeding Rs. 2 Lakh for Co-operative Societies: CBDT [Read Circular] Distributorship Contracts Alone would not Attract Penalty for Cash Transaction Exceeding Rs. 2 Lakh for Co-operative Societies: CBDT [Read Circular]](https://www.taxscan.in/wp-content/uploads/2022/12/Distributorship-Contracts-Penalty-Cash-Transaction-Co-operative-Societies-CBDT-taxscan.jpg)

![Govt Notifies List of Transactions not Hit by Provision Banning Cash Receipts Upto 2 Lakhs [Read Notification] Govt Notifies List of Transactions not Hit by Provision Banning Cash Receipts Upto 2 Lakhs [Read Notification]](https://www.taxscan.in/wp-content/uploads/2017/03/Cash-Transaction-Limit.jpg)