Begin typing your search above and press return to search.

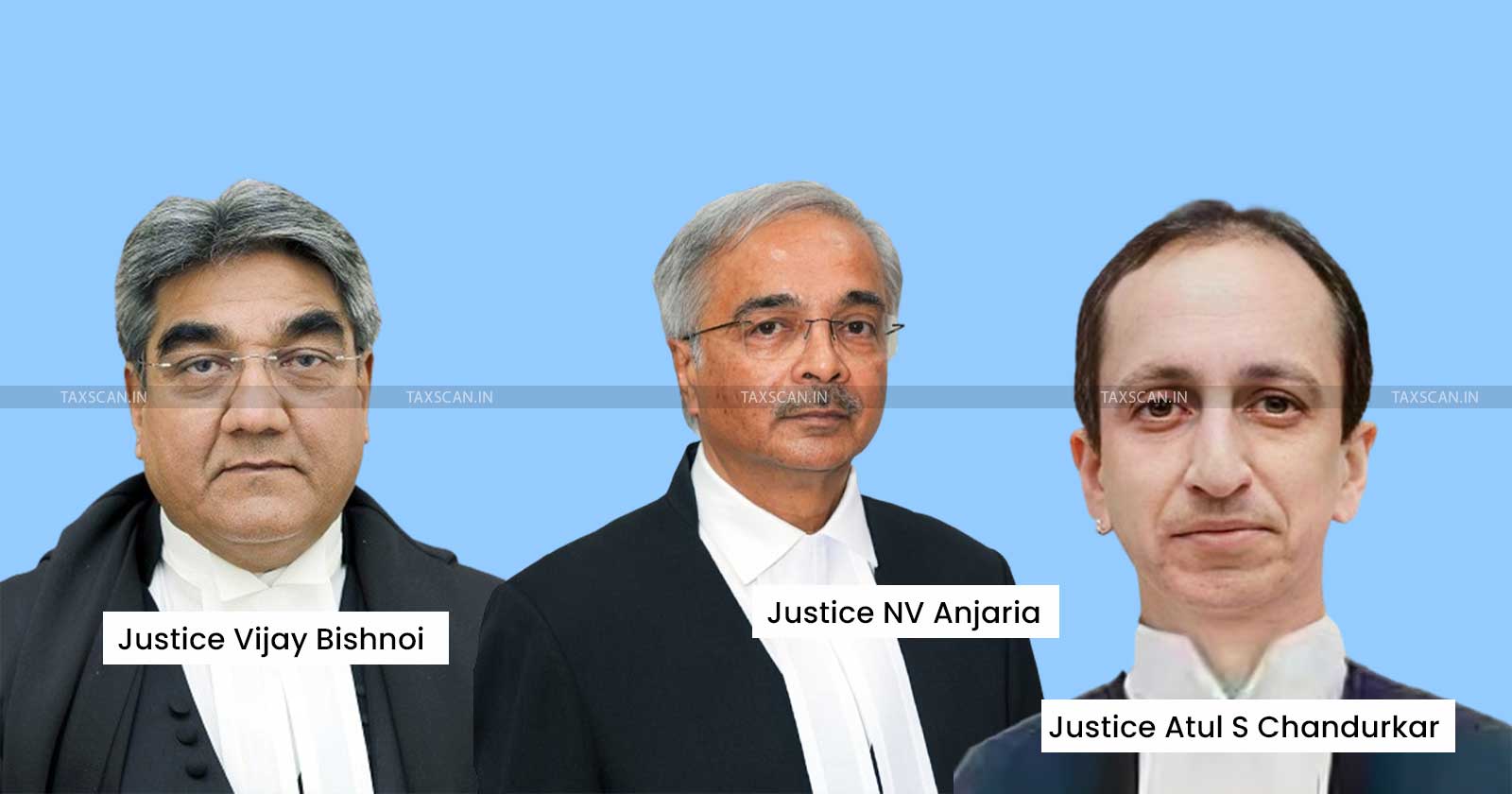

Supreme Court Collegium recommends Elevation of 3 High Court Judges to the Apex Court

The Collegium of the Supreme Court of India recently recommended the elevation of three distinguished High Court judges to fill up the vacancies...

![Specific Role of Director Need Not Be Detailed in Cheque Dishonour Complaint: Supreme Court Clarifies Vicarious Liability u/s 141 of NI Act [Read Judgement] Specific Role of Director Need Not Be Detailed in Cheque Dishonour Complaint: Supreme Court Clarifies Vicarious Liability u/s 141 of NI Act [Read Judgement]](https://www.taxscan.in/wp-content/uploads/2025/05/Supreme-Court-Section-141-NI-Act-TAXSCAN-2.jpg)

![Delhi HC sets aside SCN Passed by Sales Tax Officer without considering Challenge of Assessee against Notification [Read Order] Delhi HC sets aside SCN Passed by Sales Tax Officer without considering Challenge of Assessee against Notification [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/Madras-High-Court-Madras-HC-SCN-Show-cause-notice-Income-tax-Fresh-SCN-taxscan.jpg)

![Supreme Court Clarifies S. 80-IA(9) of Income Tax Act Does not affect Computability of Cumulative Deductions [Read Judgement] Supreme Court Clarifies S. 80-IA(9) of Income Tax Act Does not affect Computability of Cumulative Deductions [Read Judgement]](https://www.taxscan.in/wp-content/uploads/2025/05/Supreme-Court-Section80-IA9-of-Income-Tax-Act-Income-Tax-Act-taxscan.jpg)

![Mechanical and Cryptic: Bombay HC quashes NBW against Actor Arjun Rampal in Tax Evasion Case [Read Order] Mechanical and Cryptic: Bombay HC quashes NBW against Actor Arjun Rampal in Tax Evasion Case [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/Actor-Arjun-Rampal-Arjun-Rampal-in-Tax-Evasion-Case-Tax-Evasion-Case-taxscan.jpg)

![No Reopening of Income Tax Assessment w/out Failure to Disclose Fully and Truly all Material Facts Necessary: Bombay HC [Read Order] No Reopening of Income Tax Assessment w/out Failure to Disclose Fully and Truly all Material Facts Necessary: Bombay HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/No-Reopening-of-Income-Tax-Assessment-Reopening-of-Income-Tax-Assessment-Income-Tax-Assessment-taxscan.jpg)

![Bombay HC Quashes GST Refund Recovery in Absence of SCN & due to non granting of Hearing Opportunity [Read Order] Bombay HC Quashes GST Refund Recovery in Absence of SCN & due to non granting of Hearing Opportunity [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/GST-CBIC-CBIC-Clarifies-Refund-Related-Issues-Refund-Related-Issues-Refund-taxscan.jpg)

![Bombay HC quashes Income Tax Notice Issued u/s 148 which was beyond the time period specified under statute [Read Order] Bombay HC quashes Income Tax Notice Issued u/s 148 which was beyond the time period specified under statute [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/Bombay-High-Court-Income-Tax-Notice-Section-148-Income-Tax-Act-TAXSCAN.jpg)

![Bombay HC Dismisses Writ Petition Against Retrospective Withdrawal of Industrial Park Tax Benefits [Read Order] Bombay HC Dismisses Writ Petition Against Retrospective Withdrawal of Industrial Park Tax Benefits [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/Writ-Petition-Madras-High-Court-Delivery-of-Goods-TAXSCAN.jpg)

![Bombay HC Dismisses Revenue’s Appeal, Upholds ITAT Order Quashing ‘Mechanical’ Reassessment Initiated Without AO’s Independent Satisfaction [Read Order] Bombay HC Dismisses Revenue’s Appeal, Upholds ITAT Order Quashing ‘Mechanical’ Reassessment Initiated Without AO’s Independent Satisfaction [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/ITAT-Order-Reassessment-Upholds-ITAT-Order-Quashing-taxscan.jpg)

![Relief to Technova Imaging Systems: Bombay HC Allows Depreciation Claim Without Section 72A Approval [Read Order] Relief to Technova Imaging Systems: Bombay HC Allows Depreciation Claim Without Section 72A Approval [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/Technova-Imaging-Systems-bombay-high-court-taxscan.jpg)