Begin typing your search above and press return to search.

Madras HC Rules 'Business Auxiliary' and 'Engineering Consultation Services' consider as Input Service, Eligible for CENVAT Credit [Read Order]

The Madras High Court recently ruled that 'Business Auxiliary Services' and 'Engineering Consultation Services' qualify as 'Input Services' under the...

![Machinery Supplied under Lease Rent is Deemed Sale, not Liable to Service Tax under Supply of Tangible Goods for Use: CESTAT [Read Order] Machinery Supplied under Lease Rent is Deemed Sale, not Liable to Service Tax under Supply of Tangible Goods for Use: CESTAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/09/CESTAT-Customs-Excise-and-Service-Tax-Appellate-Tribunal-Service-Tax-Supply-of-Tangible-Goods-Machinery-Supplied-Lease-Rent-Deemed-Sale-Liable-to-Service-Tax-CESTAT-News-taxscan.jpg)

![Vehicle Leasing Activity Not a Service, Exempted from Service Tax: CESTAT [Read Order] Vehicle Leasing Activity Not a Service, Exempted from Service Tax: CESTAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/09/GST-Rate-GST-Lease-Pre-owned-Motor-Vehicles-Motor-Vehicles-Central-Tax-rate-Notification-AAR-Taxscan.jpg)

![Any Person Aggrieved as Used in S.129 A of Customs Act Not Includes Customs Dept: CESTAT Dismisses Appeal Filed by Dept [Read Order] Any Person Aggrieved as Used in S.129 A of Customs Act Not Includes Customs Dept: CESTAT Dismisses Appeal Filed by Dept [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/09/CESTAT-Customs-Act-Customs-Excise-Service-Tax-Appellate-Tribunal-Section-129-A-of-Customs-Act-Any-Person-Aggrieved-customs-department-CESTAT-Dismisses-CESTAT-News-CESTAT-Updates-taxscan.jpg)

![Transactions made prior to 2008 Service Tax Rules Amendment not Liable to Rule 6 Retrospectively: CESTAT [Read Order] Transactions made prior to 2008 Service Tax Rules Amendment not Liable to Rule 6 Retrospectively: CESTAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/09/CESTAT-Service-tax-transactions-Service-Tax-Act-TAXSCAN.jpeg)

![Relief to Parle Products: CESTAT rules Cheeselings is Classifiable as Namkeen, Exempted from Excise Duty [Read Order] Relief to Parle Products: CESTAT rules Cheeselings is Classifiable as Namkeen, Exempted from Excise Duty [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/09/CESTAT-Parle-Products-Relief-to-Parle-Products-Excise-Duty-Cheeselings-is-Classifiable-as-Namkeen-taxscan.jpg)

![CESTAT quashes Service Tax Demand Order on Book Entries [Read Order] CESTAT quashes Service Tax Demand Order on Book Entries [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/09/CESTAT-Service-Tax-Demand-Order-Demand-Order-cestat-on-service-tax-demand-cestat-on-Service-Tax-Demand-Order-cestat-about-Service-Tax-Demand-Order-tax-news-taxscan.jpg)

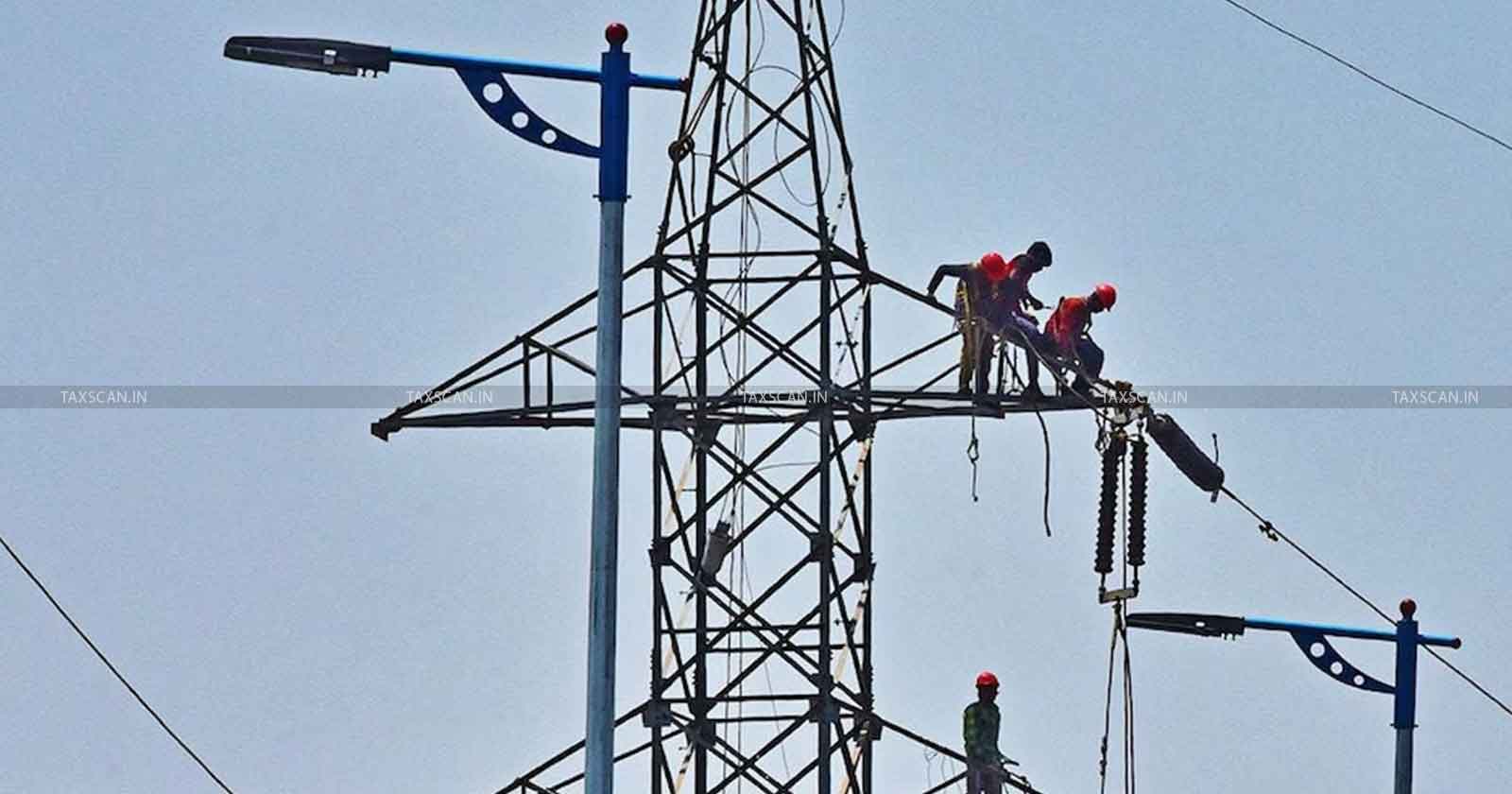

![Contract Construction Services provided to GETCO exempted from Service Tax: CESTAT [Read Order] Contract Construction Services provided to GETCO exempted from Service Tax: CESTAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/09/CESTAT-Gujarat-Energy-Transmission-Corporation-Ltd-GETCO-under-CESTAT-TAXSCAN.jpg)

![₹28.3 Lakh Refund payable to Bank of Baroda as Untransitioned CENVAT Credit to GST TRAN-1: CESTAT [Read Order] ₹28.3 Lakh Refund payable to Bank of Baroda as Untransitioned CENVAT Credit to GST TRAN-1: CESTAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/09/GST-CESTAT-Bank-of-baroda-CENVAT-CENVAT-Credit-Refund-payable-to-Bank-of-Baroda-taxscan.jpg)