Begin typing your search above and press return to search.

![Bombay HC asks GST Dept to Re-open TRAN-1 to Rectify Errors [Read Order] Bombay HC asks GST Dept to Re-open TRAN-1 to Rectify Errors [Read Order]](https://www.taxscan.in/wp-content/uploads/2018/01/Stamp-Duty-Bombay-High-Court-Taxscan.jpg)

Bombay HC asks GST Dept to Re-open TRAN-1 to Rectify Errors [Read Order]

A two- judge bench of the Bombay High Court has asked the Central Government to re-open the facility to file GST TRAN-1 to allow the tax payers to...

![Gujarat HC Upholds Provision prescribing Time limit for filing GST TRAN-1 [Read Judgment] Gujarat HC Upholds Provision prescribing Time limit for filing GST TRAN-1 [Read Judgment]](https://www.taxscan.in/wp-content/uploads/2018/04/Gujarat-High-Court-Tax-Scan.jpg)

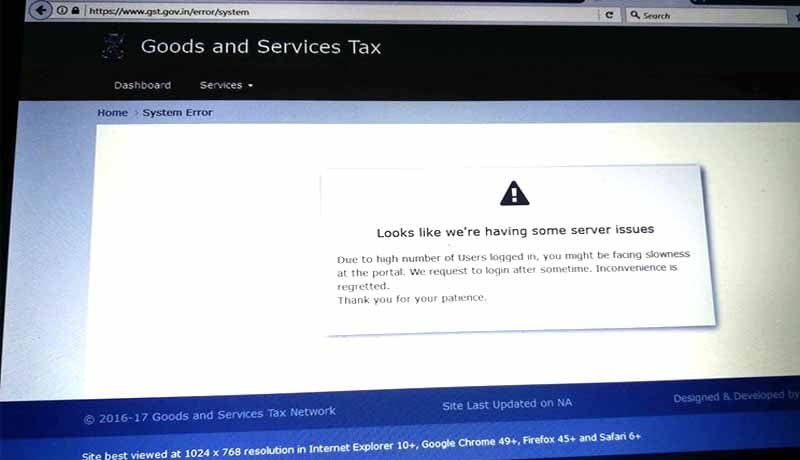

![Taxpayers who couldn’t File TRAN-1 due to Technical Glitches in Portal can file till January [Read Order] Taxpayers who couldn’t File TRAN-1 due to Technical Glitches in Portal can file till January [Read Order]](https://www.taxscan.in/wp-content/uploads/2018/03/GST-Portal.jpg)

![Transitional Credit is Substantive Right and can’t be taken away by Procedural Requirements: Gujarat HC issues notice to Centre and GST Council [Read Petition] Transitional Credit is Substantive Right and can’t be taken away by Procedural Requirements: Gujarat HC issues notice to Centre and GST Council [Read Petition]](https://www.taxscan.in/wp-content/uploads/2018/04/Transitional-Credit-Taxscan.jpg)

![TRAN-1 Uploading Glitches: Kerala HC directs authorities to allow ITC during Migration to GST [Read Judgment] TRAN-1 Uploading Glitches: Kerala HC directs authorities to allow ITC during Migration to GST [Read Judgment]](https://www.taxscan.in/wp-content/uploads/2018/02/GST-TRAN-1-Taxscan.jpg)

![GSTN Glitches: Identified Taxpayers can file TRAN-1 till 30th April [Read Circular] GSTN Glitches: Identified Taxpayers can file TRAN-1 till 30th April [Read Circular]](https://www.taxscan.in/wp-content/uploads/2018/04/Form-GST-TRAN-1-Taxscan.jpg)

![GST: CBEC to verify 50,000 Transitional Credit Claims [Read Letter] GST: CBEC to verify 50,000 Transitional Credit Claims [Read Letter]](https://www.taxscan.in/wp-content/uploads/2017/08/Transitional-ITC-under-GST.jpg)

![Tax Payer approaches Bombay HC for filing Criminal Case against GSTN for Tampering of Status of TRAN-1 [Read Petition] Tax Payer approaches Bombay HC for filing Criminal Case against GSTN for Tampering of Status of TRAN-1 [Read Petition]](https://www.taxscan.in/wp-content/uploads/2017/07/GSTN-Taxscan.jpg)

![Due Date for filing GST TRAN-1 Again Extended [Read Order] Due Date for filing GST TRAN-1 Again Extended [Read Order]](https://www.taxscan.in/wp-content/uploads/2017/09/Form-GST-TRAN-1-Taxscan.jpg)

![Tax Payers can Migrate to GST till October 31st: Govt Notifies Amended CGST Rules [Read Notification] Tax Payers can Migrate to GST till October 31st: Govt Notifies Amended CGST Rules [Read Notification]](https://www.taxscan.in/wp-content/uploads/2017/09/Migration-to-GST.jpg)