Begin typing your search above and press return to search.

![GST Annual Return: CBIC amends GSTR-9 to Allow ITC Claims and Amendment of Invoices till 30th Nov [Read Notification] GST Annual Return: CBIC amends GSTR-9 to Allow ITC Claims and Amendment of Invoices till 30th Nov [Read Notification]](https://www.taxscan.in/wp-content/uploads/2022/11/CBIC-GSTR-9-IRC-Amendment-taxscan.jpg)

GST Annual Return: CBIC amends GSTR-9 to Allow ITC Claims and Amendment of Invoices till 30th Nov [Read Notification]

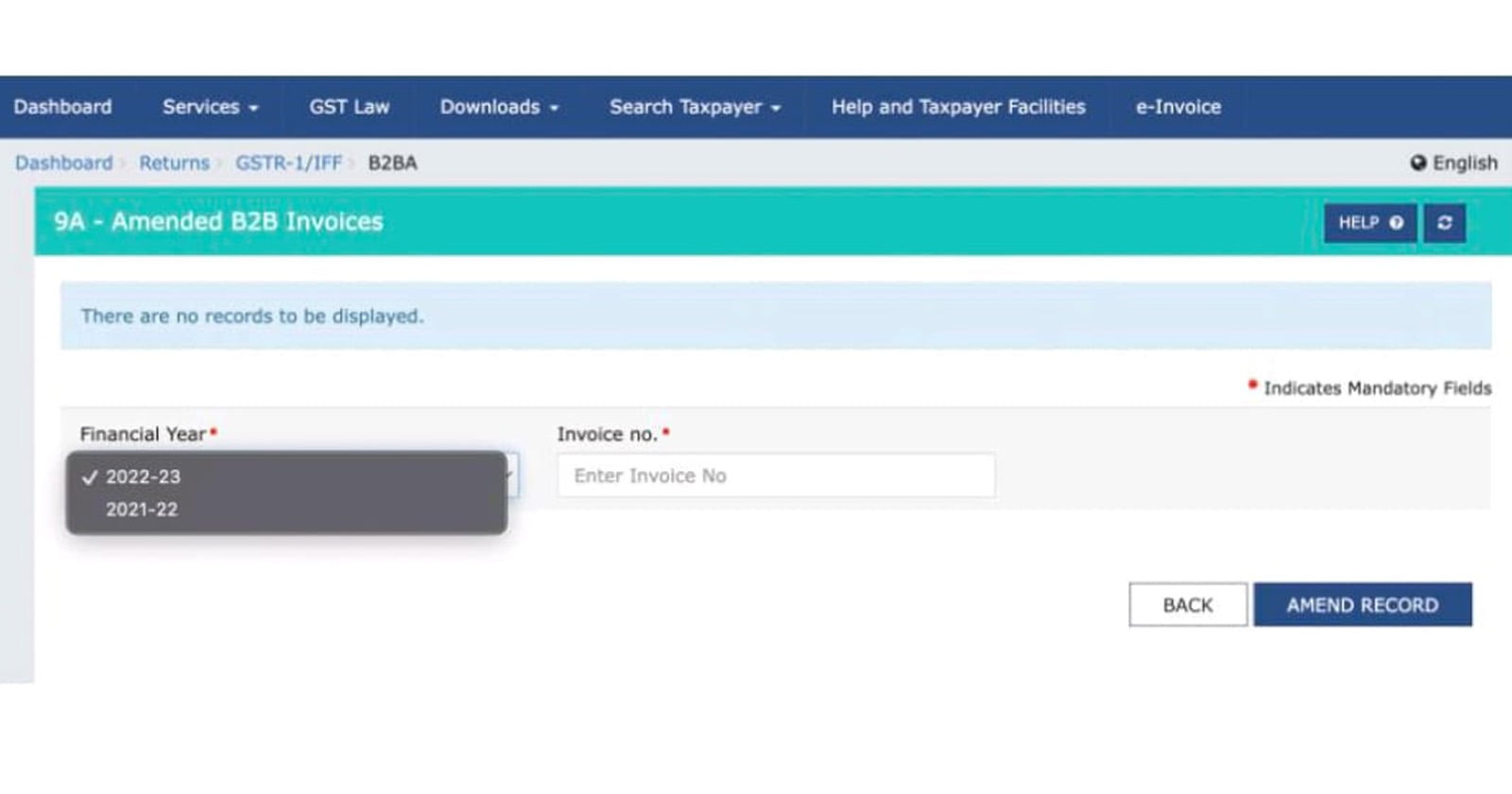

The Central Board of Indirect Taxes and Customs (CBIC) has issued a notification to allow Input Tax Credit (ITC) claims and amendment of invoices...

![Date of Filing Refund Application on GST Portal shall be Treated as Date of Filing, rules Gujarat HC [Read Order] Date of Filing Refund Application on GST Portal shall be Treated as Date of Filing, rules Gujarat HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/10/Refund-GST-Portal-Karnataka-HC-taxscan.jpeg)

![Orissa HC permits Filing of GST Returns Prior to Cancellation of Registration, Directs Govt to Make Suitable Changes on GST Portal [Read Order] Orissa HC permits Filing of GST Returns Prior to Cancellation of Registration, Directs Govt to Make Suitable Changes on GST Portal [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/10/Orissa-HC-Cancellation-of-Registration-GST-Portal-taxscan.jpg)

![TRAN-1/TRAN-2 Re-Opening: Tamil Nadu Govt Issues Clarification [Read Circular] TRAN-1/TRAN-2 Re-Opening: Tamil Nadu Govt Issues Clarification [Read Circular]](https://www.taxscan.in/wp-content/uploads/2022/09/TRAN-1-TRAN-2-Tamil-Nadu-Govt-taxscan.jpeg)