Begin typing your search above and press return to search.

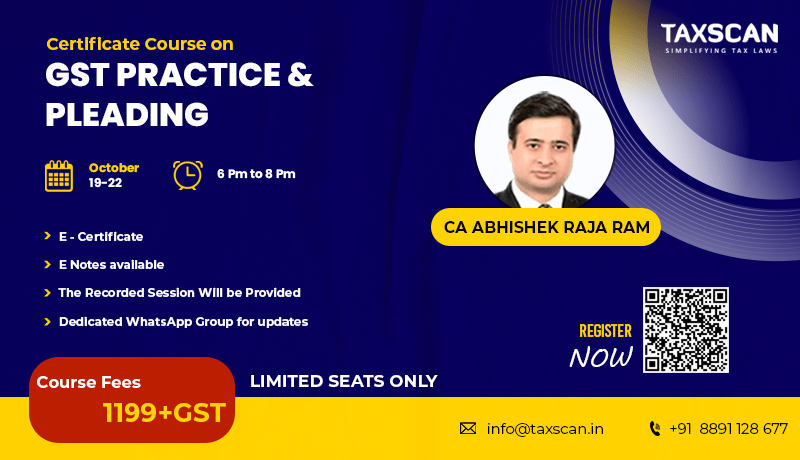

Certificate Course on GST Practice & Pleading

Faculty - CA Abhishek Raja Ram Date - 19 to 22 October 2022 Time - 6 PM to 8 PM ✅E - Certificate✅E Notes available✅The Recorded Session Will...

![Printing on Duplex Board attracts 12% GST: AAR [Read Order] Printing on Duplex Board attracts 12% GST: AAR [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/09/Printing-Duplex-Board-GST-AAR-taxscan.jpeg)

![Flavoured Milk classifiable as a beverage, attracts 12% GST: AAAR [Read Order] Flavoured Milk classifiable as a beverage, attracts 12% GST: AAAR [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/09/Flavoured-Milk-beverage-GST-AAAR-taxscan.jpeg)

![GST: Power of Confiscation can be Invoked in Extra-Ordinary Circumstances, rules Karnataka HC [Read Order] GST: Power of Confiscation can be Invoked in Extra-Ordinary Circumstances, rules Karnataka HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/09/GST-Confiscation-Karnataka-HC-taxscan.jpeg)

![GST: Allahabad HC Imposes Cost of Rs. 50,000 on Dept for Arbitrary Attachment without Tangible Material [Read Order] GST: Allahabad HC Imposes Cost of Rs. 50,000 on Dept for Arbitrary Attachment without Tangible Material [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/09/GST-Allahabad-HC-Tangible-Material-taxscan.jpeg)

![Agricultural Manually hand-operated Dressing, Coating, and Treating Drum attracts 12% GST: AAAR [Read Order] Agricultural Manually hand-operated Dressing, Coating, and Treating Drum attracts 12% GST: AAAR [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/09/dressing-coating-drum-GST-AAAR-taxscan.jpeg)

![GST: Custodial Interrogation is justifiable If Charges against Accused are Cheating in Massive Evasion Cases, rules Punjab & Haryana HC [Read Order] GST: Custodial Interrogation is justifiable If Charges against Accused are Cheating in Massive Evasion Cases, rules Punjab & Haryana HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/09/GST-MassiveEvasion-Cases-Punjab-Haryana-HC-taxscan.jpeg)

![GST: Gujarat HC grants Bail to Accused subject to Deposition of Rs. 10 Lakhs in Six Installments [Read Order] GST: Gujarat HC grants Bail to Accused subject to Deposition of Rs. 10 Lakhs in Six Installments [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/09/GST-Gujarat-HC-Bail-Deposition-taxscan.jpg)

![GST Wrongly paid to Railway under Bonafide Belief: Bombay HC Orders Refund and directs Dept to Take a Sympathetic View [Read Order] GST Wrongly paid to Railway under Bonafide Belief: Bombay HC Orders Refund and directs Dept to Take a Sympathetic View [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/09/GST-Railway-Bombay-HC-Refund-Dept-taxscan.jpg)