Begin typing your search above and press return to search.

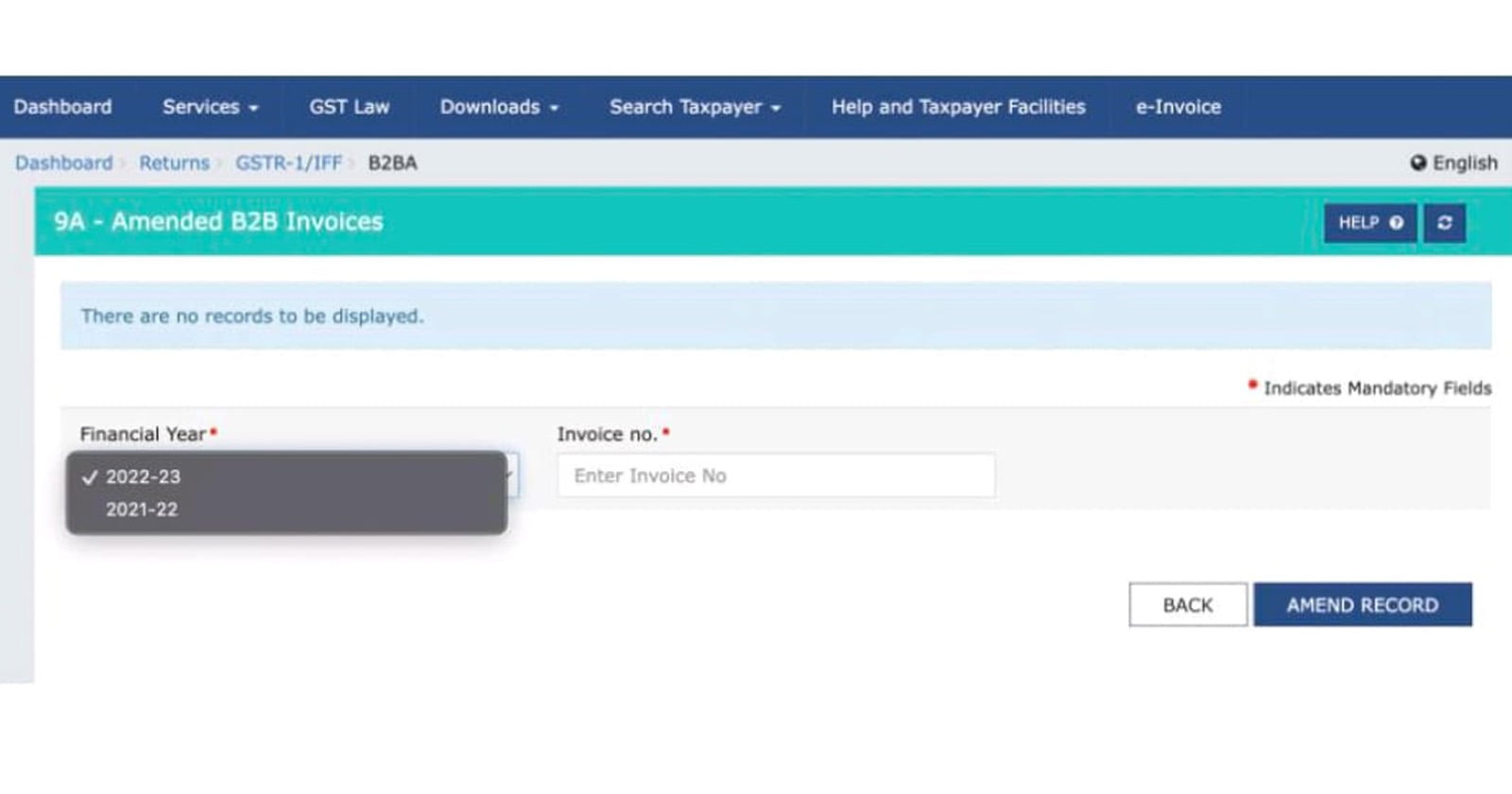

GST Portal Started Allowing Amendment in Form 9A – B2B Invoices

GSTN has started allowing the amendment related to FY 2021-22 in October 2022 return period. This in line with the recent amendment in the GST Law...

![Cancellation of GST Registration: Madras HC Permits filing of Returns/Payment of Dues for Prior Period, Advises State to facilitate Changes in GSTN [Read Order] Cancellation of GST Registration: Madras HC Permits filing of Returns/Payment of Dues for Prior Period, Advises State to facilitate Changes in GSTN [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/09/GST-Registration-Madras-HC-GSTN-taxscan.jpeg)

![Re-Opening of GST Portal for Transitional Credit: Supreme Court grants One-Month Extension to Govt [Read Order] Re-Opening of GST Portal for Transitional Credit: Supreme Court grants One-Month Extension to Govt [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/09/GST-Portal-Transitional-Credit-Supreme-Court-Govt-taxscan.jpeg)