Begin typing your search above and press return to search.

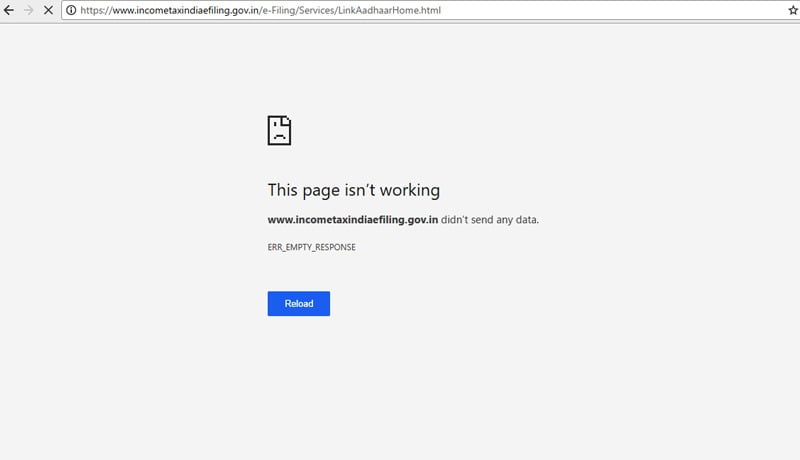

Income Tax E-Filing Services will not be available for few days: CBDT to launch new E-Filing Portal

The Income Tax Department is going to launch its new E-filing portal on June 7th, 2021. In preparation for this launch and for migration...

![Tribunal’s Power to Review does not include reappreciation of facts and modification of Order: ITAT [Read Order] Tribunal’s Power to Review does not include reappreciation of facts and modification of Order: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2021/04/Tribunal-Power-to-Review-reappreciation-of-facts-and-modification-of-Order-ITAT-Taxscan.jpeg)

![Revisional Jurisdiction cant be invoked when Re-Assessment is Illegal: ITAT [Read Order] Revisional Jurisdiction cant be invoked when Re-Assessment is Illegal: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2021/04/Revisional-Jurisdiction-Re-Assessment-ITAT-Taxscan.jpg)

![Setback to GE Capital: Delhi High Court dismisses Petition since Writ Jurisdiction can’t be invoked to challenge Order withholding Income Tax Refund [Read Judgment] Setback to GE Capital: Delhi High Court dismisses Petition since Writ Jurisdiction can’t be invoked to challenge Order withholding Income Tax Refund [Read Judgment]](https://www.taxscan.in/wp-content/uploads/2021/04/GE-Capital-Delhi-High-Court-Writ-Jurisdiction-Income-Tax-Refund-Taxscan.jpg)

![ITAT quashes reopening of Assessment, deletes addition on account of Share Application Money and Commission paid [Read Order] ITAT quashes reopening of Assessment, deletes addition on account of Share Application Money and Commission paid [Read Order]](https://www.taxscan.in/wp-content/uploads/2021/03/Income-Tax-ITAT-assessment-share-application-money-commission-Taxscan.jpg)

![Post Offices to deduct TDS on Cash Withdrawal above Rs. 20 lakh from National (Small) Savings Schemes for non-ITR filers [Read Circular] Post Offices to deduct TDS on Cash Withdrawal above Rs. 20 lakh from National (Small) Savings Schemes for non-ITR filers [Read Circular]](https://www.taxscan.in/wp-content/uploads/2021/03/Post-Offices-TDS-ITR-Cash-Withdrawal-National-Small-Savings-Schemes-Taxscan.jpg)