Begin typing your search above and press return to search.

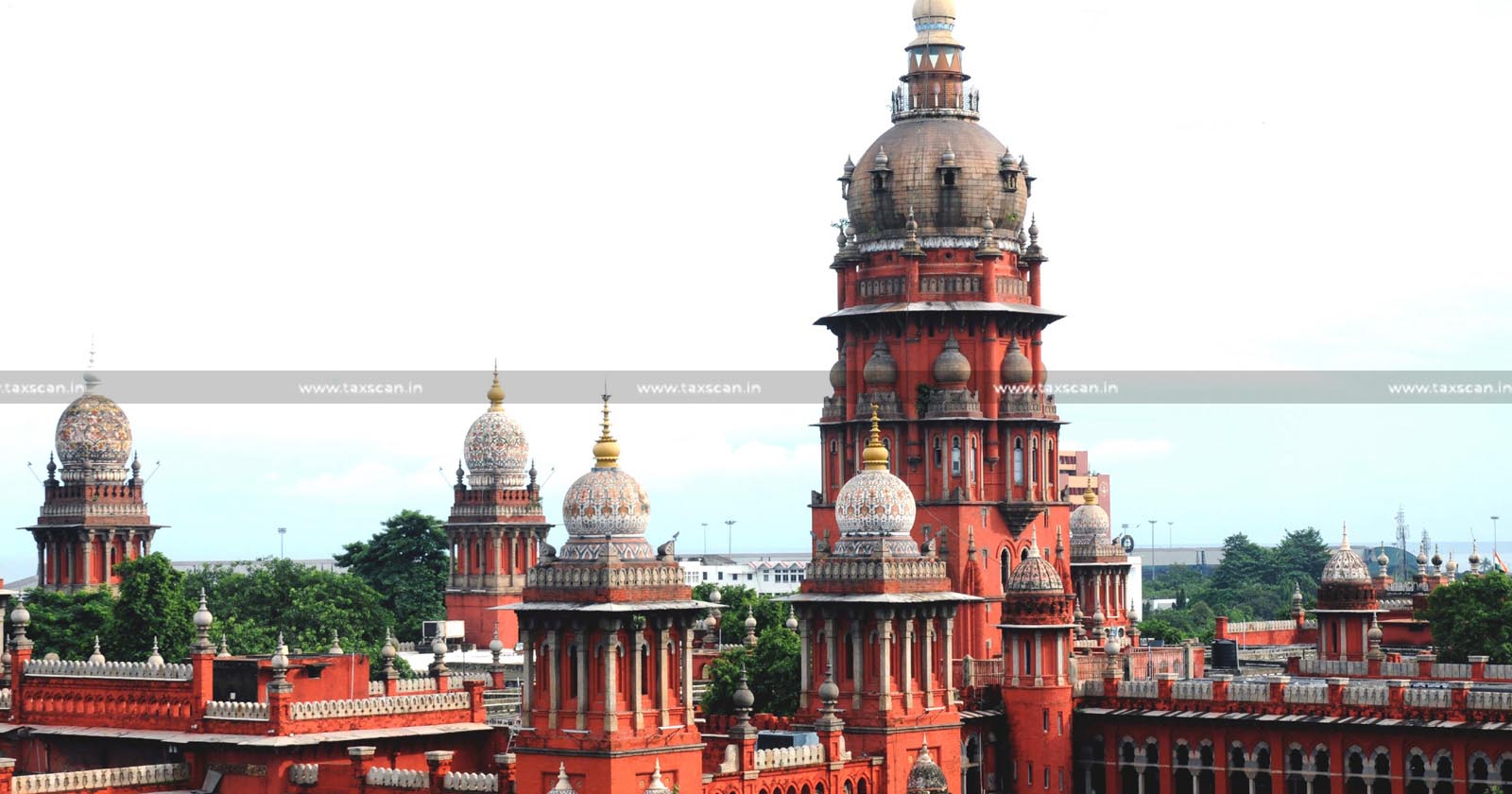

Entities Claiming Charitable Status under GPU cannot Exceed 20% of Gross Receipts from Commercial Activities: Madras HC [Read Order]

In a recent ruling, the Madras High Court ruled that entities claiming charitable status under the "general public utility" ( GPU ) category as...

![Unjustified Delay by Customs Dept. in considering Case De Novo: Madras HC directs Expedited Refund of Redemption Fine and Penalty [Read Order] Unjustified Delay by Customs Dept. in considering Case De Novo: Madras HC directs Expedited Refund of Redemption Fine and Penalty [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/11/Madras-HC-Madras-High-Court-Customs-Department-redemption-fine-and-penalty-TAXSCAN.jpeg)

![Mere Mentioning of Wrong VAT Provision does not invalidate Order if Authority has Proper Jurisdiction: Madras HC [Read Order] Mere Mentioning of Wrong VAT Provision does not invalidate Order if Authority has Proper Jurisdiction: Madras HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/10/VAT-Madras-High-Court-Madras-HC-value-added-tax-VAT-order-TAXSCAN.jpg)

![GST Recovery and Hearing Notices ignored: Madras HC orders 25% Pre-Deposit from Cash Ledger for Fresh Consideration [Read Order] GST Recovery and Hearing Notices ignored: Madras HC orders 25% Pre-Deposit from Cash Ledger for Fresh Consideration [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/10/GST-Goods-and-Services-Tax-pre-deposit-Madras-HC-Electronic-Cash-Ledger-TAXSCAN.jpg)

![Pre-GST Dues can be Cleared in Monthly Instalments: Madras HC rules Partly in Favour of Manufacturing Company in Loss [Read Order] Pre-GST Dues can be Cleared in Monthly Instalments: Madras HC rules Partly in Favour of Manufacturing Company in Loss [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/10/Madras-High-Court-GST-Pre-GST-Dues-Goods-and-Services-Tax-Monthly-instalments-for-tax-dues-Monthly-Instalments-taxscan.jpg)

![Powder Coating for Yokes, Links, and Tubes Constitutes Works Contract, Liable to VAT: Madras HC [Read Order] Powder Coating for Yokes, Links, and Tubes Constitutes Works Contract, Liable to VAT: Madras HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/10/Madras-High-Court-Value-Added-Tax-Powder-coating-tubes-TAXSCAN.jpg)

![Single Satisfaction Note Sufficient u/s 153C When Same Assessing Officer Handles Both Searched Person and Other Party: Madras HC [Read Order] Single Satisfaction Note Sufficient u/s 153C When Same Assessing Officer Handles Both Searched Person and Other Party: Madras HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/09/Income-Tax-Madras-High-Court-Single-Satisfaction-Note-TAXSCAN.jpg)

![Deemed Assessment u/s 22(4) TNVAT can be issued if No Returns Filed, Considered as First Assessment Order: Madras HC dismisses Petition challenging Limitation Period [Read Order] Deemed Assessment u/s 22(4) TNVAT can be issued if No Returns Filed, Considered as First Assessment Order: Madras HC dismisses Petition challenging Limitation Period [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/09/Commissioner-lower-authority-TNVAT-Act-HC-taxscan.jpg)

![Madras HC remands ITC denial matters u/s 16(4) of GST Act to AO, Orders Fresh Review under Finance Act 2024 [Read Order] Madras HC remands ITC denial matters u/s 16(4) of GST Act to AO, Orders Fresh Review under Finance Act 2024 [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/09/Madras-HC-madras-high-court-Demand-Passed-Hearing-Hearing-Date-Madras-HC-directs-for-Reconsideration-Madras-HC-for-Reconsideration-madras-hc-news-madras-high-court-news-taxscan.jpg)