Begin typing your search above and press return to search.

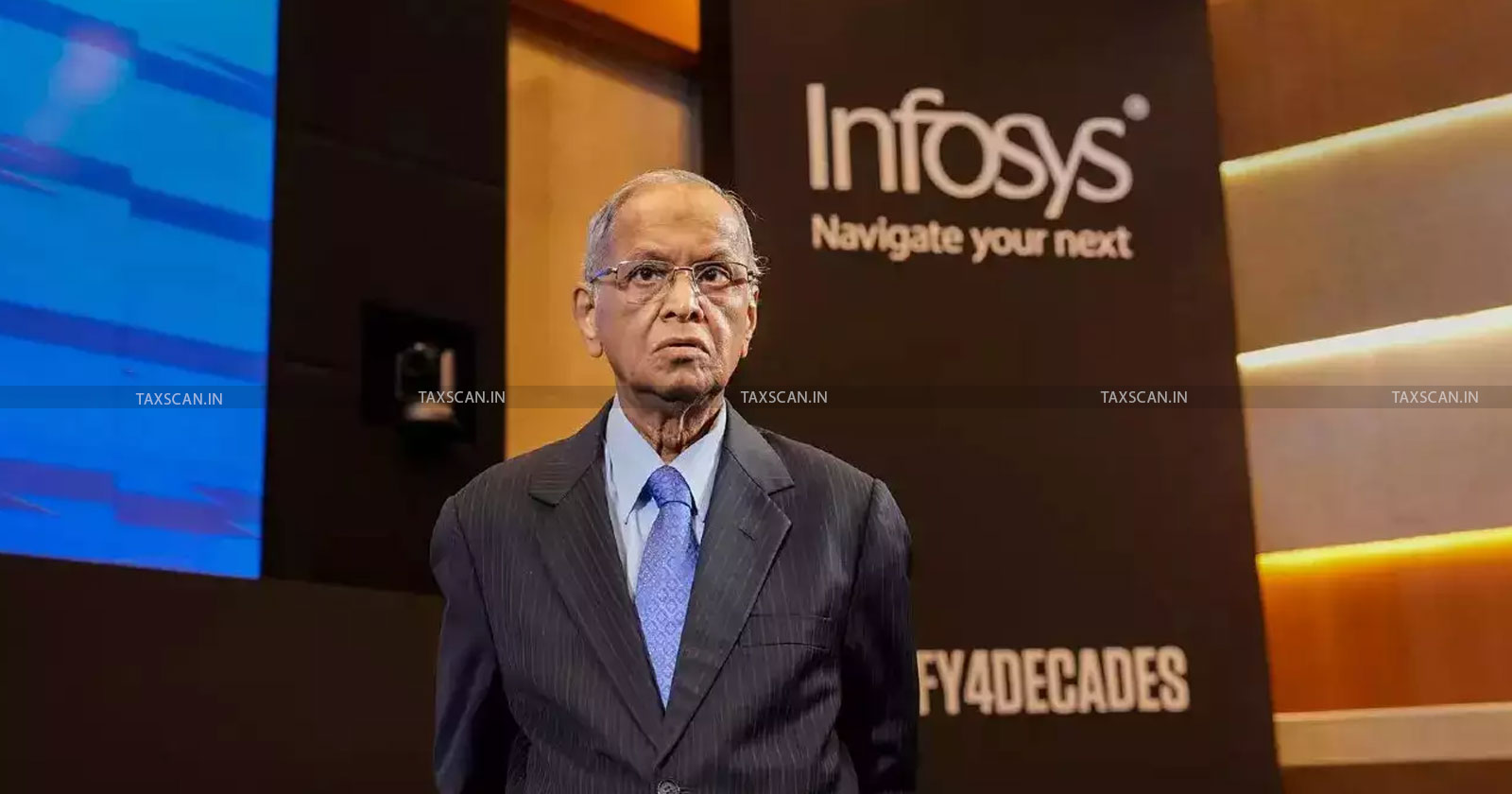

Infosys Narayana Murthy transfers Shares valued Rs. 240cr to Grandson Tax-Free: Know How

The transfer of shares by Infosys founder Narayana Murthy to his grandson, valued at Rs. 240 crores, garnered great nationwide attention. What made...

![ITAT nullifies Income Tax Additions in Penny Stock Deal for Quick Gains [Read Order] ITAT nullifies Income Tax Additions in Penny Stock Deal for Quick Gains [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/01/Penny-stock-gains-ITAT-Mumbai-Income-Tax-Appellate-Tribunal-Income-tax-additions-Taxation-on-penny-stocks-Income-Tax-taxscan.jpg)

![Difference in dates of Agreement fixing for Consideration and Registration Of Property : ITAT directs to take Date of Agreement adopted by SVA for Compute Full Value Consideration [Read Order] Difference in dates of Agreement fixing for Consideration and Registration Of Property : ITAT directs to take Date of Agreement adopted by SVA for Compute Full Value Consideration [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/11/Difference-dates-of-Agreement-Agreement-Registration-Of-Property-Registration-Property-taxscan.jpg)

![Disallowance of Bogus LTCG is Invalid in Absence of Incriminating Material: ITAT [Read Order] Disallowance of Bogus LTCG is Invalid in Absence of Incriminating Material: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/11/LTCG-income-tax-income-taxs-news-Incriminating-Material-Disallowance-of-Bogus-Income-Tax-act-TAXSCAN.jpg)

![ITAT upholds Addition on LTCG u/s 50C based on Unregistered Deeds merely Entered in Judicial Stamp Papers [Read Order] ITAT upholds Addition on LTCG u/s 50C based on Unregistered Deeds merely Entered in Judicial Stamp Papers [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/10/ITAT-Addition-on-LTCG-Unregistered-Deeds-merely-Entered-in-Judicial-Stamp-Papers-TAXSCAN.jpg)

![FMV of Agricultural Land to be Determined according to the Guidelines of the FY in which assessee Received Entire Amount of Sale Consideration: ITAT Dismisses Revenue Appeal [Read Order] FMV of Agricultural Land to be Determined according to the Guidelines of the FY in which assessee Received Entire Amount of Sale Consideration: ITAT Dismisses Revenue Appeal [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/10/FMV-of-Agricultural-Land-to-be-Determined-according-Guidelines-of-the-FY-in-which-assessee-Received-Entire-Amount-of-Sale-Consideration-ITAT-Dismisses-Revenue-Appeal-TAXSCAN.jpg)

![Indexation of Cost of Acquisition for calculation of LTCG is available from the AY in which Consideration is fully paid by Assessee: ITAT [Read Order] Indexation of Cost of Acquisition for calculation of LTCG is available from the AY in which Consideration is fully paid by Assessee: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/06/Indexation-of-Cost-of-Acquisition-for-calculation-of-LTCG-is-available-from-the-AY-which-Consideration-is-fully-paid-by-Assessee-ITAT.jpg)

![Consideration From Sale of Jointly Owned Property cannot be Treated as Long Term Capital Gain of a Co-owner Alone: ITAT [Read Order] Consideration From Sale of Jointly Owned Property cannot be Treated as Long Term Capital Gain of a Co-owner Alone: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/05/Consideration-From-Sale-Sale-of-Jointly-Owned-Property-Treated-as-Long-Term-Capital-Gain-Capital-Gain-Long-Term-Capital-Gain-of-a-Co-owner-Alone-ITAT-Income-Tax-taxscan.jpg)