Begin typing your search above and press return to search.

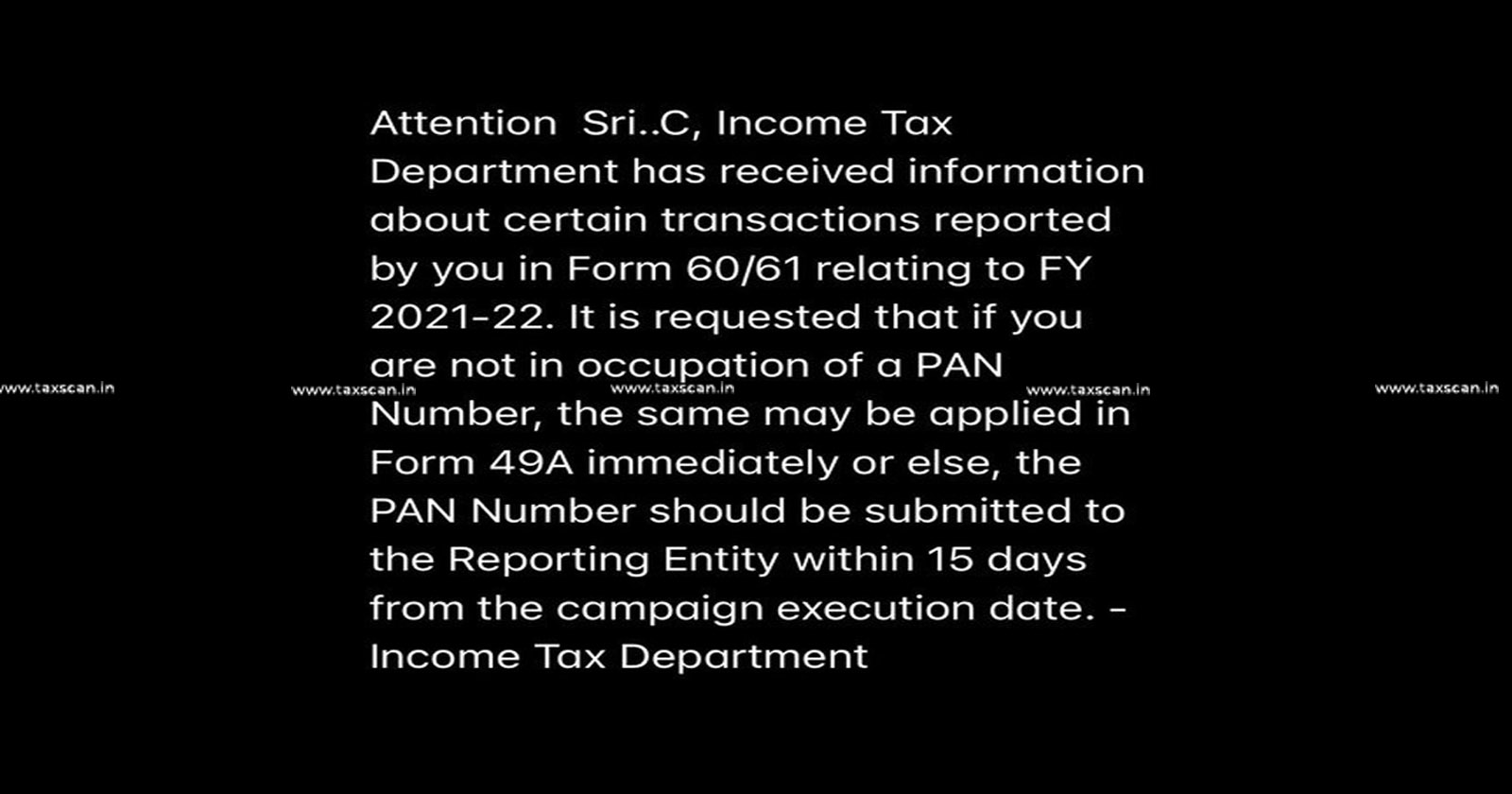

PAN Card update: Message Received for applying PAN through Form 49A by Income Tax Dept Responds it is Genuine

The Central government is cautioning individuals about false messages concerning refunds and customs duty payment. Following this, the Income Tax...

![Separate PAN and Return not Needed when Receipts of Institution Included in Financial Statement of Controlling Entity: ITAT deletes Penalty u/s 68 of Income Tax Act [Read Order] Separate PAN and Return not Needed when Receipts of Institution Included in Financial Statement of Controlling Entity: ITAT deletes Penalty u/s 68 of Income Tax Act [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/08/PAN-Separate-PAN-Separate-PAN-and-Return-not-Needed-when-Receipts-of-Institution-Included-in-Financial-Statement-Statement-of-Controlling-Entity-Receipts-taxscan.jpeg)

![Reopening Assessment u/s 147 of Income Tax Act Quoting Wrong PAN: Calcutta HC orders to Produce Relevant Records [Read Order] Reopening Assessment u/s 147 of Income Tax Act Quoting Wrong PAN: Calcutta HC orders to Produce Relevant Records [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/08/Reopening-Assessment-Income-Tax-Act-Wrong-PAN-PAN-Calcutta-High-Court-orders-to-Produce-Relevant-Records-Calcutta-High-Court-Taxscan.jpg)

![Relief to Reliance Commercial Dealers: 10% TDS Applicable on Payment to FSII for for Availing Training of Pilots, rules ITAT [Read Order] Relief to Reliance Commercial Dealers: 10% TDS Applicable on Payment to FSII for for Availing Training of Pilots, rules ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/08/Relief-to-Reliance-Commercial-Dealers-TDS-Applicable-on-Payment-to-FSII-for-for-Availing-Training-of-Pilots-rules-ITAT-TAXSCAN.jpg)

![AO Fails to Follow Procedures to Proceed Reassessment Proceedings under Income Tax Act; issued notices to different PAN Number: ITAT quashes notice u/s 148 [Read Order] AO Fails to Follow Procedures to Proceed Reassessment Proceedings under Income Tax Act; issued notices to different PAN Number: ITAT quashes notice u/s 148 [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/07/AO-Fails-to-Follow-Procedures-to-Proceed-Reassessment-Proceedings-Proceed-Reassessment-Proceedings-Income-Tax-Act-notices-to-different-PAN-number-PAN-number-ITAT-quashes-notice-taxscan.jpg)

![Profit from Bogus Purchases can be added to Taxable Income: ITAT [Read Order] Profit from Bogus Purchases can be added to Taxable Income: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/07/Profit-from-Bogus-Purchases-Taxable-Income-ITAT-Bogus-Purchases-Profit-taxscan.jpg)