Begin typing your search above and press return to search.

![Delhi HC upholds Exchange of Rs. 2000 Currency Notes without ID Proof, dismisses PIL [Read Order] Delhi HC upholds Exchange of Rs. 2000 Currency Notes without ID Proof, dismisses PIL [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/05/Exchange-of-Rs.-2000-Currency-Notes-without-ID-Proof-Currency-notes-Rs.-2000-Currency-notes-ID-Proof-PIL-Delhi-Highcourt-PIL-Delhi-Highcourt-taxscan.jpg)

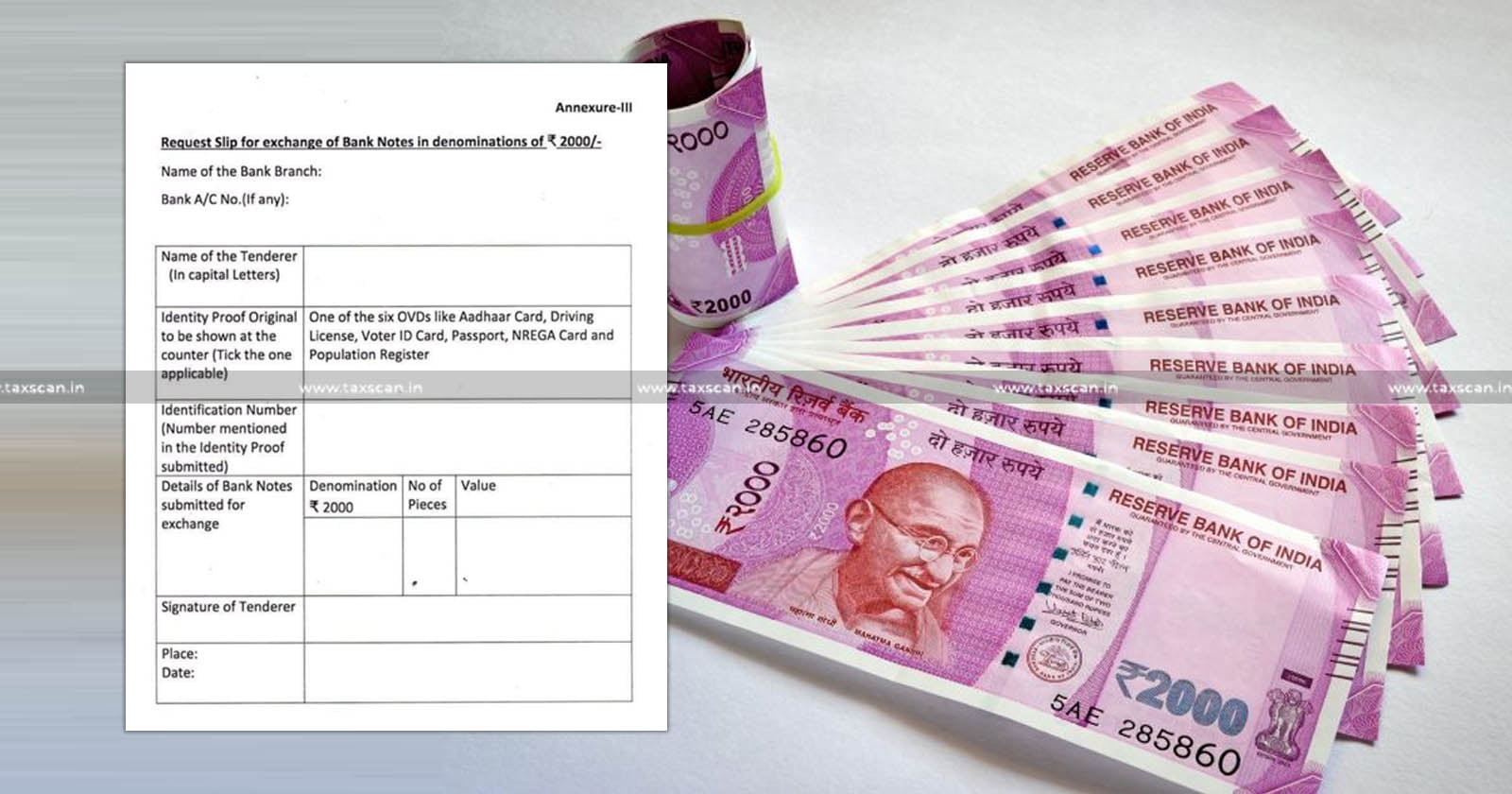

Delhi HC upholds Exchange of Rs. 2000 Currency Notes without ID Proof, dismisses PIL [Read Order]

The Delhi High Court has dismissed the Public Interest Litigation (PIL) filed against the Reserve Bank of India (RBI) and State Bank of India (SBI)...

![NBFCs Not Liable to Pay Interest Tax on Interest received under Hire-Purchase Agreement: Supreme Court [Read Order] NBFCs Not Liable to Pay Interest Tax on Interest received under Hire-Purchase Agreement: Supreme Court [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/01/NBFCs-Interest-Tax-Interest-Tax-on-Interest-received-Hire-Purchase-Agreement-Supreme-Court-taxscan.jpg)

![Depreciation can be allowed on Factual aspects under CBDT Instruction, even If the Value is not Recorded in Books of Account: ITAT [Read Order] Depreciation can be allowed on Factual aspects under CBDT Instruction, even If the Value is not Recorded in Books of Account: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/12/Depreciation-CBDT-Instruction-CBDT-Books-of-Account-ITAT-taxscan.jpg)