Begin typing your search above and press return to search.

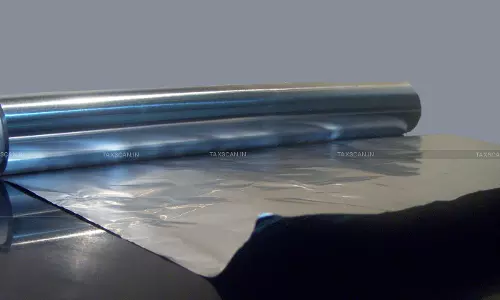

ADD Levy Determined on Ex‑Bond Date, Not Import Date: CAAR Rules Aluminium Frames Imported Pre-Notification Still Attract Duty on Clearance

The Customs Authority for Advance Rulings (CAAR), Mumbai, has held that anti‑dumping duty (ADD) liability on warehoused goods crystallises at the ...

![Cash Sales of Jeweller on Demonetisation Day Held Genuine: ITAT Deletes S.68 Addition as Books Were Not Rejected [Read Order] Cash Sales of Jeweller on Demonetisation Day Held Genuine: ITAT Deletes S.68 Addition as Books Were Not Rejected [Read Order]](https://images.taxscan.in/h-upload/2025/11/28/250x150_2108560-itat-cash-deposit-income-tax-act-taxscan.webp)

![Relief Denied in ₹100 Cr GST Fake ITC Case: Rajasthan HC Says ‘He Who Comes Into Equity Must Come With Clean Hands [Read Order] Relief Denied in ₹100 Cr GST Fake ITC Case: Rajasthan HC Says ‘He Who Comes Into Equity Must Come With Clean Hands [Read Order]](https://images.taxscan.in/h-upload/2025/12/01/250x150_2109271-gst-itc-case-hc-taxscan.webp)

![Sale Proceeds Recorded in Books Cannot be Recharacterized as Unexplained Cash Credit: ITAT Deletes Addition [Read Order] Sale Proceeds Recorded in Books Cannot be Recharacterized as Unexplained Cash Credit: ITAT Deletes Addition [Read Order]](https://images.taxscan.in/h-upload/2025/11/27/250x150_2108388-unexplained-cash-credits.webp)

![Proceeds of Sales Already Accounted Cannot be Added as Unexplained Cash Credit: ITAT Deletes Addition [Read Order] Proceeds of Sales Already Accounted Cannot be Added as Unexplained Cash Credit: ITAT Deletes Addition [Read Order]](https://images.taxscan.in/h-upload/2025/11/18/250x150_2106382-cash-credit-income-tax-taxscan.webp)

![Mere Ownership of Agricultural Land Insufficient to Prove Agri Income: ITAT Upholds 50% Addition as Unexplained u/s 68 [Read Order] Mere Ownership of Agricultural Land Insufficient to Prove Agri Income: ITAT Upholds 50% Addition as Unexplained u/s 68 [Read Order]](https://images.taxscan.in/h-upload/2025/11/13/500x300_2104840-agri-income-itat-addition-taxscan.webp)

![Relief to Indian Oil Corporation: CESTAT Sets aside Order rejecting Customs Duty Refund Citing Limitation [Read Order] Relief to Indian Oil Corporation: CESTAT Sets aside Order rejecting Customs Duty Refund Citing Limitation [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/03/Indian-Oil-Corporation.jpg)

![S. 145(3) of Income Tax Cannot Be Invoked Without Identifying Specific Defects in Books: ITAT [Read Order] S. 145(3) of Income Tax Cannot Be Invoked Without Identifying Specific Defects in Books: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/02/Defects-in-Books-of-Account-1.jpg)

![ITAT Orders Reassessment of Post-Demonetization Cash Deposits by Bar & Restaurant Business Owner [Read Order] ITAT Orders Reassessment of Post-Demonetization Cash Deposits by Bar & Restaurant Business Owner [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/02/Demonetization.jpg)

![ITAT Dismisses Revenues Appeal Due to Low Tax Effect Under CBDT Circular [Read Order] ITAT Dismisses Revenues Appeal Due to Low Tax Effect Under CBDT Circular [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/02/low-tax.jpg)

![Applicability of S.68 to CSR Funds: ITAT Rules Addition Unjustified as Identity and Genuineness Proven [Read Order] Applicability of S.68 to CSR Funds: ITAT Rules Addition Unjustified as Identity and Genuineness Proven [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/01/CSR-Funds-ITAT-Rules-ITAT-Ahmedabad-ITAT-Income-Tax-Act-Section-68-Corporate-Social-Responsibility-Income-Tax-Income-Tax-Appellate-Tribunal-taxscan.jpg)