Begin typing your search above and press return to search.

![Hotels to be Assessed for Additional Income collected as Service Charges: CBDT [Read Circular] Hotels to be Assessed for Additional Income collected as Service Charges: CBDT [Read Circular]](https://www.taxscan.in/wp-content/uploads/2018/11/Service-Charges-Taxscan.jpg)

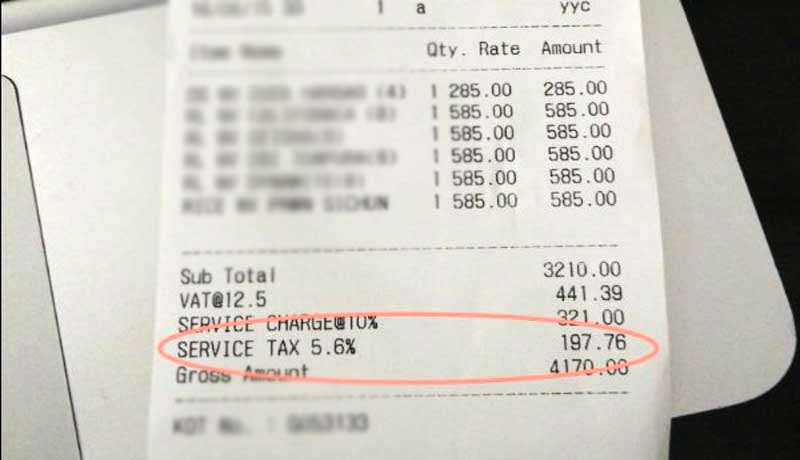

Hotels to be Assessed for Additional Income collected as Service Charges: CBDT [Read Circular]

The Central Board of Direct Taxes (CBDT) has mandated that the hotels / restaurants will be taxed for the additional income collected as service...

![Service Charges collected from Tenant is ‘House Property Income’ incidental to Rental Income: ITAT [Read Order] Service Charges collected from Tenant is ‘House Property Income’ incidental to Rental Income: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2017/03/Rental-Income-Taxscan.jpg)

![12AA Registration cannot be withdrawn on Ground of Receiving Service Charges for conducting Programmes: Delhi HC [Read Order] 12AA Registration cannot be withdrawn on Ground of Receiving Service Charges for conducting Programmes: Delhi HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2016/06/Delhi-High-Court-Tax-Scan-1.jpg)

![Rental Income and Service Charges from Leasing Out Malls/Commercial Complex constitute ‘Business Income’: Bombay HC [Read Order] Rental Income and Service Charges from Leasing Out Malls/Commercial Complex constitute ‘Business Income’: Bombay HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2017/07/Malls-Rental-Income.jpg)

![Income from Running and Operation of a Mall and Service Charges are ‘Business Income’: ITAT Mumbai [Read Order] Income from Running and Operation of a Mall and Service Charges are ‘Business Income’: ITAT Mumbai [Read Order]](https://www.taxscan.in/wp-content/uploads/2017/01/Mall-Operation-Taxscan.jpg)