[Taxscan 360] Online Money Gaming, Horse Racing and Casinos: GST Implications and Unaddressed issues

Taxscan 360 – Online Money Gaming – Horse Racing – Casinos – GST Implications – Unaddressed issues – taxscan

Taxscan 360 – Online Money Gaming – Horse Racing – Casinos – GST Implications – Unaddressed issues – taxscan

In recent years, the online gaming industry in India has witnessed remarkable growth, projected to reach $5 billion by 2025 with a compound annual growth rate of 28-30%. However, a recent decision by the GST Council to impose a 28% GST on the face value of wagers, encompassing platform fees and net wins, has raised concerns among industry stakeholders.

Over 130 companies and trade organizations in the gaming sector have collectively expressed their apprehensions to the government through an open letter. They argue that the proposed 28% GST rate could jeopardize the industry's profitability, potentially leading to job losses, hindering foreign investments, and driving gamers towards illicit offshore platforms. The tax imposition has the potential to result in a significant increase of nearly tenfold in taxation due to the maximum utilization of companies' income.

Need for Clarity for GST imposition on Online Gaming

Compounding the issue is the lack of clarity surrounding the applicability of the new GST rate across various segments of the gaming industry, including in-game app purchases, PC games, console games, and esports. This ambiguity has left gaming enterprises uncertain about how to navigate and comply with the evolving tax landscape.

The 50th GST Council Decision

In a significant decision during the 50th GST Council meeting held on July 11, 2023, key determinations were made regarding the taxation of the online gaming industry, casinos, and horse racing businesses. The GST Council, in collaboration with the Group of Ministers ( GoM ), provided recommendations to resolve the ongoing debate over "games of skill or chance." The proposal entails applying a 28% GST to online gaming, casinos, and horse racing based on the full face value, requiring an amendment to the GST law for inclusion.

The final report from the GoM proposed a 28% GST on the total value of consideration received in online gaming, encompassing the entry fee. Additionally, it suggested that after charging 28% GST on the initial purchase of casino chips, no further GST would be applicable, even on new bets made from previous round earnings.

The 51st GST Council Decision

The 51st GST Council, chaired by Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman, convened via video conferencing in New Delhi. In attendance were Union Minister of State for Finance Shri Pankaj Chaudhary, Finance Ministers of States & UTs (with legislature), and senior officers of the Ministry of Finance & States/ UTs. The Council recommended valuing the supply of online gaming and actionable claims in casinos based on the amount paid or payable to the supplier by or on behalf of the player. This excludes the amount entered into games/bets from previous winnings. Amendments to CGST Rules, 2017, for specific provisions on this valuation, were proposed. The Council also recommended issuing notifications and amendments related to the matter, with the aim to implement the changes from October 1, 2023.

Goal of India's GST Council

In the realm of Indian law, there has traditionally been a clear distinction between games of skill and games of chance. Activities requiring skill were viewed as legitimate economic endeavors, while those based on chance were regarded differently. However, a noteworthy development unfolded when the Karnataka High Court redefined the categorization of specific online games, such as rummy, deeming them games of skill. Consequently, these games became subject to Goods and Services Tax (GST) solely on player fees, with the elimination of the prize element as an "actionable claim." Despite this legal stance, a recent initiative from the GST Council seeks to challenge this interpretation, bringing the 'actionable claim' component under the purview of GST. This move indicates the Council's intention to overturn the court's ruling, potentially signaling an effort to enhance revenue from online gaming activities.

Games of Skilll and Games of Chance

The legal feasibility of the suggested GST tax presents notable apprehensions. Although the Supreme Court has endorsed GST on specific actionable claims, such as lottery, gambling, and betting, implementing this tax exclusively on online skill-based games could be deemed as a form of "hostile discrimination." This move might potentially reshape the tax framework for the online gaming , especially if additional legal challenges arise. It's crucial to closely monitor the unfolding legal landscape to gauge the potential ramifications on the taxation structure of online gaming businesses.

The GST Council aims to incorporate the proposed modifications by October 1, 2023. However, navigating the intricate legislative process and overcoming resistance from certain state governments suggests that this timeline might be overly optimistic. The pivotal nature of the implementation date is noteworthy, as it holds implications for both businesses and consumers within the online gaming industry. The potential impact of these changes adds an extra layer of importance to closely monitoring the progress of this legislative adjustment.

The decision by India’s GST Council to levy a 28% GST on online gaming has ignited debates and apprehension within the industry. While the government aims to curb gambling, industry stakeholders argue that the high tax rate could lead to dire consequences, including job losses and limitations on foreign investment, possibly driving players towards illegal offshore platforms. The future of the online gaming sector hangs in the balance, awaiting the government's response to industry concerns. Only time will reveal whether a reconsideration of this decision is on the horizon.

Relevant Laws regarding Government's Interference in Gaming Sector

The Public Gambling Act,1867

The Public Gambling Act, 1867, is a historic legislation in India aimed at regulating gambling activities. Enacted during British rule, it addresses the prohibition and regulation of public gambling. The key features include defining various forms of gambling and providing legal consequences for those engaged in unlawful activities. Section 12 of the Public Gambling Act explicitly exempts games based solely on skill from its provisions. In essence, the Act does not apply to activities classified as games of mere skill.

The Public Gambling Act of 1867 is a legislative framework in India that seeks to control and curb the menace of public gambling. Enacted during the colonial era, its primary objective is to regulate betting and wagering activities, reflecting the societal concerns of that time.

The rise of online gambling platforms has raised questions about the applicability of the Act to virtual spaces, prompting discussions on the need for legal updates.

The regulation of online games in India falls under the purview of the Public Gambling Act 1867 and the Information Technology Act 2000.

Section 66 of the IT Act addresses computer-related crimes, while Section 67, 67A, and 67B empower the formulation of laws regarding online gaming, aligning with the constitutional placement of gambling and betting in the state list.

As societal attitudes toward gambling evolve, there is ongoing debate about finding a balance between restricting potentially harmful activities and allowing responsible gaming. Section 12 of the Public Gambling Act explicitly exempts games based solely on skill from its provisions. In essence, the Act does not apply to activities classified as games of mere skill.

The Act, in conjunction with state laws, addresses online gambling offenses, imposing penalties on illegal activities and those involved in them.

Platforms facilitating online gambling come under the purview of intermediary liability, emphasizing responsible operation to prevent misuse.

The Act faces challenges in regulating the dynamic landscape of online gaming and gambling, with the emergence of new platforms and technologies.

Ongoing discussions center on adapting the Act to address emerging challenges, including technological advancements in the online gaming and gambling sectors.

The Information Technology Act, 2000 (IT Act)

The Information Technology Act, 2000 (IT Act), is a crucial legislation in India designed to address issues related to electronic transactions, digital signatures, and cybercrimes. Enacted to facilitate e-commerce and govern digital activities, it plays a pivotal role in regulating the rapidly evolving technology landscape.

As of April 6, 2023, the Indian government has announced an amendment to the Indian Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021. This amendment brings players in the online gaming industry under the jurisdiction of the IT Rules.

The IT Rules, coupled with the Indian Information Technology Act, 2000, act as the main regulatory framework for online intermediaries in India. According to Section 2(w) of the IT Act, an intermediary broadly refers to any entity facilitating the reception, storage, transmission of electronic records, or provision of related services. This encompasses various entities such as telecom service providers, network service providers, internet service providers, web-hosting service providers, search engines, online payment sites, online auction sites, online marketplaces, and cyber cafes.

After the April amendment, the IT Rules introduced a statutory definition for an "online gaming intermediary" under Rule 2(qa). This term encompasses an intermediary that facilitates users of its computer resource to access one or more online games. Additionally, the amendment explicitly defines an "online game" as any game available on the Internet and accessible by a user through a computer resource or an intermediary.

Notably, the revised IT Rules define an "online real money game" as any online game where a user deposits cash or kind, expecting potential winnings distributed based on their performance and in accordance with the game's rules. The rules distinctly classify a "permissible online game" as either a "permissible online real money game" or any other online game not involving real money. Furthermore, the amended regulations outline the creation of an "online gaming self-regulatory body" tasked with determining and regulating permissible online real money games.

The legislative intent behind the recent amendment in the IT Rules is notably driven by the rise of technological advancements in the gaming industry, coupled with increased accessibility to a broader demographic. This surge has coincided with a growing body of studies highlighting risks associated with excessive gamRealm

The IT Amendment Rules aim to regulate online gaming through self-regulation, placing due-diligence obligations on a new category of online gaming intermediaries. These changes introduce the online gaming self-regulatory body to oversee these efforts.

Notably, Rule 3(b)(ii) now includes the phrase "or an online game that causes user harm," requiring intermediaries to remove games that pose harm to users, with user harm defined broadly to cover any detrimental effect on users or children.

Additionally, Rule 4A empowers the online gaming self-regulatory body to prohibit real money games that rely on wagering outcomes. Under Rule 3(b)(xi), a general obligation is imposed on all intermediaries, including online gaming intermediaries, to ensure that the information or online games they handle do not contravene any existing laws in the country.

Interpretively, Rule 3(b)(xi) appears to facilitate the harmonious coexistence of Central and State enactments, allowing intermediaries to ensure compliance with both sets of laws. This mandate does not encroach upon the States' authority, affording them the flexibility to determine the permissibility of various online games.

Conversely, the amendment to Rule 3(b)(ii) and the introduction of Rule 4A present a direct constraint on the autonomy of State governments in deciding the categories of games they permit or prohibit. Rule 4A, particularly, imposes restrictions on games involving wagering or causing user harm, areas traditionally within the States' legislative competence. The contention arises from the argument that the Centre, through these amendments, oversteps its boundaries, infringing on powers constitutionally reserved for State legislatures.

The Central Government may argue its authority under entry 31 of the Union List, asserting its right to legislate on forms of communication, including internet intermediaries. However, critics contend that the essence of the amendment lies in restricting online games involving real money and wagering outcomes, an arena that falls under State jurisdiction. This invokes concerns of the Centre encroaching on exclusive state legislative domains under the guise of internet regulation.

While a centrally controlled law for the expansive medium of the Internet may be advocated for efficiency, technological advancements like geo-blocking offer states the ability to regulate content independently. Instances in states like Tamil Nadu, where geo-blocking has been employed to restrict specific online games, highlight the feasibility of state-level interventions despite a centralized approach.

Constitutionality of Government's Interference in Gaming Realm

Assigns the regulation of betting and gambling to the state list (Entry 34, List II of the Seventh Schedule). This grants exclusive legislative authority to states for enacting laws pertaining to gambling within their respective territories. Notably, many existing legislations, including the Public Gambling Act of 1867, were established prior to the advent of online gambling and gaming.

State-wise regulations for online gaming platforms in India.

The Sikkim Online Gaming (Regulation) Act of 2008 oversees online gaming, particularly digital casinos offering games like blackjack, through the imposition of licensing and other requirements.

In Meghalaya, the gaming law permits the operation of digital casinos once licensed, while in Nagaland, games of skill like poker are allowed.

Tamil Nadu, on the other hand, enacted the Tamil Nadu Prohibition of Online Gambling and Regulation of Online Games Act in 2022. This legislation, receiving the governor's assent on April 7, 2023, prohibits online gambling and games of chance played for money or other stakes, including Rummy and Poker.

The Telangana Gaming Act of 1974 amendment prohibits all online games without distinguishing between those based on skill and chance. In Rajasthan, the draft of the Rajasthan Virtual Online Sports (Regulation) Bill, 2022, introduces a licensing system to oversee fantasy sports and e-sports. Notably, other skill-based games like virtual poker, stock exchange, and quiz games are not explicitly covered in the Bill, suggesting they could be considered permissible.

Efforts to prohibit all online games through amendments to the Karnataka Police Act, 1963, were nullified by the Karnataka High Court in the case of All India Gaming Federation v. State of Karnataka & Ors.[6], deeming them unconstitutional.

Similarly, the State of Kerala attempted to remove the exemption for online rummy, citing reasons like increased suicide rates and malpractices. However, the Kerala High Court, in September 2021, struck down this move, asserting that blanket bans on online gaming and targeting games of skill violated Article 19(1)(g) by restricting the right to trade and profession. The Courts acknowledged legislative competence but emphasized the need for laws in alignment with fundamental rights.

Recent Cases On Online Gaming in India

Junglee Games India Pvt. v. State of Tamil Nadu [ 2021] SCC Online Mad 2762]

In 2021, the Tamil Nadu government introduced the Tamil Nadu Gaming and Police Laws (Amendment) Act 2021, prohibiting all forms of online games, including those based on skill. The legality of this amendment was contested in the Junglee Games India Private Limited v. State of Tamil Nadu case. The Madras High Court, in its judgment, deemed the blanket prohibition unconstitutional. Following this, the Tamil Nadu government formed the Justice Chandru Committee to recommend a new legislation. Based on the committee's report, the Tamil Nadu Prohibition of Online Gambling and Regulation of Online Games Ordinance, 2022, was promulgated and later received the Governor's assent in October 2022. The subsequent enactment, known as the Tamil Nadu Prohibition of Online Gambling and Regulation of Online Games Act, 2022, has been recently notified.

Saahil Nalwaya v State of Rajasthan & And. [ D. B. Civil Writ Petition No. 2026 / 2021, decided on July 22, 2021]

The provision of online fantasy sports, aligned with the principles of the Federation of Indian Fantasy Sports Charter, has received judicial acknowledgment as a legitimate business. Consequently, it is entitled to the protection afforded by Article 19(1)(g) of the Indian Constitution. Any plea requesting the State Government to restrict such activities would be contested on grounds of contravening both Article 14 and Article 19(1)(g) of the Indian Constitution.

Avinash Mehrotra v State of Rajasthan & Ors [ Special Leave Petition ( Civil) No (s). 18478/2020, decided on July 30, 2021]

The Supreme Court, in a notable decision, rejected an appeal challenging a Rajasthan High Court ruling that affirmed Dream11 as a platform requiring skill and not constituting gambling. The appeal, filed by Mehrotra, contested the Jaipur bench of the Rajasthan High Court's order dated February 14, 2020, in the case of Chandresh Sankhla v. State of Rajasthan & Ors.

D. Siluvai Venance v State of rep. The Inspector of Police , Koodan kulam Police Station, Tirunelveli [ Crl. (MD) No. 6568 of 2020 and Crl. MP. ( MD) No. 3340 of 2020, decided on, July 24, 2020]

The Madras High Court (Madurai Bench) expressed the necessity for a legislative framework to address the rising prominence of online and virtual games. The court emphasized the importance of establishing a comprehensive regulatory structure, overseen by a regulatory body, to effectively manage online sports and prevent any unlawful activities.

Ravindra Singh Chaudhary v Union of India . [ D.B Civil Writ Petition No.20779/ 2019, decided on October 16, 2020]

The Rajasthan High Court determined that users engaging in online fantasy sports are not involved in gambling on the actual outcome of a game. This decision stems from the court's observation that the results achieved by participants in online fantasy sports are entirely independent of the outcomes in real-life games.

Chandraesh Sankhla v the State of Rajasthan [ 2020 SCC Online Raj 264, Order dated February 14, 2020]

The Rajasthan High Court, taking into account the decisions of the Punjab High Court and the Bombay High Court regarding the Dream11 online fantasy sports gaming platform, determined that considering Dream11 as involving any element of betting or gambling is no longer a subject of debate. Consequently, the Rajasthan High Court dismissed the case, affirming the legality of the Dream11 online fantasy sports gaming platform. Additionally, the Special Leave Petition filed before the Supreme Court was also dismissed.

Gurdeep Singh Sachar v UOI , Bombay High Court [ Judgement dated 30th April 2019 in Criminal P.I.L No. 16 of 2019]

The Bombay High Court (BHC) sided with Dream11, dismissing the petitioner's arguments. Drawing inspiration from the judgments of the Punjab and Haryana High Court, as well as the case of K.R. Lakshmanan v State of Tamil Nadu, the BHC concluded that the games conducted on the platform are games of skill, not games of chance.

Shri Varun Gumber v Union Territory of Chandigarh and Ors. [ CWP No. 7559 of 2017]

The Punjab and Haryana High Court (PHC) ruled that success on Dream11 is derived from a user's application of superior knowledge, judgment, and attention, and therefore, Dream11's games are exempt from the provisions of the Public Gambling Act as they necessitate a significant degree or "preponderance of skill."

Drawing on the Supreme Court decision in K.R. Lakshmanan v State of Tamil Nadu [(1996) 2 SCC 226], which held that horse racing required skill, judgment, and discretion, the PHC concluded that the Fantasy Dream11 game was skill-based and did not qualify as gambling.

Despite an appeal filed before the Supreme Court of India against the PHC judgment, the Supreme Court affirmed the validity of the decision and summarily dismissed the appeal.

India's Current Status on Online Gaming GST Implementation

M/S E-GAMING FEDERATION & ANR. vs UNION OF INDIA & ORS. CITATION: 2024 TAXSCAN (SC) 121 Counsel for Appellant: Mr. Harish N Salve, Sr. Adv. Mr. Sajan Poovayya, Sr. Adv. Mr. V Lakshmikumaran Counsel for Respondent: Mr. N. Venkataraman, A.S.G. Mr. Arijit Prasad, Sr. Adv. Mr. Mukesh Kumar Maroria

In a notable development, the Supreme Court of India considered the Writ Petition filed by M/s E-Gaming Federation & Anr. against the Union of India & Ors., prompting the issuance of a notice to the Central Government. The court is addressing concerns regarding the imposition of a 28% GST on online money gaming, horse racing, and casinos. The Petitioner(s) were represented by a strong legal team led by Mr. Harish N Salve, Senior Advocate, supported by Mr. Sajan Poovayya, Senior Advocate, and others. On the Respondent(s) side, Mr. N. Venkataraman, Additional Solicitor General, along with Mr. Arijit Prasad, Senior Advocate, and others, represented the Union of India & Ors.

The Supreme Court directed a notice to the Union of India, with Mr. N. Venkataraman assuring the filing of a counter affidavit within two weeks. The legal challenge revolves around the constitutional validity of imposing a 28% GST, with Senior Advocate Harish Salve arguing that the tax was applied to the entire value of bets, starting from October 1, rather than on the companies' revenue. This, as per Salve, raised concerns of arbitrariness and illegality, resulting in demand notices for previous financial years. The case delves into questions about whether actionable claims can be deemed goods without a constitutional change and if wagering can generate an actionable claim.

The case has been linked with SLP (C) Nos 19366-19369 of 2023 (Director General of Goods and Services Tax Intelligence & Ors v Gameskraft Technologies Private Limited & Ors), aligning with the Gameskraft issue. To streamline proceedings, Ms. Charanya Lakshmikumaran and Mr. Chandrashekhar have been designated as nodal counsel, responsible for compiling submissions, pleadings, documents, and precedents in electronic form, following the Circular dated August 22, 2023, regulating submissions in larger Bench cases.

The Supreme Court has issued notices in response to petitions filed by online gaming companies Head Digital Works and Games 24/7, challenging the government's retrospective imposition of a 28% Goods and Services Tax (GST) on the total value of bets instead of the gross gaming revenue. All cases related to the taxation of online gaming companies will be collectively heard by the top court.

On December 15, the Supreme Court rejected interim relief against GST demand notices issued to Head Digital Works and Games 24/7. In the 50th GST Council meeting on July 11, 2023, a 28% GST was recommended for Online Gaming, Casinos, and Horse Racing, irrespective of whether these activities were deemed games of skill or chance. This decision sparked controversy in the gaming industry. Subsequently, in its 51st meeting, the GST Council clarified that the decision would be effective from October 1, 2023, and would undergo a review after six months of implementation.

In September 2023, the apex court stayed the Karnataka High Court's judgment, which had annulled a goods and services tax (GST) notice against Bengaluru-based online gaming company Gameskraft Technology for an alleged evasion of Rs 21,000 crore.

On October 7, 2023, the 52nd Goods and Services Tax (GST) Council convened to discuss various matters, including the formation of the GST Appellate Tribunal (GSTAT) and the taxation of numerous goods and services. Notably, no resolution was reached concerning the taxation of Online Gaming.

The Delhi minister is poised to advocate for a reconsideration of this aspect in the upcoming GST Council meeting. The goal is to propose a more favorable taxation framework that safeguards the future of the online gaming industry. This reflects the industry's concerns and underscores the minister's commitment to addressing them at a policy level, demonstrating a nuanced understanding of SEO implications.

Despite discussions, no decision was made regarding GST on Online Gaming, Online Money Gaming, and Casinos in today's meeting. The Central Government remains steadfast in its intention to impose a 28% Goods and Services Tax on the face value of all money gaming transactions, despite facing strong opposition from both the industry and other states.

The Supreme Court's decision to halt the Karnataka High Court's ruling in the case of Gameskraft Technology Private Limited regarding Goods and Services Tax (GST) is expected to prompt the issuance of Show Cause Notices (SCN) to around 40 other online gaming companies.

Gameskraft Technology Private Limited faced accusations of substantial GST tax evasion totaling Rs 21,000 crore. Despite the Karnataka High Court previously siding with the company and dismissing the GST notice, the Supreme Court's stay order has now suspended that decision, allowing for further legal proceedings.

Beyond the Gameskraft case, two additional gaming companies have also received show-cause notices, alleging a collective tax evasion of Rs 3,000 crore. While these amounts may not match the scale of the Gameskraft case, they still represent noteworthy tax liabilities that have captured the attention of tax authorities.

DIRECTORATE GENERAL OF GOODS AND SERVICES TAX INTELLIGENCE (HQS) vs GAMESKRAFT TECHNOLOGIES PRIVATE LIMITED CITATION: 2023 TAXSCAN (SC) 217 Counsel for Appellant: Mr. N. Venkatraman Counsel for Respondent: Mr. Mukul Rohatgi

The Supreme Court recently issued a stay on the High Court of Karnataka's Single Judge's order, which had set aside the 21,000 Crore Rupee GST demand served on Gameskraft. The Division Bench, comprising Chief Justice of India DY Chandrachud, along with Justices JB Pardiwala and Manoj Misra, has requested a response from Gameskraft and scheduled a follow-up hearing in three weeks. CJI Chandrachud orally reassured that no significant developments would occur within this three-week period.

This bench is currently reviewing the Central government's appeal against the High Court's ruling, which asserted that Rummy, whether played with or without stakes, does not constitute gambling. N Venkatraman, Additional Solicitor General, highlighted a decision of a three-Judge Bench of the Apex Court in Skill Lotto Solutions Private Limited vs Union of India & Ors. The judgement, distinguished in paragraph 7 of the impugned judgement at page 320, is seriously in question.

Following a GST raid at Gameskraft's office in November 2021, resulting in freezing all the company's bank accounts, initial allegations of ₹419 crore in tax evasion escalated to ₹5,000 crore and eventually exceeded ₹21,000 crore after July 2022. Authorities shifted their narrative, suggesting Gameskraft's potential involvement in betting. In the High Court order, Justice SR Krishna Kumar asserted that Rummy, whether played online or in physical form, predominantly involves skill rather than chance.

Due to the High Court's decision, online Rummy games and other digital games on Gameskraft's platforms were not categorized as 'betting' or 'gambling,' making them exempt from taxation. The Karnataka government has contested this ruling in the Supreme Court, with the Special Leave Petition scheduled for a hearing on October 10, 2023.

Lok Sabha Passes CGST and IGST Amendment Bill Proposing 28% GST on Online Gaming

On August 11, 2023, the Lok Sabha passed the Central Goods and Services Tax (Amendment) Bill and Integrated Goods and Services (Amendment) Bill, endorsing the proposed 28% GST rate on online gaming, casinos, and horse racing. Union Finance Minister Nirmala Sitharaman presented the bill today. The CGST Amendment bill introduced Section 80A and 80B, offering definitions for Online gaming and Online money gaming. The implementation of the amendment will occur upon its publication in the official gazette, following the specified dates mentioned in the respective sections.

Input Tax Credit ( ITC)

Operators in the online gaming and casino industry have the opportunity to avail Input Tax Credit (ITC) on the Goods and Services Tax (GST) incurred for the utilization of goods and services essential to their operations. This encompasses expenditures associated with software development, infrastructure, and maintanence.

On February 1, 2023, key updates to the Budget 2023 were made:

Income Tax Calculation for Online Gaming Earnings

Section 115BAC introduces a non-obstante clause, signaling its supremacy; however, it is crucial to note the qualifier "subject to the provisions of this Chapter" (Chapter XII). This clause establishes a hierarchy within the tax rates, giving precedence to the rates articulated in Section 111A, 112, and 112A over those in Section 115BAC.

The interplay of these provisions implies that the tax landscape is not solely dictated by Section 115BAC; rather, it is contingent upon the broader framework outlined in Chapter XII. Consequently, tax rates specified in Section 115BBJ take precedence over those in Section 115BAC, given the latter's subordination to the provisions of the chapter.

In practical terms, this means that the tax rate applicable to income generated from online gaming winnings stands at 30%. This nuanced understanding underscores the intricacies of tax regulations, where specific provisions within a chapter can modify the application of tax rates, resulting in a tailored approach to the taxation of online gaming earnings.

Determining Tax Liability under Sections 115BAC, 115BBJ, and 87A

The rebate under section 87A, as per the amendment by the Finance Act, 2023, is applicable in the new regime. This rebate allows for the lesser of the total tax or ₹25,000 if the total income is below ₹700,000. If the total income exceeds ₹700,000 and the total tax surpasses the amount by which the income exceeds ₹700,000, the rebate equals the total tax minus the excess amount.

It's noteworthy that the ₹25,000 limit doesn't apply when the total income exceeds ₹700,000. This could potentially be a drafting error that may be rectified in the future.

Additionally, the rebate under section 87A is applicable even if the total income includes earnings from online gaming. Section 58(4) restricts deductions of expenditure or allowances when computing income from winnings, but it doesn't impose restrictions when calculating tax on such income. Consequently, the rebate under section 87A remains applicable to tax on winnings from online gaming.

Notifications

28% GST on Online Gaming w.e.f Oct 1st: Govt notifies amended CGST Rules

Notification No: 50/2023 Date of Judgement: 29th September, 2023

The Central Government, through the Central Board of Indirect Taxes and Customs (CBIC), has amended the Central Goods and Services Tax Rules to enable the imposition of Goods and Services Tax (GST) on Online Gaming, Online Money Gaming, and Actionable Claims in Casinos. The amendments, notified via gazette notifications, include the inclusion of supplies such as online money gaming, online gaming (excluding online money gaming), and actionable claims in casinos under the purview of GST. Form GSTR-5A has been modified for reporting details related to online information and database services and online money gaming.

Central Govt notifies Online Gaming Amendments in CGST & IGST Acts w.e.f. 18th August 2023

Notification No: 31 OF 2023 Date of Judgement: 18th August, 2023

The Central Government vide notification no. 30 of 2023 and 31 of 2023 have notified the amendments in online gaming in the Central Goods and Services Taxes Act (CGST Act), 2017 and Integrated Goods and Services Act (IGST Act), 2017 respectively on 18th August 2023.

The Central Government vide notification number 31 of 2023 issued on 18th August 2023 has notified the amendments relating to the online gaming, betting and gambling activities in both Central Goods and Services Tax Act (CGST Act), 2017 and Integrated Goods and Services Act (IGST Act), 2017.

AAR Ruling

18% GST applicable to Service of Online Gaming: AAR

The Maharashtra Authority of Advance Ruling (AAR) ruled that 18% GST applicable on the service of Online Gaming. The Applicant, Mr. Amogh Ramesh Bhatawadekar is a supplier in digital goods i.e. online games. He is located at Thane and has not obtained GSTIN under the impression that whatever services they are rendering is export of e-goods. It is a proprietary concern.

States Decisions

GST on Online Gaming: Kerala Govt assents to GST Amendment Ordinance

Kerala State: Kerala Governor Arif Mohammed Khan has approved an ordinance modifying the state Goods and Services Tax (GST) law related to gambling. The amendment, initiated during the 50th GST Council meeting, established a 28% GST on gambling activities, including casinos, horse racing, and online platforms, with the tax applied to the face value of the bet. Following the central government's official notification of the amendment to the GST Act, the Kerala government introduced the ordinance, aligning with the Union Finance Ministry's decision for a uniform 28% GST on online money gaming, casinos, and horse racing. This move aims to regulate online money gaming and gambling, addressing tax implications within the state. Finance Minister Nirmala Sitharaman clarified that the 28% GST on entry-level bets would be applied prospectively, excluding winnings according to valuation rules.

‘Place of Supply’ in Online Gaming shall be Clarified through Notification says Revenue Secretary

The 51st meeting of the Goods and Services Tax (GST) Council was conducted on August 2nd 2023 through video conferencing in New Delhi, with Nirmala Sitharaman, the union Finance Minister, presiding over the session along with Revenue Secretary Sanjay Malhotra, Union Minister of State for Finance Pankaj Chaudary and other state ministers too.

States like Kerala have expressed concerns in the GST Council regarding the determination of the place of supply for online gaming. In response, the Revenue Secretary assured that a notification or rules will be issued as necessary to address the matter.

West Bengal Assembly passes Bill for 28% GST on Online Gaming, Horse Racing and Gambling

On Thursday, the West Bengal assembly successfully passed the West Bengal Goods and Services Tax (Second Amendment) Bill, 2023, marking a significant move in the taxation landscape. The bill, once enacted, will subject online gaming, horse racing, and casinos to the highest Goods and Services Tax (GST) rate of 28%, to be calculated on the entire face value of the bets placed.

Unsolved Issues In Cyberspace

In India, the realm of online gaming has presented a unique set of challenges that require attention and correction. While the implementation of the Goods and Services Tax (GST) has had its share of complexities, the country faces a more pressing need to address and rectify various IT issues associated with online gaming. This sector demands a comprehensive approach to ensure a seamless and secure digital gaming environment, encompassing issues such as data privacy, cybersecurity, and regulatory frameworks. Strengthening IT infrastructure and regulations in the online gaming industry is essential for sustained growth and user trust.

Anticipated to reach a total of US$ 4.6 trillion in 2023, global IT spending is set to increase by 5.5%, projecting a further rise to US$ 5.04 trillion in 2024, marking an 8.6% growth. Gartner reports the global IT industry market size to surge to US$ 1.36 trillion in 2023, reflecting a significant 9.1% increase from 2022. Despite ongoing global economic turbulence, all regions are expected to witness positive IT spending growth in 2023.

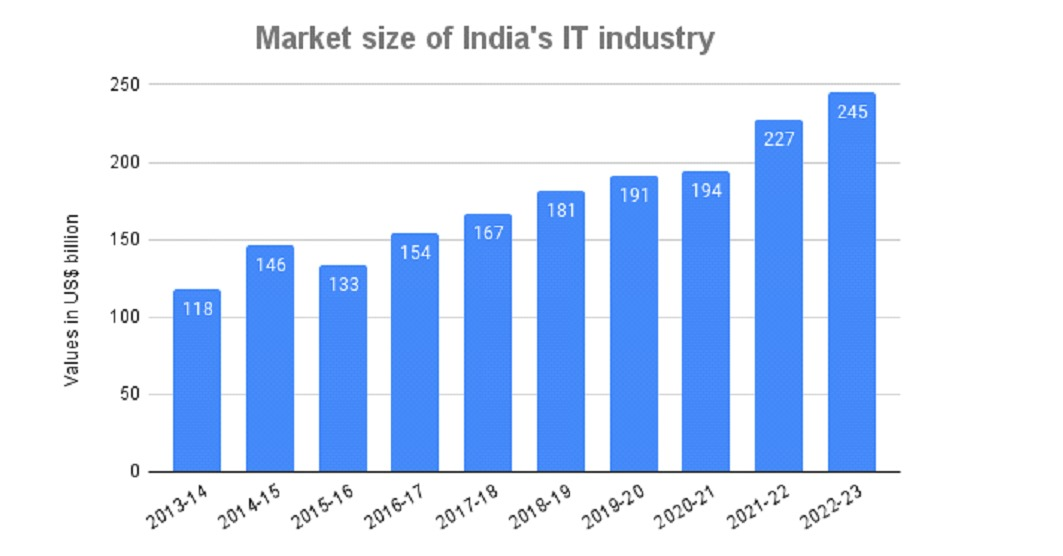

India's IT industry is poised to generate US$ 245 billion in revenue in FY23, showcasing an 8.4% year-on-year growth. NASSCOM's Strategic Review 2023 forecasts a trajectory towards reaching US$ 500 billion by 2025. With exports totaling US$ 194 billion, the sector is expected to grow by 9.4% in reported currency terms and 11.4% in constant currency terms. This growth is driven by IT modernization, including application modernization, cloud migration, and platformization. Gartner, Inc. also predicts India's IT spending to reach US$ 112.4 billion in 2023, exhibiting a modest 2.6% increase compared to the previous year.

Challenges faced by IT and Gaming Industries

The IT industry grapples with intricate challenges demanding innovative solutions, crucial for future success. Key hurdles encompass:

1. Skills Shortage: A scarcity of proficient IT professionals poses difficulties for organizations, particularly in specialized domains like cloud computing and cybersecurity.

2. Cybersecurity Threats: The rising frequency and sophistication of cyber attacks pose a constant challenge, leading organizations to struggle in maintaining robust defenses. The repercussions involve financial losses, damage to reputation, and regulatory penalties.

3. Remote Work Challenges: The remote work landscape introduces unique obstacles, such as the absence of immediate managerial or team support, hindering prompt responses and collaboration.

4. Infrastructure Expenses: While substantial investments are directed towards acquiring robust assets capable of managing extensive data loads, the industry faces additional costs for robust security measures against hacking and data theft.

5. Outsourcing Risks: The growing trend of outsourcing, driven by talent scarcity or cost considerations, brings forth challenges including security threats, legal complexities, cultural disparities, and time zone-related issues.

In the vast expanse of cyberspace, several persistent and unsolved issues continue to challenge the security and integrity of digital landscapes. These unresolved problems underscore the complex nature of the digital realm and the ongoing struggle to safeguard information in an interconnected world.

Unresolved Cyberspace Issues

1. Attribution in Cyber Attacks: One of the paramount challenges is the attribution of cyber attacks. Determining the true origin of an attack remains a formidable task, often complicated by the use of sophisticated techniques like proxy servers and malware that obfuscate the attacker's identity.

2. Zero-Day Exploits: The discovery and exploitation of software vulnerabilities, known as zero-day exploits, persist as a critical concern. The clandestine nature of these vulnerabilities, often undisclosed to the software vendor, allows malicious actors to capitalize on security gaps before they can be patched.

3. Global Regulatory Framework:Cyberspace transcends geographical boundaries, posing a challenge in establishing a comprehensive global regulatory framework. Divergent legal systems and varying levels of cybersecurity maturity among nations contribute to difficulties in creating universally effective regulations.

4. Supply Chain Vulnerabilities: The interconnected nature of today's digital supply chains introduces vulnerabilities. Cyber adversaries increasingly target the supply chain to compromise software and hardware components, posing risks to organizations and their customers.

5. Emerging Technologies Security: Rapid advancements in technologies like artificial intelligence, quantum computing, and the Internet of Things bring forth new security challenges. Securing these cutting-edge technologies requires proactive measures to stay ahead of potential threats.

6. Insider Threats: Malicious activities or unintentional breaches by individuals within an organization, known as insider threats, remain a persistent issue. Balancing the need for employee access and trust with effective security measures proves to be an ongoing challenge.

Addressing these unsolved issues in cyberspace demands collaborative efforts from governments, industries, and cybersecurity experts. As technology evolves, the pursuit of effective solutions becomes more critical to ensure the resilience and security of digital ecosystems globally.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates