5 Income Tax Portal Glitches Right Now: Taxpayers and Professionals Demand Due Date Extension

Multiple screenshots shared by users highlight errors ranging from “Access Denied” messages to non-responsive filing utilities, leading to widespread frustration and calls for an extension of the due date

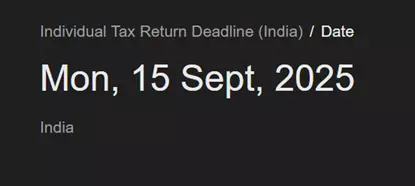

As the September 15 deadline for filing Income Tax Returns (ITR) for Assessment Year (AY) 2025-26 approaches, taxpayers and professionals are struggling with persistent glitches on the Income Tax Department’s e-filing portal. Multiple screenshots shared by users highlight errors ranging from “Access Denied” messages to non-responsive filing utilities, leading to widespread frustration and calls for an extension of the due date.

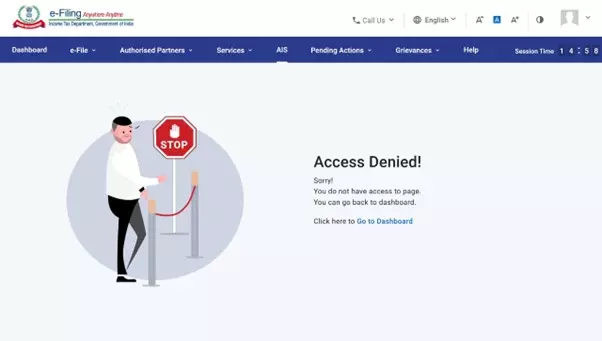

1. Access Denied Errors Several users attempting to access the Annual Information Statement (AIS) or related compliance pages are greeted with “Access Denied” screens. Despite logging in with valid credentials, the portal restricts access to certain sections, forcing taxpayers back to the dashboard without allowing them to view or download crucial data.

2. Loading Loops on AIS Instructions The AIS instructions page, which is essential for understanding reported transactions and discrepancies, remains stuck on “Loading…” with no further progress. This prevents taxpayers from cross-verifying third-party data with their reported income, a critical step in compliance.

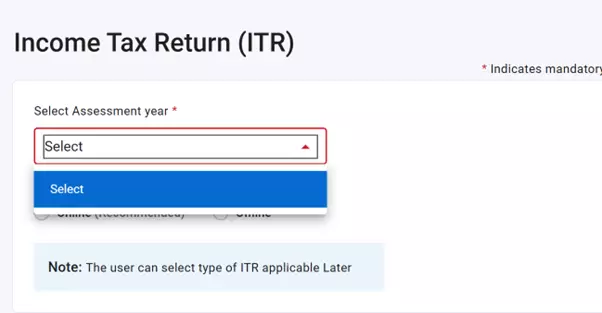

3. Assessment Year Selection Failure The ITR filing utility is showing incomplete dropdown options for assessment years. In several cases, the “Select” field displays no available choices, leaving taxpayers unable to initiate return filing. For many, this effectively halts the process at the very first step.

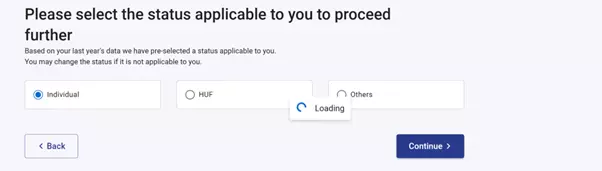

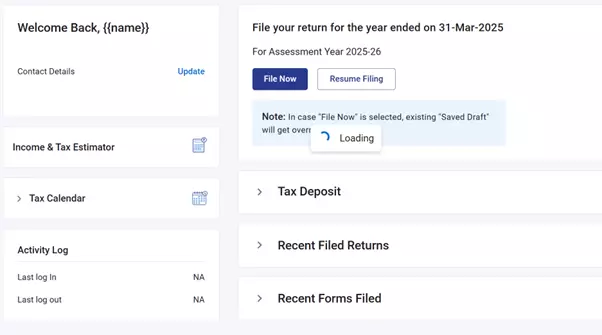

4. Filing Process Freezes Even where taxpayers manage to proceed, the portal stalls during critical stages. For instance, users selecting filing status (Individual, HUF, Others) are stuck at “Loading” loops, preventing progression to the return preparation stage. These freezes waste valuable time and make filing unpredictable.

5. Submission and Dashboard Errors At the final submission stage, taxpayers encounter glitches in the declaration and preview screens, including missing fields and incomplete autofill data. The dashboard itself sometimes displays placeholders like “{{name}}” instead of the user’s details, with “Loading” loops persisting across filing functions such as “File Now” or “Resume Filing.”

Demand for Extension

Tax professionals argue that these glitches not only inconvenience taxpayers but also risk penal consequences for delays beyond the statutory deadline.

With just days left before the due date, associations and practitioners are urging the Central Board of Direct Taxes (CBDT) to extend the deadline, citing fairness and operational impossibility under current conditions.

The date to file returns for FY 2024-2025 remains to be 15th September for Individuals.

The issues echo similar issues experienced in previous filing cycles, where last-minute technical problems had led to extensions. Stakeholders argue that unless addressed immediately, the system risks overwhelming both taxpayers and the support infrastructure, eroding confidence in the digital compliance framework.

As of September 12, users continue reporting unresolved issues, reinforcing demands for a deadline extension to ensure smooth compliance.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates