Auto Populated Liabilities in table 3.2 of hard-locked GSTR-3B to be re-introduced on GST portal from July 2025 tax period: GSTN

Hard-Locked Auto-Populated Liabilities in GSTR-3B Table 3.2 Return from July 2025, Announces GSTN

The Goods and Services Tax Network (GSTN) has notified taxpayers of a key change impacting the filing process for the GSTR-3B return. Commencing from the July 2025 tax period, Table 3.2 of GSTR-3B—pertaining to inter-State supplies—will once again be auto-populated and made non-editable on the GST portal. This measure reintroduces the system lock on values, following an earlier deferment based on taxpayer feedback.

Complete Referencer of GSTR-1, GSTR-1A, GSTR-3B, GSTR-9 & GSTR-9C - CLICK HERE

Background

Earlier in April 2025, GSTN issued an advisory explaining that from the April tax period onwards, details of inter-State supplies in Table 3.2 would be auto-filled by the GST system and hard-locked for editing, thereby standardizing reported data.

However, having received numerous representations from taxpayers and tax professionals about difficulties experienced under the new system, the implementation was temporarily suspended and the table was made editable in subsequent months to facilitate smoother compliance.

The original plan will now resume from July 2025, with Table 3.2 reverting to system-generated, hard-locked values.

What’s Changing?

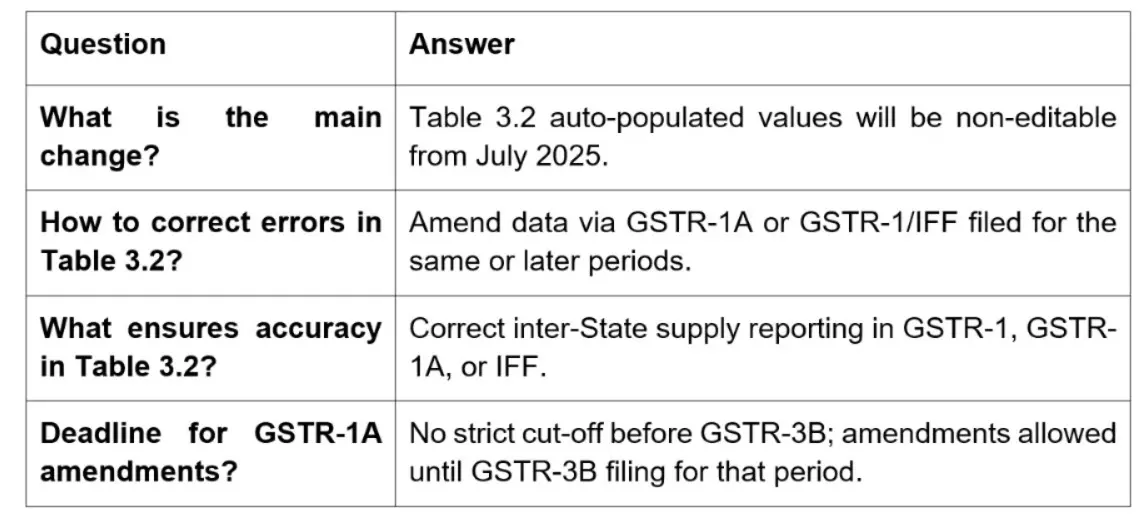

- Non-Editable Auto-Population: For returns pertaining to July 2025 and onwards, the GST portal will auto-populate Table 3.2 of GSTR-3B with values reflecting inter-State supplies made to unregistered persons, composition taxpayers, and UIN holders. Taxpayers will no longer be able to manually edit these figures.

- Compliance Requirement: GSTR-3B must be filed using these system-generated values only.

How to Report or Amend Values

If there are discrepancies or corrections needed in the auto-populated data:

- Amendments must be made in GSTR-1A or through GSTR-1/IFF for the relevant or subsequent periods.

- Accurate reporting in original GSTR-1, GSTR-1A, or IFF is critical, as the portal pulls these values to auto-fill Table 3.2.

- Form GSTR-1A can be filed after submitting GSTR-1 and up until GSTR-3B is filed for the period.

FAQs

Understand the complete process and tax nuances of GST refunds, CLICK HERE

Taxpayers are urged to exercise caution and ensure proper reporting in GSTR-1 and, if changes are necessary, make timely amendments via GSTR-1A or IFF. This will help align the auto-populated data in GSTR-3B Table 3.2 with actual business transactions and maintain compliance with GST regulations.

For further clarification, taxpayers are encouraged to consult the official FAQs or reach out to the GSTN helpdesk.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates