[BREAKING] Rajasthan HC directs CBDT to extend Income Tax Audit Deadline

The extension was welcomed across the tax community, which has been struggling with technical glitches on the income tax e-filing portal and delays in the release of key utilities.

![[BREAKING] Rajasthan HC directs CBDT to extend Income Tax Audit Deadline [BREAKING] Rajasthan HC directs CBDT to extend Income Tax Audit Deadline](https://images.taxscan.in/h-upload/2025/09/22/2089542-income-tax-audit.webp)

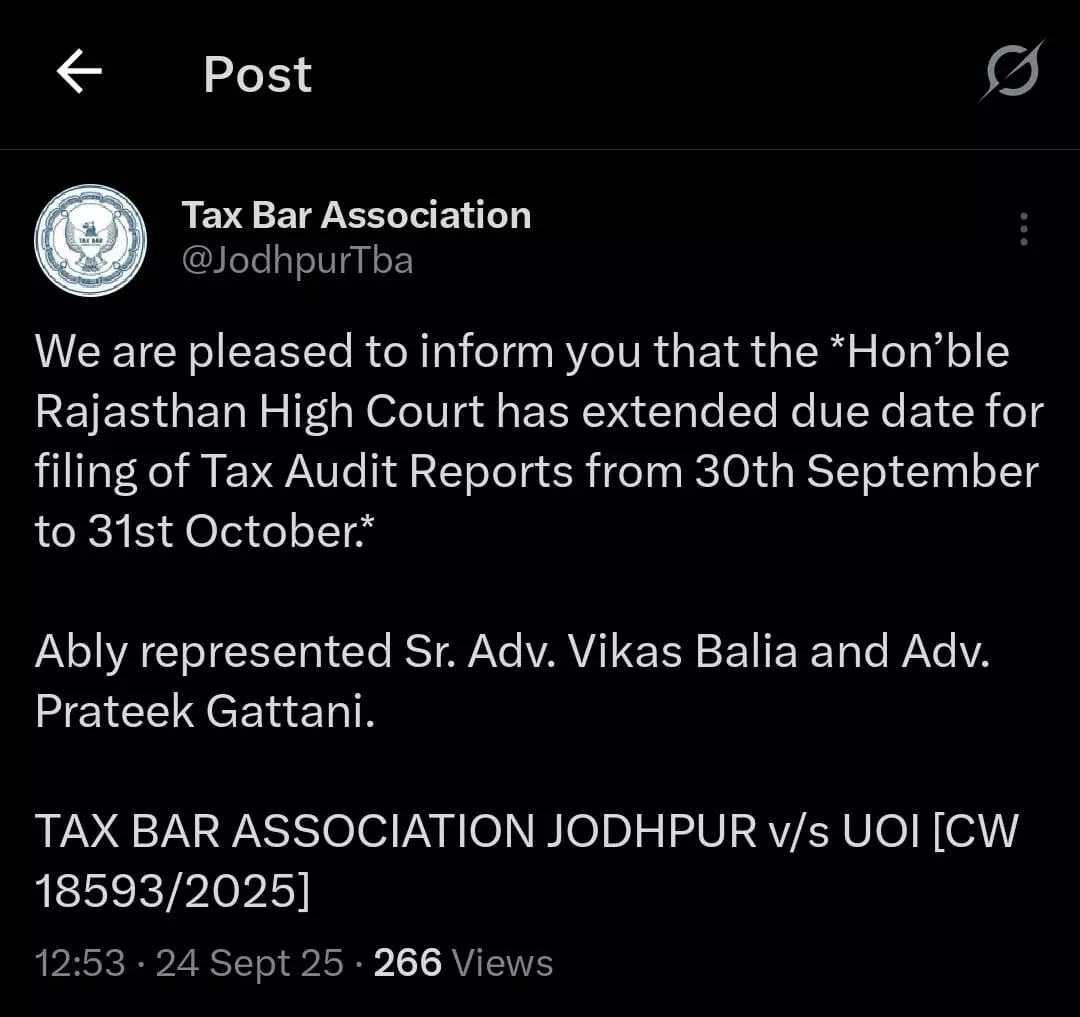

The Central Board of Direct Taxes (CBDT) has been directed by the Rajasthan High Court to grant an extension for filing Tax Audit Reports (TAR) and the corresponding Income Tax Returns (ITR) for Assessment Year (AY) 2025–26. The deadline for TARs under Section 44AB, originally set for September 30, 2025, has now been directed to be extended by one month to 31st October, 2025.

The decision, announced today by the Rajasthan HC in the form of an interim order, comes in relief to persistent representations from taxpayers, professionals, and industry bodies including the Institute of Chartered Accountants of India (ICAI).

As the order is of Rajasthan High Court, therefore this Order essentially will apply in Rajasthan only (that too if appeal or a Review Petition isnt filed by CBDT in SC).

But, there are very high chances that on the basis of this Order, CBDT can issue a general extension order for the whole country.

Your 2025 GST Companion — Clarity You Can Count On - Click here

The extension is welcomed across the tax community, which has been struggling with technical glitches on the income tax e-filing portal and delays in the release of key utilities. According to professional associations, taxpayers and auditors faced repeated log-in failures, slow portal performance and difficulties in accessing documents such as the Annual Information Statement (AIS).

Another major concern was the late release of utilities for ITR-5, ITR-6, and ITR-7, which are crucial for firms, companies and trusts. Professionals pointed out that the shortened compliance window made timely filings nearly impossible. Additionally, the revised Form 3CD introduced expanded reporting requirements, significantly increasing the workload for auditors.

Amid these developments, members of the Chartered Accountants (CA) fraternity staged a peaceful protest at the Institute of Chartered Accountants of India (ICAI) headquarters in New Delhi on 24th September 2025, highlighting widespread dissatisfaction over persistent portal glitches and inadequate extensions. The demonstration, convened through social media calls by CA leaders, was an attempt to peacefully voice professionals’ demand that compliance timelines be rationalized to match functional systems, with many also criticizing ICAI’s muted stance on the issue.

The overlap of the September filing season with festive schedules and other compliance deadlines for GST and MCA filings further added to the burden.

With this extension, taxpayers subject to audit now have until 31st October 2025, to submit both their tax audit reports and related income tax returns. The notification is seen as an acknowledgment of the genuine compliance challenges faced by taxpayers and professionals this year.

An official copy of the judgement is awaited.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates