CA-CMA Turf Tussle: ICAI's Expanding Audit Mandate Rekindles Debate Over Professional Boundaries

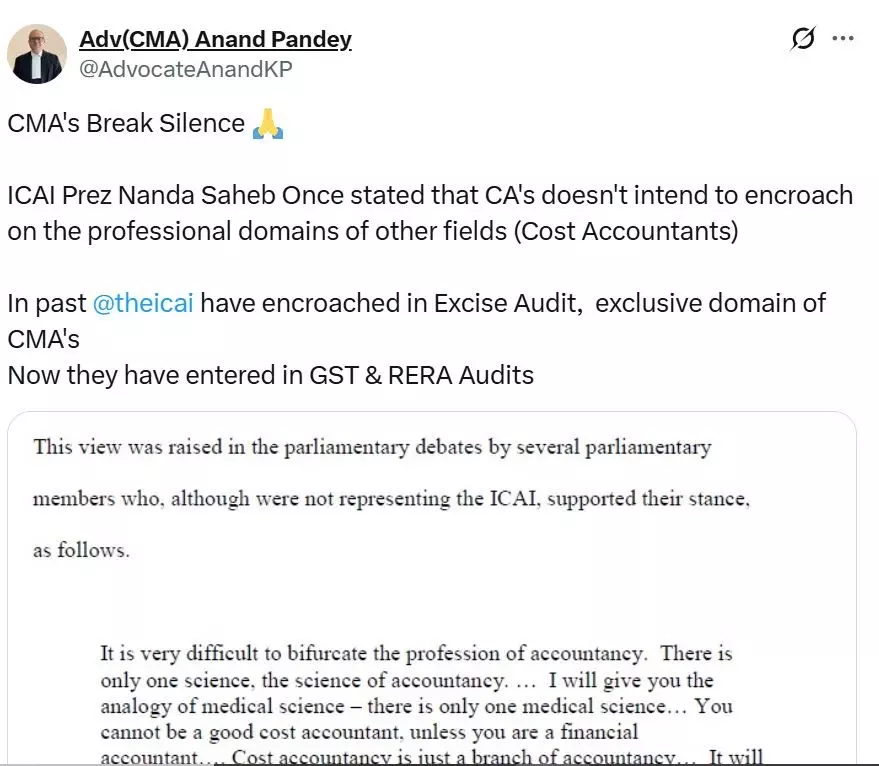

The tweet from Adv(CMA) Anand Pandey (@AdvocateAnandKP) is a prominent recent example highlighting the ongoing dispute between Chartered Accountants (CAs) and Cost Accountants (CMAs) regarding professional jurisdiction

The decades-old professional rivalry between Chartered Accountants (CAs) and Cost Accountants (CMAs) is once again under the spotlight.

Recently, CMA professionals broke their silence as reports surfaced about the Institute of Chartered Accountants of India (ICAI) making fresh inroads into audit territories traditionally reserved for CMAs.

In a statement in the past, ICAI President Nihar N. Jambusaria (Nanda Saheb) had assured stakeholders that CAs do not intend to encroach upon the exclusive professional domains of Cost Accountants. However, history and current developments suggest otherwise.

Your 2025 GST Companion — Clarity You Can Count On - Click here

Previously, CAs entered into Excise Audits, an area that many cost professionals see as the exclusive preserve of CMAs. Now, the battlefront has moved to new age audit spaces: Goods and Services Tax (GST) and Real Estate (Regulation and Development) Act (RERA) audits. Many CMAs argue that these audits inherently demand cost and management expertise, yet ICAI has proactively engaged in these areas.

This overlap has sparked unease within the cost accounting community. CMAs are raising concerns about fair recognition, transparency in allocation of professional assignments, and the need to protect the unique skillsets each profession offers. Questions abound: Are the regulatory bodies adequately respecting the delineated boundaries set by law and long-standing convention? Are businesses missing out by not leveraging the distinct analytical expertise of CMAs in these crucial audits?

The tweet from Adv(CMA) Anand Pandey (@AdvocateAnandKP) is a prominent recent example stating the dispute between Chartered Accountants (CAs) and Cost Accountants (CMAs) regarding professional jurisdiction.

In his tweet, Advocate Anand specifically draws attention to claims of historical and ongoing encroachment by the Institute of Chartered Accountants of India (ICAI) into domains regarded as exclusive to CMAs, such as Excise Audits, and now key areas like GST and RERA audits.

This public statement reflects growing concern within the CMA community that the boundaries between the two professions are being blurred, despite previous assurances from ICAI’s leadership that CAs do not intend to overstep into exclusive CMA roles. The attached image to the tweet underscores the seriousness with which CMAs view this issue, calling for accountability and a review of professional domain boundaries to ensure fairness.

The Institute of Cost Accountants of India (ICAI( has long called for a more level playing field, advocating for clear demarcation of professional jurisdictions. As India’s tax and regulatory landscape continues to evolve rapidly with increased digitalisation and regulatory scrutiny the friction between CAs and CMAs is more than just a turf war; it speaks to the heart of professional identity, competence, and the future of statutory compliance.

With CMAs now voicing their stance loudly, and the ICAI reiterating its position, it remains to be seen how policymakers and stakeholders will respond. The one certainty: The debate over professional boundaries in India’s audit ecosystem is far from settled.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates