Can UDINs be Generated in Bulk? ICAI Explains the Bulk UDIN Facility on its Portal

As long as the overall number of UDINs does not exceed the limit of 300 per bulk upload, members can also modify or remove rows on-screen.

The Institute of Chartered Accountants of India ( ICAI ) has clarified that UDINs can indeed be generated in bulk, which was a practical concern of members handling high volumes of certificates.

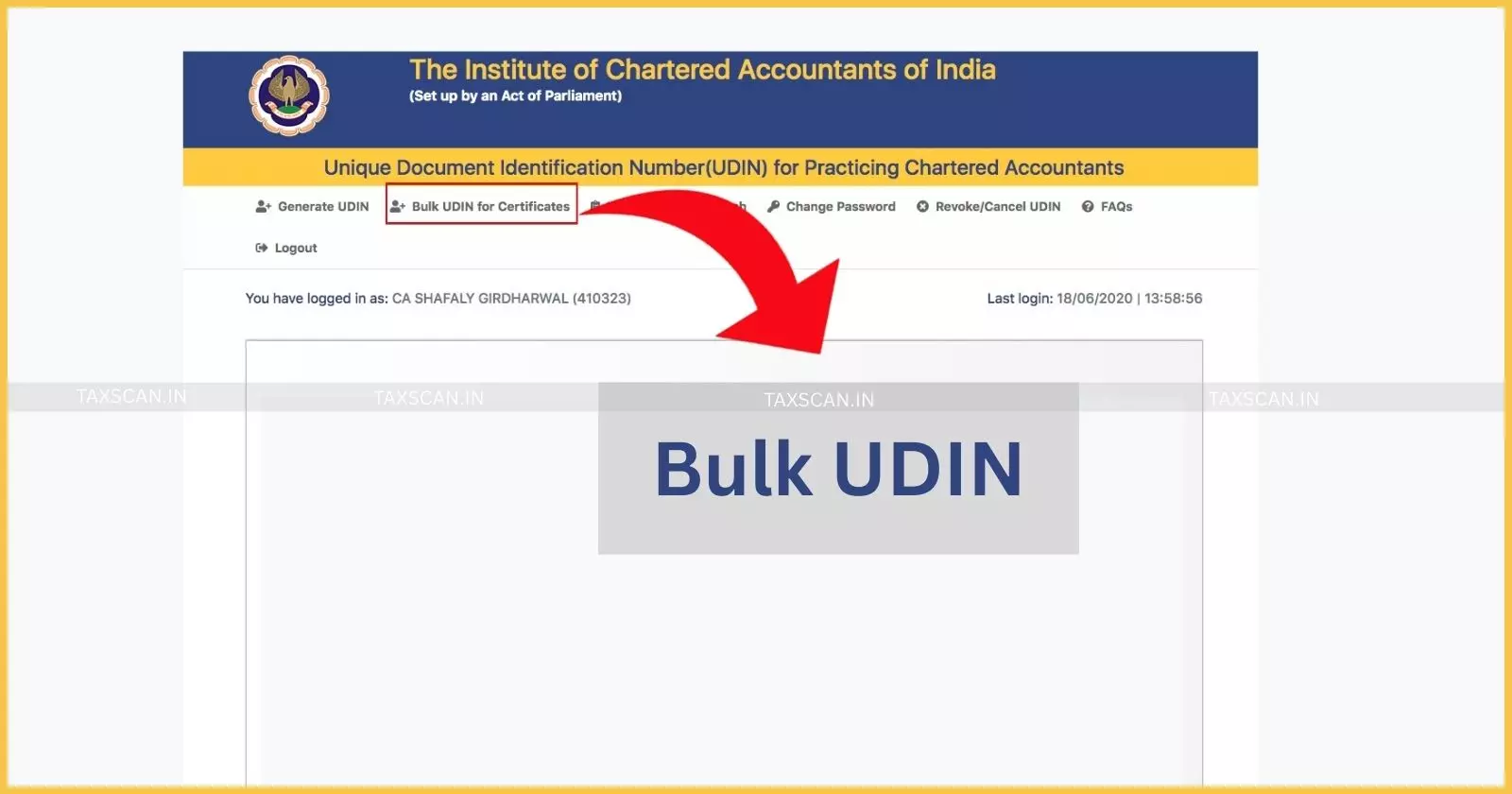

As explained in the updated UDIN Portal User Manual (Version 1.2), the ICAI has enabled a dedicated Bulk UDIN Generation facility on its portal.

Under this facility, ICAI members can generate up to 300 UDINs in one go through a structured bulk upload process. The bulk option is currently available only for certificates, and members are required to first select the relevant certificate category on the UDIN portal.

Each certificate category has a separate, prescribed Excel template, which must be downloaded, filled with the required particulars, and uploaded back to the system.

According to the User Manual, the portal automatically transfers the data to the appropriate fields on the screen after the completed template is uploaded. The system immediately shows any errors or invalid data, allowing members to make the necessary corrections by either amending the entries directly on the user interface or re-uploading the template.

Most importantly, as long as the overall number of UDINs does not exceed the limit of 300 per bulk upload, members can also modify or remove rows on-screen.

The bulk UDIN functionality is intended to increase efficiency without compromising accuracy or control, ICAI stated. In the bulk mode, all required features that apply to a single UDIN generation such as document details, the signing date, and pertinent numbers also apply.

Any UDIN created using the bulk function has the same legal and verification validity as one created on an individual basis.Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates