DGFT Notifies Import Restriction on ATS-8, CIF Value Below $111/Kg Restricted Till Sept 30, 2026 [Read Notification]

With this change, importers dealing in ATS-8 below the prescribed CIF threshold will now require specific authorization.

![DGFT Notifies Import Restriction on ATS-8, CIF Value Below $111/Kg Restricted Till Sept 30, 2026 [Read Notification] DGFT Notifies Import Restriction on ATS-8, CIF Value Below $111/Kg Restricted Till Sept 30, 2026 [Read Notification]](https://images.taxscan.in/h-upload/2025/09/19/2088795-dgft-notifies-import-restriction-ats-8-cif-value-restricted-taxscan.webp)

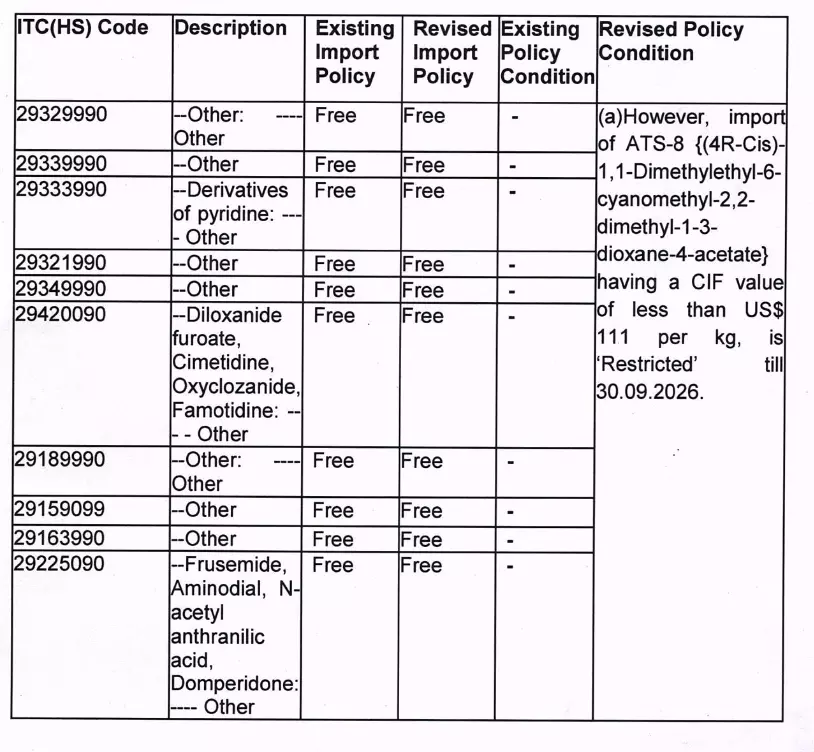

The Directorate General of Foreign Trade ( DGFT ), Ministry of Commerce & Industry, has amended the Import Policy condition under Chapter 29 of ITC (HS), 2022, Schedule–I (Import Policy), imposing restrictions on the import of ATS-8.

As per the notification, import of ATS-8 - {(4R-Cis)-1, 1-Dimethylethyl-6-cyanomethyl-2, 2-dimethyl-1-3-dioxane-4-acetate}, having a CIF value of less than US$111 per kilogram will be treated as ‘Restricted’ with immediate effect and shall remain so until 30th September 2026. This measure effectively introduces a Minimum Import Price (MIP) protection for the product. The revised policy condition is given below:

The notification It clarifies that the MIP condition shall not apply to inputs imported by holders of Advance Authorization, Export Oriented Units (EOUs), and units located in Special Economic Zones (SEZs), subject to the condition that such inputs are not diverted or sold in the Domestic Tariff Area (DTA).

The amendment, issued under the powers conferred by Section 3 and Section 5 of the Foreign Trade (Development & Regulation) Act, 1992, and read with the Foreign Trade Policy (FTP) 2023, underscores the government’s intent to regulate low-value imports of ATS-8 while ensuring uninterrupted supply for export promotion schemes.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates