Filing ITRs? 5 Common Income Tax Portal issues This Assessment Year

Professionals and Taxpayers face multiple technical issues while trying to file the ITR

The Income Tax e‑filing portal for Assessment Year 2025‑26 was made available in early July 2025, with the deadline extended to September 15, 2025 to accommodate revised ITR utilities. The portal’s Excel utilities for ITR‑2 and ITR‑3 have been upgraded to include mandatory disclosures for cryptocurrencies, overseas assets, and detailed capital gain reporting.

Law Simplified with Tables, Charts & Illustrations – Easy to Understand - Click here

Despite these enhancements, taxpayers face multiple technical issues—from “Request Not Authenticated” login failures to mismatches in AIS and Form 16 data—that disrupt the filing workflow. An additional glitch preventing the upload of tax audit attachments has further compounded delays for both professionals and individuals. Industry experts have called on the Finance Ministry to urgently address these portal malfunctions to help taxpayers meet deadlines without penalty.

Extended Filing Deadline

The Central Board of Direct Taxes (CBDT) announced an extension of the ITR filing due date from July 31 to September 15, 2025, giving taxpayers additional time to navigate new utilities and resolve technical issues ([Income Tax Department][1]). This extension applies to all non‑audit cases and aligns with recent notifications enabling Forms 10AB and 3CEFC on the portal.

Enhanced Excel Utilities for ITR‑2 and ITR‑3

For AY 2025‑26, the Income Tax Department released updated Excel utilities for ITR‑2 (for individuals with capital gains, foreign income, etc.) and ITR‑3 (for businesses and traders). These utilities now support detailed reporting of share buybacks, dividend incomes, cryptocurrency transactions, and pre‑filled data validations, aiming to minimize manual errors and improve compliance.

Common Portal Issues

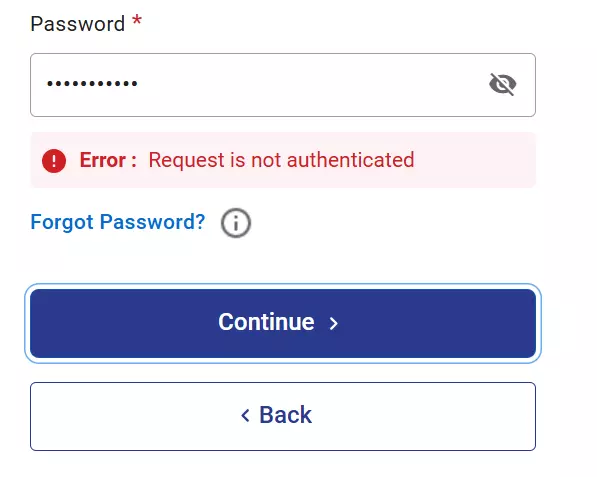

1. “Request Not Authenticated” Error on Login

Taxpayers often encounter a “Request Not Authenticated” error when attempting to log in, even when their credentials are correct, especially during high‑traffic periods. This persistent authentication failure requires multiple login attempts, disrupting the filing of individual or consolidated returns and adding to taxpayer frustration.

Possible Fix: Try clicking the login button 3-4 times after entering the password.

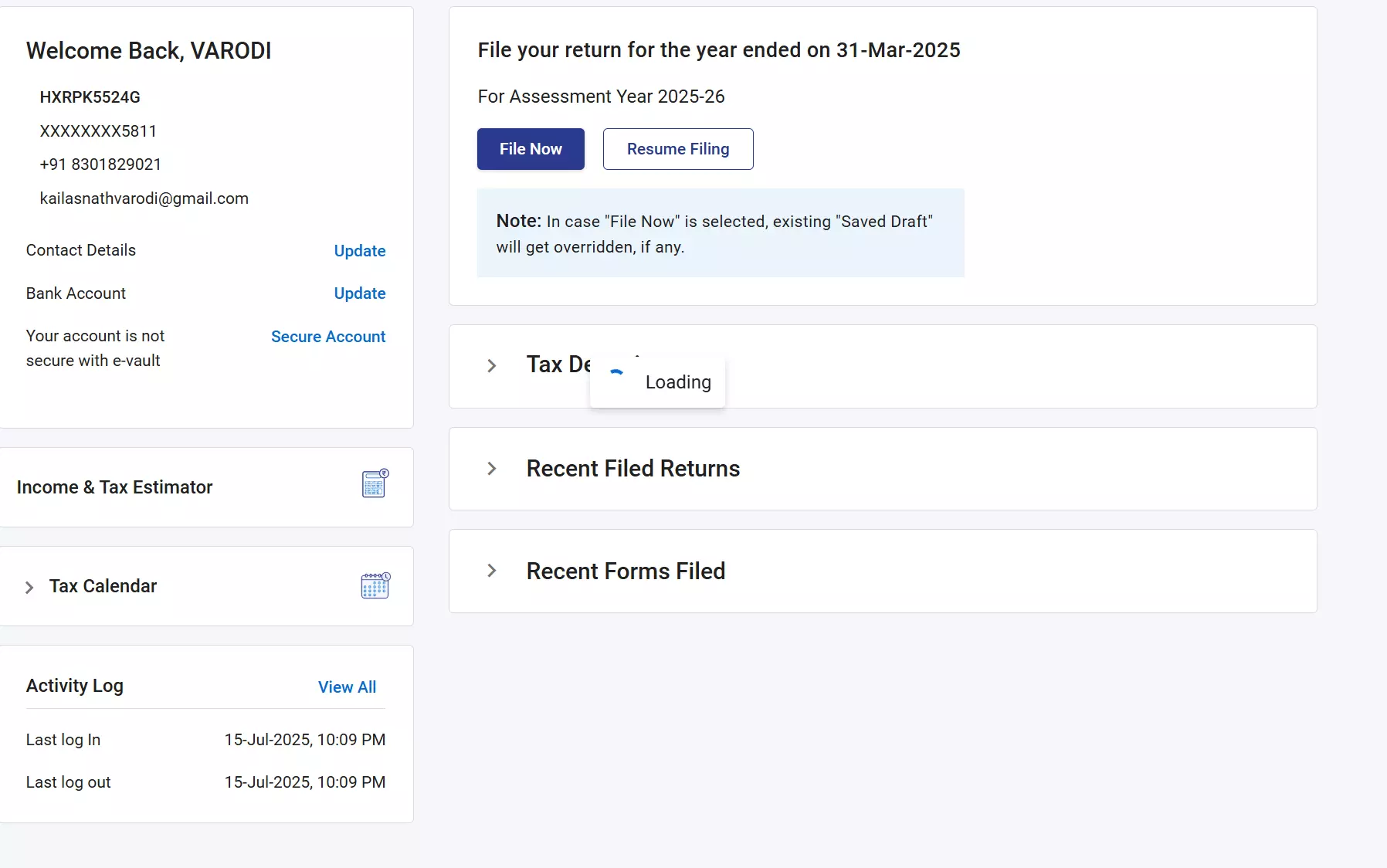

2. Persistent Loading Screen on Resume Filing

After filling initial details, many users report that clicking “Resume Filing” leads to an indefinite loading screen that never advances, effectively freezing the process . This issue is amplified during portal maintenance windows or unplanned downtime, risking missed deadlines and penalties.

Possible Fix: Start Fresh Filing.

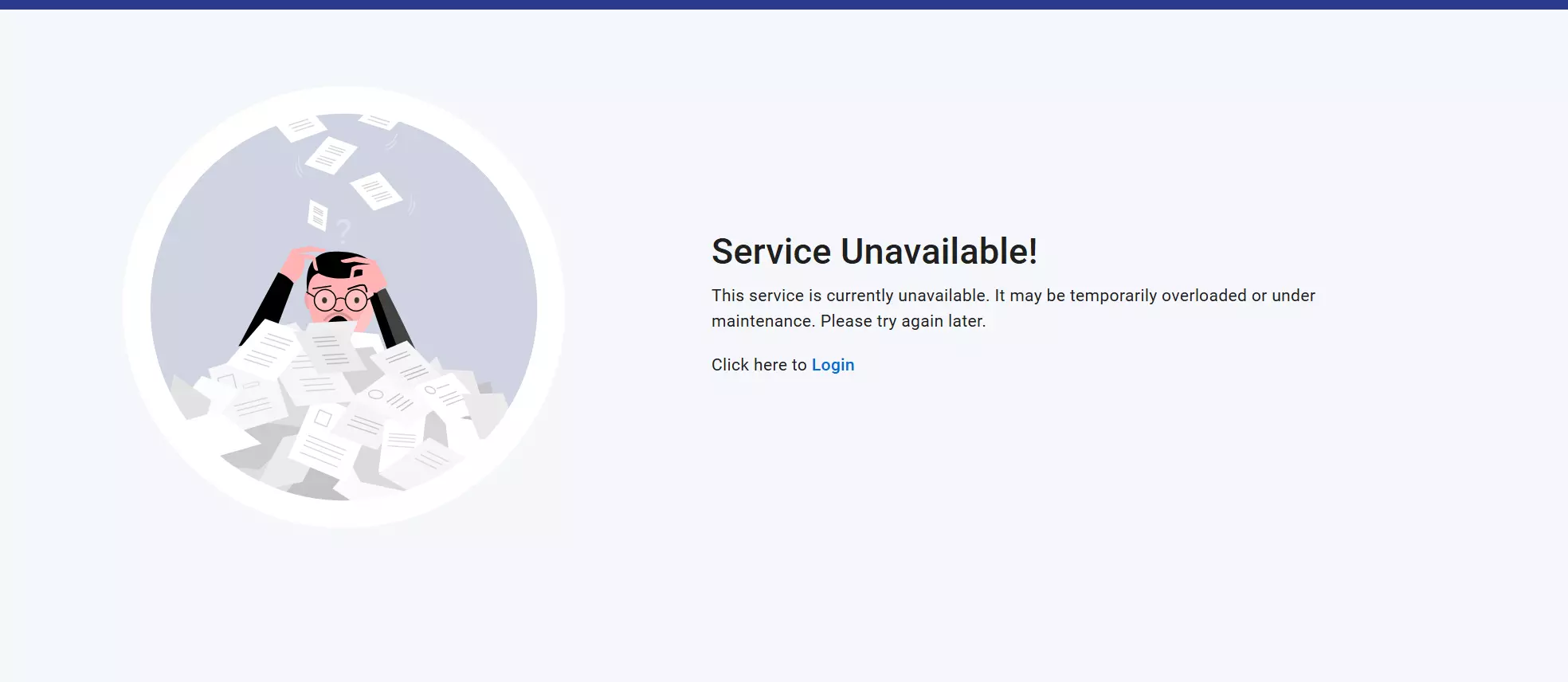

3. Sudden Logouts

During active sessions, the portal sometimes logs users out without warning, erasing unsaved data and forcing them to re-enter information from scratch . These abrupt session terminations not only slow down the filing process but also heighten anxiety over potential data loss and inaccuracies.

Possible Fix: Try Logging in Again

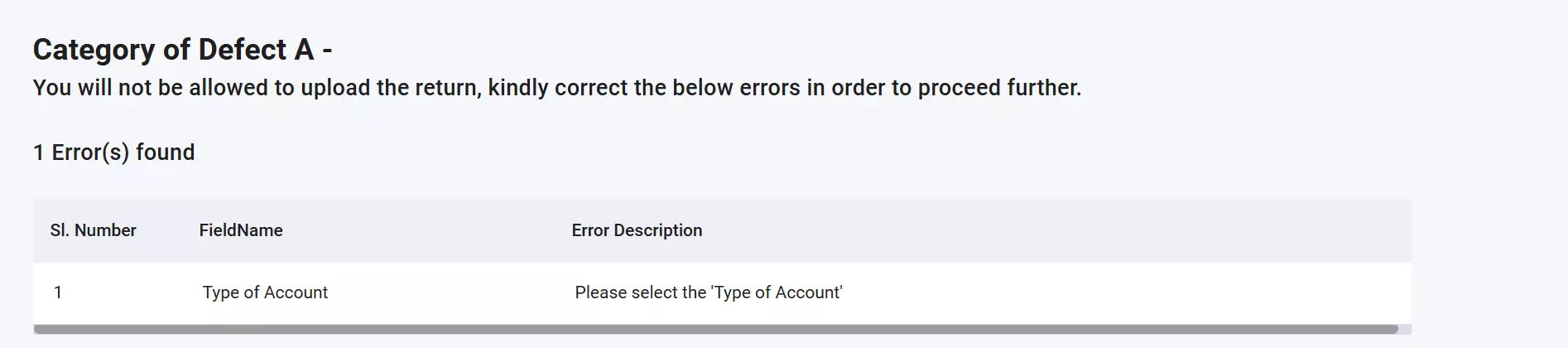

4. Type of Account Selection Error

Taxpayers selecting their account type (Salaried, Self‑Employed, Non‑Resident, etc.) sometimes receive an error stating “please select type of account,” even when a valid option has been chosen . Workarounds reported by users include deleting pre‑validated bank accounts and restarting the draft, but no official resolution has yet been provided.

Possible Fix: Try Revalidating existing accounts and remove accounts that are in dormant state/no longer exist.

5. AIS – Form 26AS & Form 16 Mismatches

The pre‑filled Annual Information Statement (AIS) and Form 26AS data frequently do not align with values in Form 16, triggering validation errors and confusion over taxable income . These discrepancies often stem from delayed AIS updates and mismatched TDS credits, compelling taxpayers to manually reconcile figures before submission.

Possible Workaround: Double Check Form 16/16A downloaded from portal and received from employer and reconcile with AIS/TIS/Form 26AS and file after editing TDS details. Make sure to exercise extra caution as this is a risky workaround.

Bonus Glitch: Failure to Upload Attachments

A critical issue highlighted by tax professionals is the portal’s inability to accept uploads of tax audit reports, audit certificates, and other supporting documents, such as Form 10AB.

Despite repeated attempts, users encounter generic error messages with no clear guidance, forcing many to resort to emailing the Central Processing Centre (CPC) or physically mailing ITR‑V forms.

This failure undermines the benefits of digital filing and threatens compliance timelines.

Impact on Taxpayers

These recurring glitches have led to significant stress among taxpayers, with many reporting last‑minute filings that increase the risk of errors and penalties. Professional bodies like the Karnataka CA Association have formally petitioned the CBDT to resolve these systemic faults, citing both financial and reputational harm if left unchecked. Additionally, the delay in releasing ITR‑5, ITR‑6, and ITR‑7 utilities has magnified user exasperation and filing bottlenecks.

Here’s What You can Do in case of an error

Taxpayers should clear their browser cache and cookies before accessing the portal to prevent authentication and loading errors. Using recommended browsers—latest versions of Chrome, Firefox, Edge, or Safari—in private/incognito mode can reduce compatibility issues. To avoid peak‑hour slowdowns, consider filing early in the morning or late at night, and save drafts frequently to minimize data loss. If problems persist, reach out to the official helplines with error screenshots and PAN details for support.

Technological modernization of the Income Tax e‑filing portal has delivered powerful new features but also introduced operational challenges that threaten timely and accurate tax compliance. Adherence to best practices, proactive troubleshooting, and continued advocacy from professional bodies will be crucial to mitigate these issues as the filing season progresses.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates