Found Error in Your AIS? Income Tax Dept Notifies to Submit Feedback Directly on Portal

The Department of Legal Affairs, Ministry of Law & Justice selected CBIC as one of the Top 5 Ministries/Departments for exemplary implementation of LIMBS.

The Income Tax Department has informed that the taxpayers should use the e-filing system to provide direct feedback if you discover any mistakes or inconsistencies in your Annual Information Statement (AIS). This was done as a part of an initiative taken under the name of ‘E Filing Made Easy’.

A taxpayer's financial information from a variety of sources, including banks, the stock market, mutual funds, and others, is provided in the AIS, a complete statement. It makes your financial transactions easier for the Income Tax Department to understand. Errors may cause discrepancies with your Income Tax Return (ITR) and can result in departmental notices.

Want a deeper insight into the Income Tax Bill, 2025? Click here

Pre-filling your ITR is increasingly being done using the data in AIS. Resolving AIS mistakes guarantees the accuracy of the pre-filled data, which facilitates the submission of your ITR. The ability to offer feedback is an effort to encourage voluntary compliance and aid in the early resolution of disagreements.

How to submit feedback ?

- First, log in at www.incometax.gov.in.

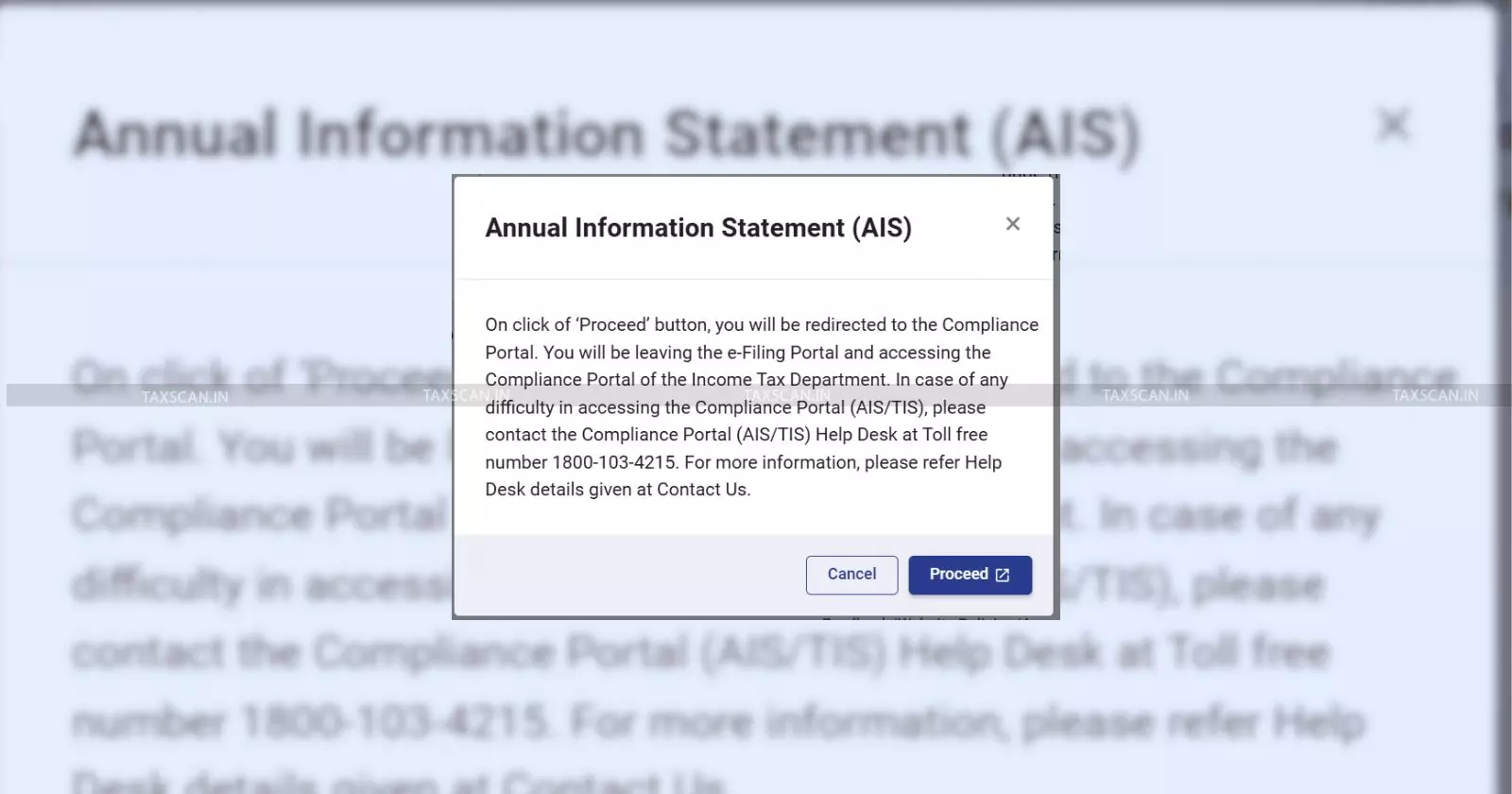

- Select the "Annual Information Statement (AIS)" menu after Login.

- You can access the Compliance Portal by clicking on AIS.

- To access your Annual Information Statement, choose the appropriate fiscal year and then click on the AIS tile. TDS/TCS Information, SFT Information, Other Information, and other areas will be visible to you.

- Identify the particular transaction or category of information where the problem occurred.

- Next to the entry, click the "Optional" button (or comparable feedback icon).

- Choose the relevant feedback choice from a dropdown menu on a new screen that appears.

- Click "Submit."

Also Read:CBDT Grants Income Tax Exemption to Baddi Barotiwala Nalagarh Development Authority [Read Notification]

Also Read:CBDT Grants Income Tax Exemption to Baddi Barotiwala Nalagarh Development Authority [Read Notification]

Know Tax Planning Real Estate Transactions - CLICK HERE

Upon a successful submission, the information will be shown together with the feedback, and next to the "reported value" will be a "modified value" that has been adjusted in light of your suggestions. The reporting entity (such as your bank, company, or mutual fund house) may get your comments from the Income Tax Department for verification and a response.

To make sure that the information is correct and to take corrective action by sending feedback if any errors are discovered, it is essential to check your AIS on a frequent basis, particularly prior to filing your ITR.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates