Goa Nightclub Fire: GST Certificate Reveals Third Partner Ajay Gupta Involved with Missing Luthra Brothers

The Luthra brothers reportedly flew to Thailand on an Indigo merely hours after the fire.

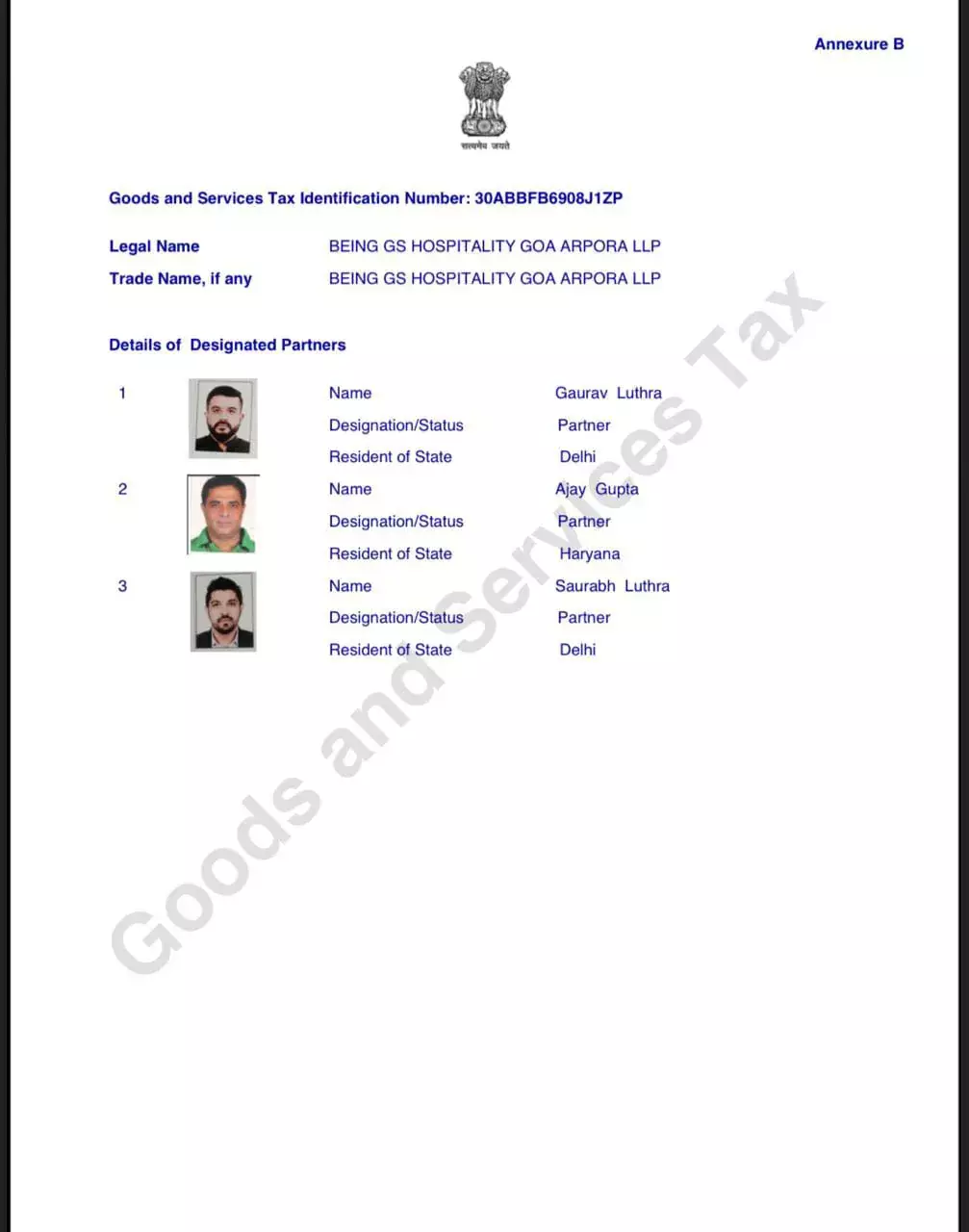

accessed A major breakthrough has emerged in the Goa nightclub fire investigation after authorities a Goods and Services Tax (GST) Registration Certificate that formally identified a third partner - Ajay Gupta in the parent entity that functioned the ‘Birch by Romeo Lane’ nightclub where 25 people died in a catastrophic blaze on the night of Saturday (December 6).

Until the GST certificate surfaced, the probe had centered almost exclusively on the absconding Luthra brothers - Gaurav and Saurabh, who fled to Phuket within hours of the incident, interestingly, on an Indigo flight.

Also Read:Rajasthan HC Denies Bail to Accused Carrying 15.74 Kg Hydroponic Weed; Holds NDPS Act Overrides Customs Act in Airport Seizures [Read Order]

The tragedy unfolded around midnight during a weekend event, with investigators later confirming that the venue lacked essential fire safety systems, clear exits, and valid permissions.

A Look Out Circular (LOC) was issued the same evening, followed by an Interpol Blue Corner Notice.

Police investigation of the official GST REG-06 certificate revealed that there were three designated partners of “Being GS Hospitality Goa Arpora LLP”, namely:

- Gaurav Luthra

- Ajay Gupta

- Saurabh Luthra

This authoritative listing shifted the spotlight to Gupta, who was soon traced to a private hospital in Delhi’s Lajpat Nagar, where he claimed to be merely a “sleeping partner.”

Gupta was detained by the police and began transit procedures to bring Gupta to Goa in order to continue the investigation process.

Comprehensive Guide of Law and Procedure for Filing of Income Tax Appeals, Click Here

It is important to note how a GST certificate - a government-issued digital document that rarely sees reference in criminal investigation matters has proven to be central for examining financial and operational roles within the LLP.

Also Read:9200 g Ganja Held Intermediate Quantity: Telangana HC Grants Bail to Accused in NDPS Case

Why the use of a GST Certificate Use in a Criminal Probe Is Remarkable

A GST Registration Certificate is one of the most legally reliable identity documents issued to a business. It includes the Goods and Services Tax Identification Number (GSTIN), legal name, trade name, principal place of business, and critically - the names of the partners, promoters or key persons.

The certificate is digitally authenticated, stored on the GST portal and carries a statutory presumption of accuracy unless proven otherwise.

Traditionally, GST certificates are invoked in tax and financial litigation. For instance, in a recent ITAT ruling, the Tribunal directed tax authorities to verify proprietorship claims using GST registration and Import Export Code certificates due to the certificate’s credible evidentiary value in disputes over ownership and attribution.

However, using a GST certificate to expand a criminal investigation as in the Goa fire case is highly uncommon. Police typically rely on corporate filings, bank records or licensing documents. Here, the GST certificate has effectively become a gateway document, identifying individuals potentially responsible for management decisions tied to fire safety compliance, staffing, permissions, and financial flows.

Also Read:58g Gold Chain Seized from Saudi Passenger, No SCN issued: Delhi HC Orders Fresh Personal Hearing [Read Order]

A New Axis in the Investigation

With Gupta now in custody and the Luthras still absconding, the GST certificate’s clarity has refocused investigative resources and raised new questions of operational liability. The inter-operability and knowledge sharing between departmental sources is clear.

As agencies coordinate internationally to secure the brothers’ return, the once-routine tax document has evolved into a pivotal anchor in one of India’s most closely watched criminal investigations.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates