GST 2.0: D-Mart’s Pre- and Post-GST Invoices on Sunfeast Marie Reveal Revised Pricing

The consumers see small relief at the billing counter, but manufacturers like ITC Ltd gain a higher margin by raising the base price

The GST 2.0 was implemented from September 22, 2025. However, to some extent, the same has triggered fresh discussions on how tax reforms translate into consumer pricing.

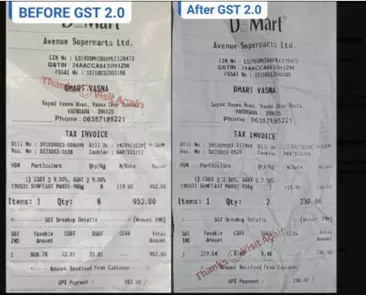

Two GST invoices of a D-Mart customer are spreading on twitter. One invoice shows the Pre-GST 2.0 and the second is the Post-GST 2.0. Comparing the both bills, the consumer/public will benefit Rs. 4 from buying a Sunfeast biscuit, however, the benefit to the manufacturing company is Rs. 9.

📘 NEW BOOK RELEASE for GST Professionals! Historical Rates Reform In GST 2.0

https://x.com/AdeParimal/status/1971903517259608302

Here' s the detailed story :

Before GST 2.0, Sunfeast Marie (956g pack) was priced at ₹119 per unit. For 8 packets, the total came to ₹952, with the taxable value recorded at ₹806.78. GST was levied at 18% (9% CGST + 9% SGST), resulting in ₹145.22 tax. This translated to a base price per packet of ₹100.85, with the final consumer price for a single unit is ₹119.

After GST 2.0, the tax rate dropped to 5% (2.5% CGST + 2.5% SGST). The invoice shows Sunfeast Marie billed at ₹115 per unit, with 2 packets costing ₹230. The taxable value was ₹219.04, with GST of ₹10.96. This led to a new base price per packet of ₹109.52, around ₹9 higher than earlier.

While the GST rate was reduced from 18% to 5%, the benefit to consumers was not fully passed on. The per-packet price came down marginally from ₹119 to ₹115, offering a saving of ₹4 to the public or the consumer.

However, analysis of the base price reveals that ITC Ltd, the manufacturer, raised the pre-tax price from ₹100.85 to ₹109.52, pocketing much of the relief. For 8 packets, the consumer ends up paying ₹919.97 under GST 2.0 compared to ₹952 earlier, a saving of about ₹32 overall.

The data suggests a dual outcome, that the consumers see small relief at the billing counter, but manufacturers like ITC Ltd gain a higher margin by raising the base price. Thus, GST 2.0 lowers tax incidence, but market pricing adjustments dilute its impact. For the public, the effective saving is ₹4 per packet, while ITC enjoys an incremental benefit of around ₹9 per packet.

📘 NEW BOOK RELEASE for GST Professionals! Historical Rates Reform In GST 2.0

The important question that arises is this: while the customer saves just ₹4 per pack, does this truly reflect the Government’s intention of providing relief?

Can it genuinely be called a ‘huge benefit’ to consumers when the manufacturer has simultaneously raised the base cost by ₹9, absorbing most of the tax reduction?”

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates