GST Grievance Redressal System faces Fire on ‘X’ from CA for Denial of Appeal Rights to Taxpayer

GST Grievance Redressal System faces Fire on ‘X’ for Denial of Appeal Rights to Taxpayer

In a concerning development that raises questions about the functionality and jurisdiction of the Goods and Services Tax Network (GSTN) portal, a taxpayer has alleged that the system is arbitrarily denying the right to file an appeal against a rectification order, despite clear statutory provisions under the Central Goods and Services Tax (CGST) Act, 2017.

According to a detailed post shared by Chartered Accountant Arpit Haldia (@haldiaarpit) on social media platform X, the matter pertains to a taxpayer who received an order dated 10 October 2024. Subsequently, the taxpayer filed an application for rectification under Section 161 of the CGST Act on 16 December 2024. This application was formally rejected through an order dated 21 March 2025.

Step by Step Handbook for Filing GST Appeals, Click HERE

https://x.com/haldiaarpit/status/1934834201645502813

In a logical continuation of legal remedy, the taxpayer sought to appeal this rejection order under Section 107 of the CGST Act, which explicitly provides for appeals against decisions or orders passed by an adjudicating authority. However, the GSTN portal prevented the filing of the appeal on technical grounds—specifically, the portal did not capture the Reference Number of the rectification rejection order, thereby blocking the submission process.

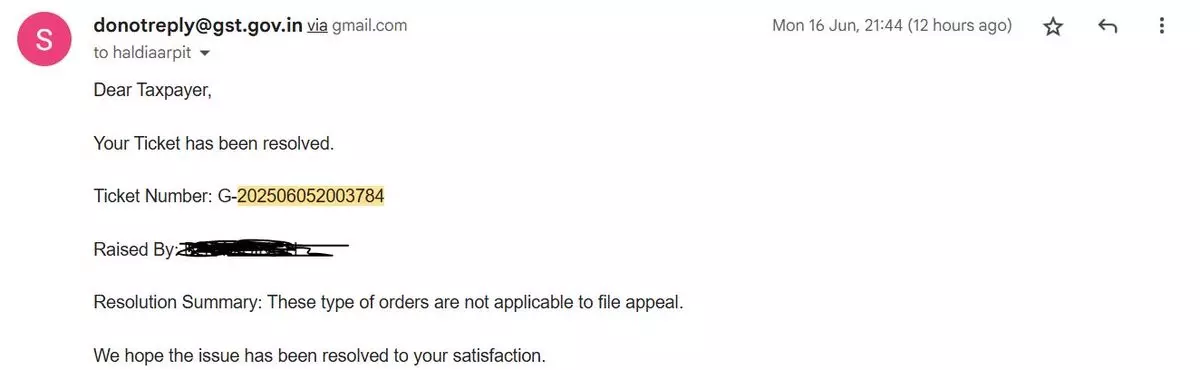

The taxpayer raised a grievance with Infosys GSTN on 5 June 2025. However, the resolution provided was dismissive, stating:

“Resolution Summary: These type of orders are not applicable to file appeal.”

This has triggered widespread concern among taxpayers and professionals, who argue that such a stance by the GSTN portal exceeds its role. “The portal is a facilitation platform and not a judicial authority to interpret the applicability of appeal provisions,” said Haldia in his post, which also tagged key institutions including Infosys_GSTN, FinMinIndia, and GST_Council.

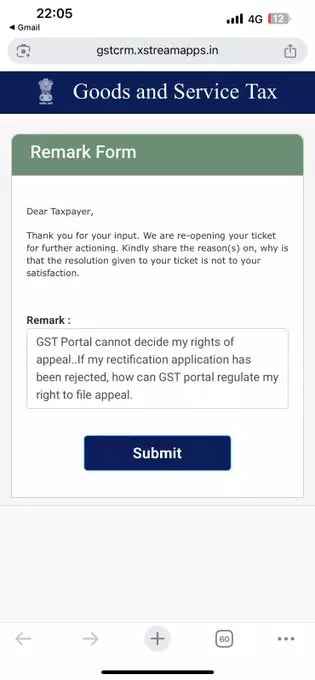

The taxpayer has since responded through the “Remark Form” option on the GST portal, writing:

“GSTPortal cannot decide my rights of appeal. If my rectification application has been rejected, how can GST portal regulate my right to file appeal?”

Legal experts have weighed in, affirming that a rejection order is indeed appealable under Section 107 and that the inability to file such an appeal due to system limitations amounts to a denial of justice. They emphasize that digital infrastructure should support, not restrict, taxpayer rights.

As of now, the grievance has been reopened for further action. The GSTN and relevant authorities have not issued any formal statement in response to the public outcry. Stakeholders are urging immediate corrective measures, stressing that administrative and technological bottlenecks should not undermine statutory remedies.

Complete Referencer of GSTR-1, GSTR-1A, GSTR-3B, GSTR-9 & GSTR-9C - Click HERE

The issue strikes at the heart of taxpayer rights and shouts out the need for a better legally aligned digital framework, especially as India deepens its reliance on technology for tax governance. The matter is likely to gain more attention unless resolved swiftly and transparently.

Stay tuned for more updates on the evolving story.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates